In trading, understanding the concept of a spread is essential for managing costs and making informed decisions. A spread refers to the difference between the buying and selling prices of a financial instrument, impacting overall trading expenses. Whether you're a day trader, scalper, or long-term investor, the type of spread you choose can significantly influence your trading strategy.

This article explores what a spread is, the differences between fixed and floating spreads, and how they can affect your trading experience.

1. What is a spread?

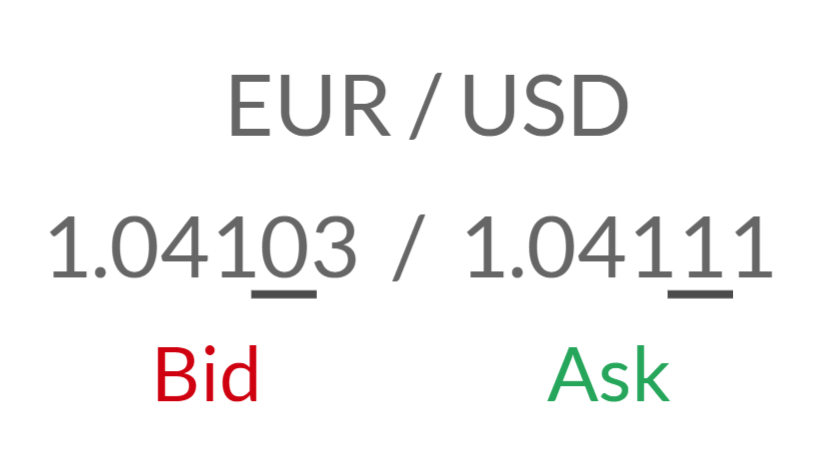

When traders trade Forex, Shares, Cryptos, or other common financial instruments through online Forex brokers, they will see two different prices displayed: the buying price and the selling price

Buying price (ASK): The buying(ask) price refers to the price at which traders can BUY the base currency in exchange for the quoted currency from the broker.

Selling price (BID): The selling(bid) price refers to the price at which traders can SELL the basic currencies in exchange for the quoted currency from the broker.

The price difference between the two prices is also known as the spread, especially the “bid-ask spread”.

This is one of the ways that “no-commission brokers” earn money. The spread is the fee for providing transaction immediacy. This is why the terms “transaction cost” and “bid-ask spread” are often used interchangeably.

Instead of charging a separate fee for executing a trade, the cost is built into the buy and sell prices of the currency pair you want to trade. From a business standpoint, this makes sense. The broker provides a service and needs to make money somehow. The currency is sold to you for more than it cost them and bought from you for less than it will be worth when sold.. This difference is called the spread.

2. How to calculate spread?

In most cases, spread is already calculated into the price quote that you’re looking at. As a trader, all you have to do is find the difference between the bid & ask price.

fig 1. For currency pairs and quotes displayed to 5 decimal places

fig 2. For currency pairs and quotes displayed to 3 decimal places

To accurately calculate the actual transaction cost, you’ll need to know two additional things;

Value per pip

Volume of trade

Example;

With the price quote above, the spread would be the difference between 1.04103 and 1.04111 is 8 points or 0.8 pip.

To find out the transaction cost, you’ll need to multiply the value per pip and the number of lots you’re trading.

If you’re trading one mini lot (10,000 units), the value per pip will be $1, so the cost incurred to open this trade will be;

Example 1

1 Mini Lot (10,000 units)

0.8pips x 1 mini lot x $1 (value per pip) = USD0.80

Example 2

5 Mini Lot (10,000 units)

0.8pips x 5 mini lot x $1 (value per pip) = USD4.00

If you increase your volume or lot size, you’ll need to multiply the cost per pip by the number of lots accordingly to determine the transaction cost.

