EURUSD Long-term Forecast: Can ECB Hawks Overcome the Dollar Bullishness?

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

Forex markets behave differently every year, and each year experts weigh in on how markets, especially the major forex pairs, will respond.

The most traded pair in the forex market, the EUR/USD, has been on a wild ride in 2022. It dropped below parity for the first time since the EUR came to be.

With the Fed having a bit between their teeth and ECB's (European Central Bank) dovish monetary policy, the king dollar rose against the Euro.

However, that wasn't the only thing. The Eurozone's terms of trade were affected by the Ukraine War, which led to the region's current account running a deficit for the first time in 10 years. Also, the greenback benefitted from the safe haven status as the economic uncertainty deepened.

This report will look at the EUR/USD forecast for 2023 and determine if the ECB will stop the dollar rise.

Summary

● EUR/USD's future depends on the monetary policies of the Fed Reserve and the European Central Bank.

● The Fed may pivot its aggressive policy stance by the second half of 2023.

● Factors like the war in Ukraine, Eurozone's economic condition, and the energy crises will keep weighing in on the EUR.

Euro / US dollar Live Chart - Mitrade

Will ECB raise rates in 2023?

The basic economic improvements coincide with announcements from the ECB indicating that at least two further 50 basis point interest rate hikes would be delivered in early 2023 to curb inflation.

"The ECB's recent hawkish pivot should support medium-term upside," suggests Fiotakis.

This means that the ECB will increase more than the Fed in 2023: following the release of inflation data on January 12, markets now expect a 25bp boost in February, with speculation that this might be the end of the cycle.

Eurozone bonds market

On the other hand, the Eurozone bond market is not moving in cahoots with these Eurozone rate forecasts, with rates sliding throughout the curve.

The yield on the German 10-year Bund has fallen 45 basis points in the previous two weeks, while the Italian 10-year BTP has fallen over 80 basis points in the same time frame. Reduced bond rates in the United States have aided this shift. Rising concerns that the ECB would have to soften rate rises due to mounting recessionary risks drive lower longer-dated bond yields.

In the next months, Eurozone bond yields and rate fluctuations with other economies will need to be regularly monitored.

Eurosystem staff macroeconomic projections

The Eurozone's forecast has declined slightly, with slower growth and higher and more persistent inflation than anticipated in the ECB staff macroeconomic predictions for September 2022.

Economic growth was greater than predicted throughout the summer, thanks to a surge in services activity from the economy's resumption and government support programs.

Eurozone challenges

The continued oil crisis, high inflation, increased uncertainty, the global recession, and tougher financing conditions, on the other hand, are all driving down economic activity and have already resulted in a severe deceleration in real GDP growth in the third quarter of 2022.ECB's Staff anticipates a brief and modest Eurozone recession at the year's end.

Consumer and business sentiment have been quiet as the economic effects of the Ukraine crisis unfolded and fed the high inflationary pressures. At the same time, real spending power is being reduced, and mounting cost pressures restrict output, particularly in energy-intensive industries. Fiscal policy efforts are likely to alleviate some of the negative economic consequences.

Furthermore, high levels of natural gas inventories and ongoing efforts to cut demand and replace Russian gas with new sources indicate that the Eurozone is predicted to avoid compulsory energy-related cutbacks over the projection horizon. However, risks of energy supply outages remain high, particularly for the winter of 2023-24.

Over the medium run, as the energy market revamps, instability is predicted to decrease and real earnings to rise.

As a result, economic growth is likely to revive despite less favorable financing conditions, boosted partly by growing international demand and the clearance of residual supply bottlenecks. The labor market is likely to be robust to the upcoming moderate recession.

Eurozone GDP's decline

Overall, yearly average real GDP growth is predicted to drop significantly, falling from 3.4% in 2022 to 0.5% in 2023 before rebounding to 1.9% in 2024 and 1.8% in 2025. The forecast for GDP growth has been revised by 0.3 percentage points for 2022, thanks to good surprises over the summer, and down by 0.4 percentage points for 2023, which is still the same for 2024.

Despite strong drops in wholesale gas and power prices, declining demand, easing supply constraints, and government initiatives to curb energy inflation, inflation has remained on the upside compared to September 2022 estimates and has expanded across HICP categories.

