Ripple Price Forecast: XRP fragile recovery stalls despite UAE grants RLUSD stablecoin regulatory green light

- XRP succumbs to pressure below its $2.30 resistance amid sticky bearish sentiment in the crypto market.

- UAE's FSRA green lights Ripple's RLUSD stablecoin as a lending protocol in the Middle East region.

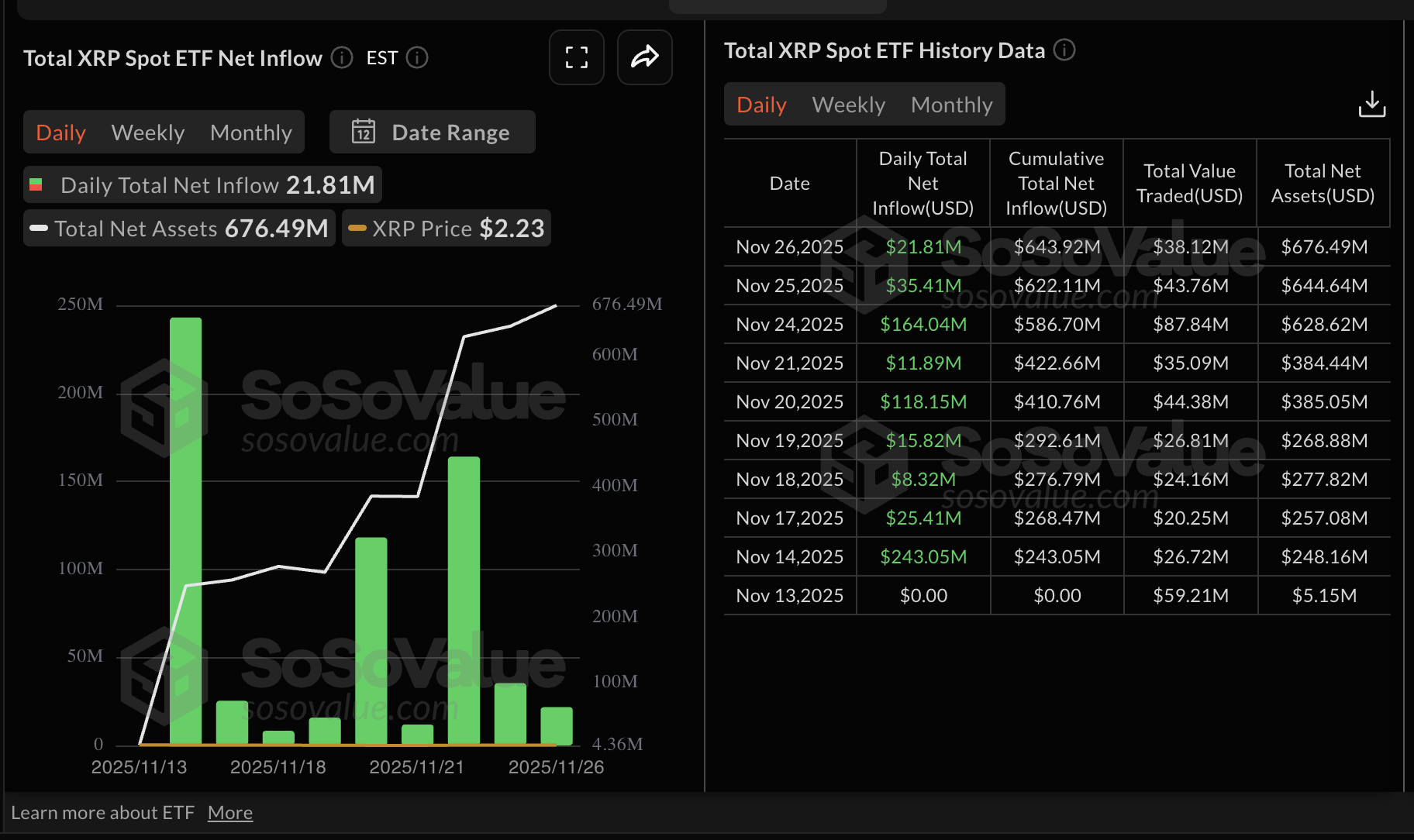

- XRP ETF inflows extend the positive streak for nine consecutive days, underscoring growing institutional interest.

Ripple (XRP) is losing momentum, trading at around $2.19 at the time of writing on Thursday. Bulls' attempts to shape the uptrend toward key hurdles at $2.36 and $2.52 failed to gain traction amid resistance at $2.30.

Despite the broader cryptocurrency market's bearish outlook, XRP spot Exchange Traded Funds (ETFs) continue to record steady inflows, reflecting growing institutional interest.

Ripple RLUSD receives regulatory green light in UAE

Ripple USD (RLUSD), a Ripple-backed stablecoin, has been recognized as an Accepted Fiat-Reference Token by the Financial Services Regulatory Authority (FSRA) in Abu Dhabi, allowing its use within the Abu Dhabi Global Market (ADGM).

The regulatory approval implies that RLUSD is now eligible for use by Authorised Persons licensed by the FSRA to provide regulated financial services, provided they comply with the obligations set out in relation to Fiat-Referenced Tokens.

"The FSRA's recognition of RLUSD as a Fiat-Referenced Token reinforces our commitment to regulatory compliance and trust – two non-negotiables when it comes to institutional finance," Jack McDonald, Senior Vice President of Stablecoins at Ripple, stated.

Arvind Ramamurthy, the Chief Market Development Officer at ADGM, praised Ripple for achieving this regulatory milestone, adding that he "looks forward to seeing them make use of our robust regulatory framework, designed to support the sustainable growth of innovative firms and ensure the highest international standards of governance and compliance."

RLUSD is a regulated stablecoin issued under the New York Department of Financial Services (NYDFS). It boasts a market capitalisation of over $1.2 billion, according to CoinGecko. The stablecoin, launched in late 2024, is designed for institutional use while meeting regulatory expectations.

XRP ETFs recorded nearly $22 million in inflows on Wednesday, bringing the cumulative net volume to approximately $644 million and net assets to $676 million. The steady inflows, now on their ninth consecutive day, indicate that institutional investors are paying attention to altcoin-based ETFs.

Technical outlook: XRP dips as bears return

XRP is trading at $2.19 at the time of writing on Thursday, weighed down by prolonged bearish sentiment across the crypto market. The 50-day Exponential Moving Average (EMA) at $2.37, the 100-day EMA at $2.51 and the 200-day EMA at $2.52 slope lower and remain stacked above price, preserving downside pressure.

A recovery would face hurdles at the above--mentioned moving averages. The Moving Average Convergence Divergence (MACD) histogram stands in positive territory and has widened, placing the blue MACD line above the signal line.

Still, the Relative Strength Index (RSI) at 46 is neutral and has eased, suggesting fading upside momentum. The SuperTrend descends and sits at $2.40, also capping rebounds. The descending trend line from the record high of $3.66, reached on July 18, limits gains, with resistance seen at $2.67.

The momentum indicator holds above the zero line and edges higher, indicating strengthening buying interest. A close above the SuperTrend could open the path toward the trend-line barrier, while failure to reclaim it would keep the bearish bias intact below the declining averages.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.

(The technical analysis of this story was written with the help of an AI tool)