0 commission, low spreads

0 commission, low spreads Diverse risk management tools

Diverse risk management tools Flexible leverages and instant analysis

Flexible leverages and instant analysis Practice with $50,000 risk-free virtual money

Practice with $50,000 risk-free virtual money

3. Types of spreads and pros & cons

The types of spreads you’ll see on a trading platform depends on the broker. They are categorized into 2 types:

Fixed

Floating (also known as “Variable”)

Fixed spreads are usually offered by brokers that operate as a market maker or “dealing desk” model while variable spreads are offered by brokers operating a “non-dealing desk” model.

Fixed Spread

Regardless of the time and any market conditions, the spread remains unchanged, which means that no matter how the market fluctuates, the spread is always the same. Fixed spread is often used by market makers or “dealing desk” models. These market makers buy large positions from their liquidity provider(s) and sell these positions to retail investors. By doing so, the broker acts as the counterparty to the clients’ trades. This allows the broker to control the prices they display to their clients.

Pros:

Predictable costs: The spread remains constant regardless of market conditions.

Easier to plan trades, especially for scalping.

Cons:

Typically higher than floating spreads during normal market conditions.

May widen during high volatility.

Example: A broker might offer a fixed spread of 2 pips for the EUR/USD pair. This means that regardless of market conditions, the spread will always be 2 pips.

Floating Spread

As the name suggests, floating spreads are ever-changing. With floating spreads, the difference between the bid-ask prices of currency pairs is constantly changing. Floating spreads are offered by non-dealing desk brokers. Non-dealing desk brokers get their pricing of currency pairs from multiple liquidity providers and pass on these prices to the trader without the intervention of a dealing desk.

This means the broker has no control over the spreads. And spreads will widen or tighten based on the supply and demand of currencies and the overall market volatility.

Typically, spreads widen during economic data releases as well as other periods when the liquidity in the market decreases (like during holidays and when there’s global economic events).

Pros

Often lower during normal market conditions, potentially saving costs.

Can be more favorable during stable market times.

Cons:

Can widen significantly during high volatility, increasing trading costs.

Less predictability in costs.

Example: A broker might offer a floating spread that ranges from 1 to 3 pips for the EUR/USD pair. During calm market conditions, the spread might be as low as 1 pip, but it could widen to 3 pips or more during high volatility.

4. Fixed or floating spread: which one is better?

When choosing between fixed and floating spreads, the best option depends on your trading style. As discussed, both types have their pros and cons:

Best for Scalpers: Fixed spreads are ideal due to their predictability, allowing for precise cost management during quick trades.

Best for Long-Term Traders: Floating spreads can offer potentially lower costs, making them suitable for those who hold positions over a longer period.

Common Brokers for Fixed and Floating Spreads

Fixed Spread Brokers:

Typically include market makers and some retail brokers.

Known for providing consistent spreads, which can be beneficial for traders who prioritize stability.

Floating Spread Brokers:

Often found among ECN (Electronic Communication Network) and STP (Straight Through Processing) brokers.

These brokers may offer lower spreads during regular market hours, appealing to traders who can navigate varying costs.

Ultimately, the choice between fixed and floating spreads should align with your trading strategy and preferences. Consider the type of broker that best fits your needs, whether they offer fixed or floating spreads, to optimize your trading experience.

5. Summary

A spread in trading refers to the difference between the buying price (ask) and the selling price (bid) of a financial instrument. It represents the cost of executing a trade and can vary based on market conditions. There are two main types of spreads: fixed spreads, which remain constant regardless of market fluctuations, and floating spreads, which can change based on market volatility. Understanding spreads is crucial for traders, as they impact overall trading costs and strategies.

6. FAQs about spreads

#How do spreads affect trading costs?

Spreads increase the overall cost of trading, as traders must account for the difference between the buying and selling prices when entering and exiting positions.

#Can spreads change during market hours?

Yes, spreads can change during market hours, especially for floating spreads, which may widen during periods of high volatility or low liquidity.

#How do brokers determine their spreads?

Brokers determine their spreads based on market conditions, liquidity, and their own pricing models, which can vary between fixed and floating spread offerings.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.