HICP inflation is projected to remain exceptionally high in the immediate term as pipeline pricing pressures from past commodity price rises, euro devaluation, supply constraints, and tight labor markets continue to flow through to inflationary pressures.

Eurozone inflation forecast

Despite this, inflation is anticipated to fall from an average of 8.4% in 2022 to 6.3% in 2023, with inflation falling from 10% in the fourth quarter of 2022 to 3.6% in the fourth quarter of 2023. Inflation is anticipated to fall to 3.4% on average in 2024 and 2.3% in 2025.

Source: Bloomberg GDP Watch

The projected decline in inflation indicates high energy-related falling base impacts throughout 2023, the gradual implications of the ECB's monetary policy normalization, which began in December 2021, and the lower growth outlook. The drop in energy and food prices and the expectation that longer-term inflation forecasts will remain grounded.

The ECB's medium-term inflation objective of 2% is likely to be reached in the second half of 2025. However, HICP inflation without energy and food will continue at over 2% throughout the forecast period.

This is driven by delay effects from high energy costs and the Euro's previous strong depreciation, resilient labor markets, and inflation adjustment effects on wages, which are likely to expand at rates much above the historical average in nominal terms.

In comparison to the September 2022 forecasts, headline inflation for 2022 (by 0.3 percentage points), 2023 (by 0.8 percentage points), and 2024 (by 1.1 percentage points) has been revised up significantly, indicating recent data uncertainties, a reevaluation of the price pressures and their pass-through, greater wage growth, and higher food prices.

These positive impacts outweigh the negative implications of lower oil, gas, and electricity pricing estimates, speedier supply bottleneck relief, the recent euro gain, and a poorer growth projection. Importantly, additional fiscal measures enacted after the September 2022 predictions, the majority of which attempt to reduce energy price rises in 2023, moderate the upward adjustment to inflation in 2023 but considerably contribute to the higher revision in 2024 since many of the policies expire.

Is the US dollar more predictable in 2023?

Under President Biden, the dollar's trajectory may become simpler to anticipate. To begin with, financial markets expect the incoming US president to run less overseas and deal with trade conflicts more politely. This increases financial market calm and stability, lessening the demand for a safe haven greenback.

Additionally, Biden is anticipated to continue stimulating the US economy, which would boost the US's debt situation even higher. The fact that interest rates will remain low for a longer time also plays a role: during the most recent Federal Reserve meeting, Chairman Jerome Powell signaled that interest rates would be raised in mid-2023.

Fed's slowdown

Following a year of aggressive rises, with another boost expected in January 2023, the Fed will most likely hold its policy rate and review the economy to assess the entire impact of its tightening so far. This pause can serve as a break in the dollar's rise.

According to the Fed's December 14 examination of economic forecasts, officials expect rates to range between 4.75% and 5.75% in 2023. In 2023, at least one additional rate increase, if not more, is expected

Trading the EURUSD online

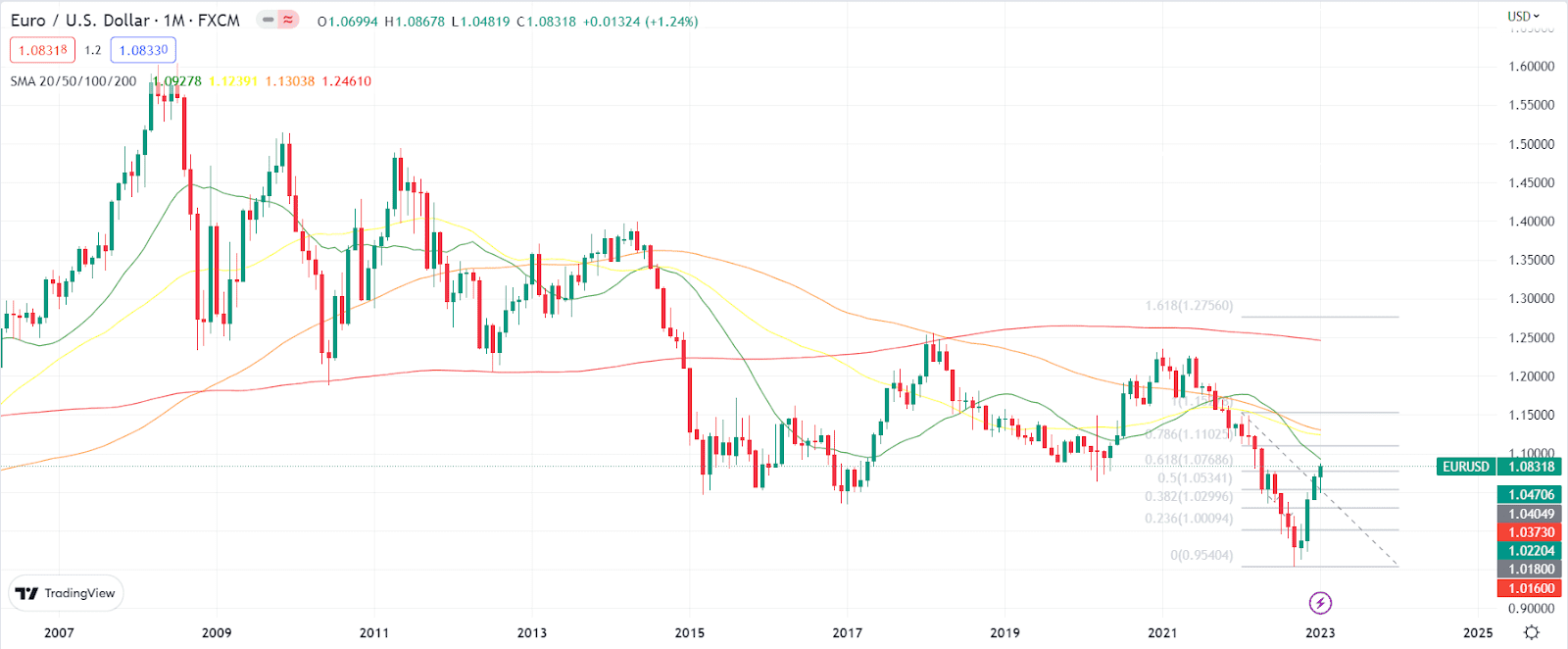

Looking at the EUR/USD monthly chart, the nearly 1,100-pip rebound from the multi-year low of 0.9535 appears to be a correction. The 61.8% Fibonacci retracement of the 2022 fall from 1.1494 to the stated low is about 1.0735, which is also the December monthly high.

However, based on the same chart, technical indicators have lost their upward vigor after erasing strong oversold levels, indicating that bulls have a long way to go before taking control. The 20-SMA on the same chart maintains a solidly bearish slope below the longer ones, which also trend south, suggesting long-term bearishness.

The price is now above the 50% retracement of the year's loss at about 1.0510, even though the longer moving averages have neutral-to-bearish trends considerably below the shorter one.

The Relative Strength Index (RSI) remains around 50 without indications of upward exhaustion, signaling that the risk is still tilted to the upside. Finally, after correcting overbought levels achieved in mid-November, the Momentum indicator bounces from about its midline.

The 1.1460/80 has been the persistent zone since the end of 2014. With the EUR/USD trading nearly 800 pips below the level and the potential of future rate hikes on both sides of the pond, the chances of the pair reaching such a price zone in the first quarter of 2023 are slim.

If it breaks over the Fibonacci resistance mentioned above, the pair might go toward the 1.1060/1.1120 price zone. A monthly closing above 1.1500 would be necessary for the bulls to continue.

What drives EURUSD's price in 2023?

The key factors driving the EUR/USD down this year will largely stay in place. These factors include:

ECB's stance

Fed's stance

Consumer Price Index of the US and the Eurozone

Russia-Ukraine war

Energy crisis in Europe

Pandemic

EURUSD price predictions for 2023 and beyond

Many financial institutions and banks weigh in on the EUR/USD yearly forecast. Here we'll look at what experts and analysts say about the EUR/USD 2023 price prediction.

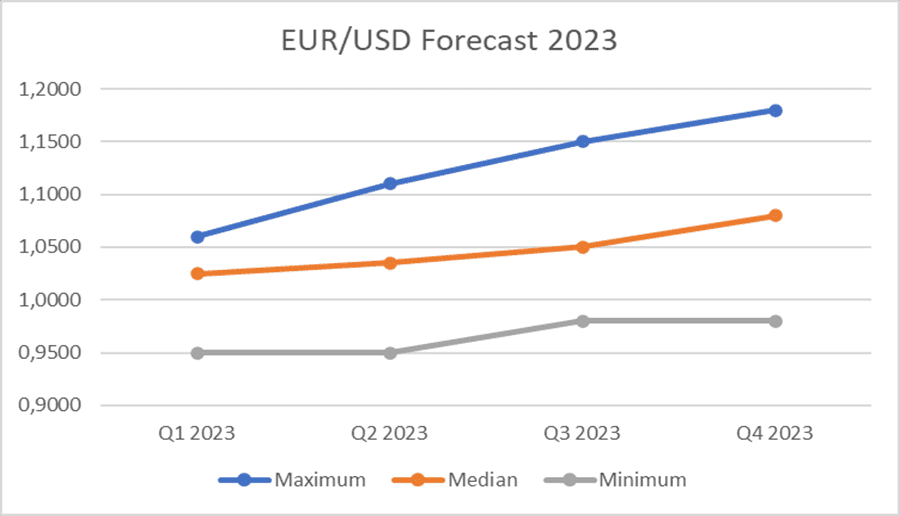

Bloomberg

Analysts predict little movement in the EUR/USD exchange rate over the next several months, at least for the first quarter of 2023. Therefore, one might claim that the market will trade in a consolidated range.

Source: Bloomberg EURUSD 2023 forecast

Another conclusion may be that the market does not anticipate any big developments in the year's first half. The fourth quarter is expected to be more interesting, with most analysts forecasting a rise in the EUR/USD.

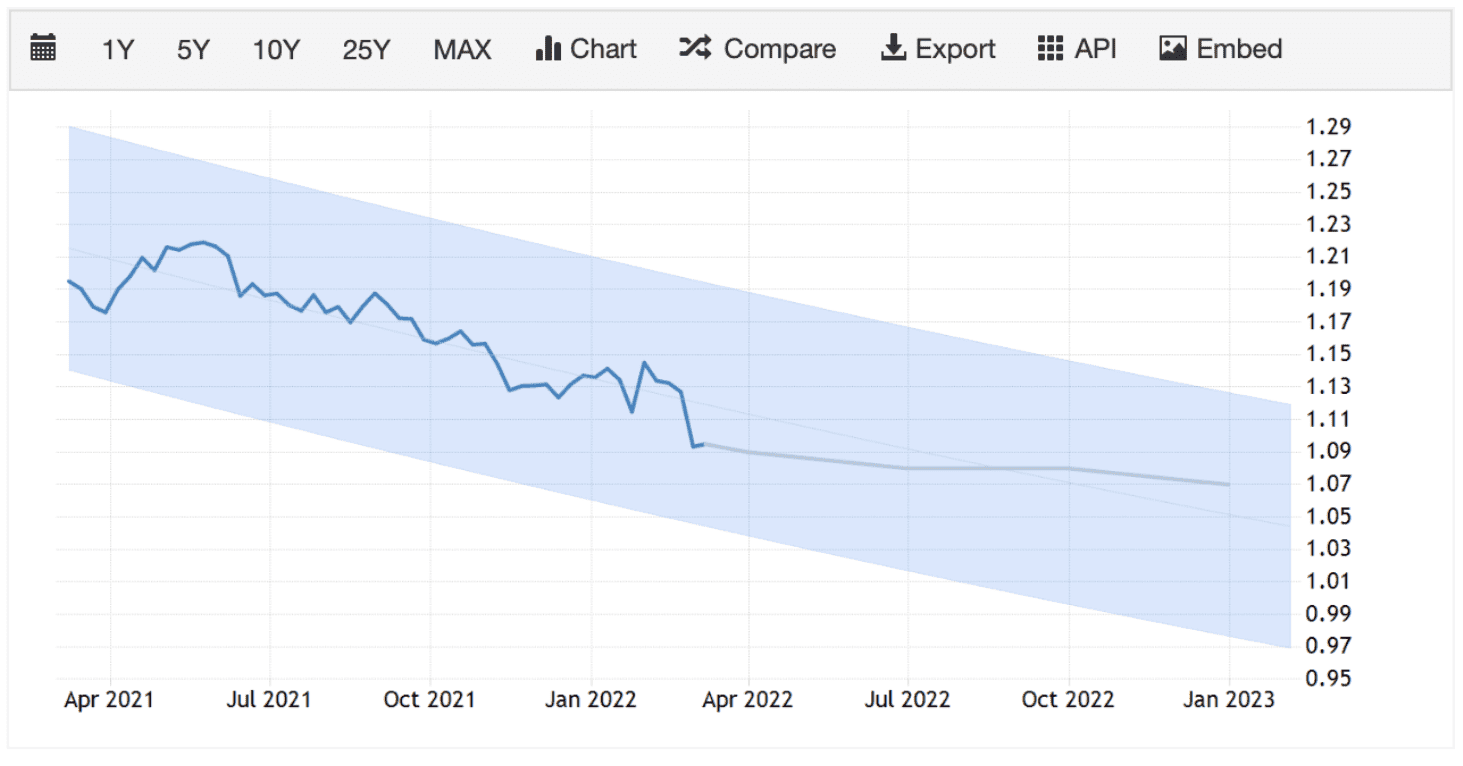

Trading Economics

According to global macro models and Trading Economics experts' forecasts, the pair might trade at 1.09 by the end of March. EUR/USD may fall to 1.08 by July. The price may fall to 1.07 by the end of the year. The downward trend appears to be minor. However, comparing the future rate to the past rate reveals that the pair has weakened.

Source: Trading Economics EURUSD projection

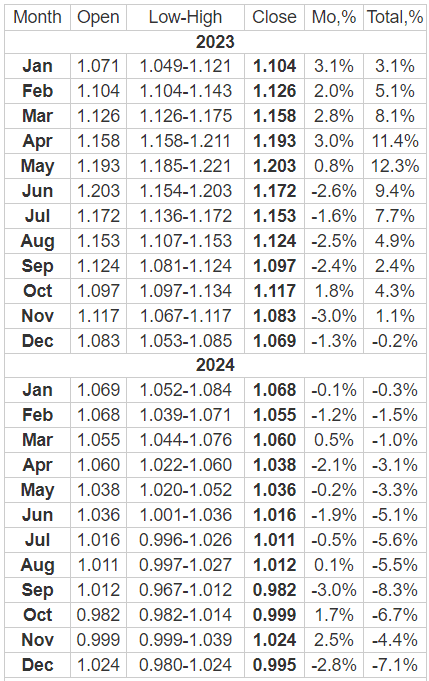

Long Forecast

Long Forecast is not quite optimistic about the current bullish trend. The following table shows its monthly price projection. The table clearly shows that the projection remains in the current broad range starting from a parity level up to 1.10 in 2023 and 2024.

Source: Long Forecast EURUSD price prediction for 2023-24

Barclays Bank

Barclays has improved its expectations for the EUR/USD exchange rate in 2023 but advises that the pair may still conclude the first quarter lower than it is now.

Analysts at the investment bank have raised their projections for the Euro versus the USD, citing lower gas costs, the reopening of China's economy, and a mature Federal Reserve tightening cycle.

The move comes despite further out-performance in the EUR/USD, which has climbed 1.30% in 2023, adding to its 12% gain from a low of 0.9543 on September 26 to the year-end close of 1.0660.

Without a doubt, the recovery is driven mostly by a big reassessment of the Eurozone's economic prospects in light of decreasing gas prices and higher gas storage levels.

"Strikingly, natural gas prices are at pre-Ukraine war levels thanks to a mild winter, implying a reduction in the euro's energy risk premium but also skewing risks to the upside," says Themistoklis Fiotakis, Head of FX Research at Barclays.

Conclusion

Many analysts think that Euro will remain below parity with the dollar until mid-2023, as the Eurozone's lackluster economic outlook, worries of another energy crisis in the winter of 2023, and instability in Ukraine weigh on the currency.

However, the biggest factor will be the monetary policies of the two central banks. An uptrend will not begin until the monetary policy gap between the Fed and the ECB narrows in the second half of 2023.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.