Broadcom’s Q1 FY2025 Earnings: 3 Things Investors Should Be Watching

TradingKey - Technology stocks in the US are extremely volatile right now as trade and tariff news coming from the US causes market swings.

However, despite all this, semiconductor firms involved in the Artificial Intelligence (AI) space have continued to post strong results on the back of the incredible demand for power-hungry processors for data centres.

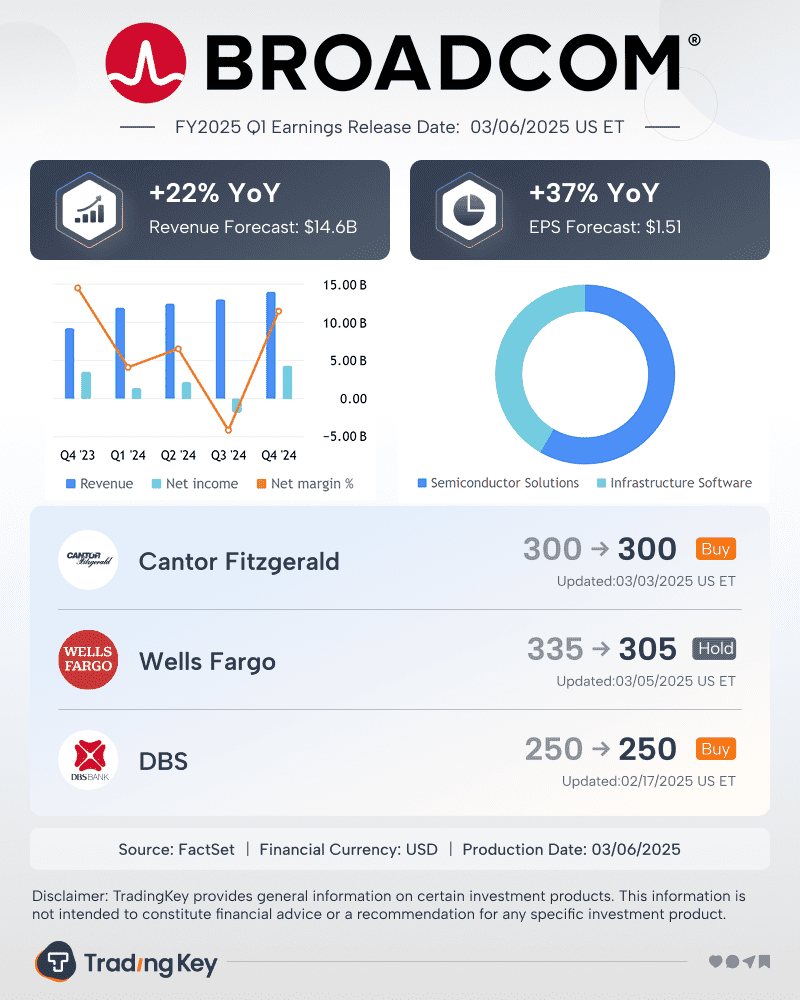

One of the biggest firms in the AI-related semiconductor space is Broadcom Inc (NASDAQ: AVGO) and the company is set to report its Q1 FY2025 results (for the three months ending 31 January 2025) on Thursday (6 March) after the market closes in the US.

Broadcom shares have been hit by the various tech market sell-offs in 2025, with its stock down over 17% so far this year. With that in mind, here are three big things that tech investors should be watching ahead of Broadcom’s latest earnings.

Revenue growth

As with any growth stock in the AI space, revenue growth will be top of mind for investors looking at Broadcom’s latest numbers.

In its most recent Q4 FY2024 results, Broadcom posted revenue of US$14.05 billion, which was up 51% year-on-year. That higher growth rate was mainly on account of its acquisition and integration of VMWare – a multi-cloud software provider – which was completed in November 2023.

Average analysts’ expectations are for Broadcom to post revenue of US$14.61 billion in Q1 FY2025, which would translate to a 22% year-on-year growth rate.

Infrastructure and AI growth

In terms of revenue breakdown, investors will also be keen to see how strongly Broadcom’s Infrastructure Software division grows as the VMWare acquisition continues to reap benefits for the company.

Broadcom’s Infrastructure Software division made up 41% of total revenue in Q4 FY2024, versus just 21% of total revenue in Q4 FY2023.

Broadcom FY2024 revenue by segments

Source: Broadcom Q4 FY2024 earnings presentation

A lot of that revenue growth, with the division posting sales of US$5.82 billion in Q4 FY2024 (up 196% year-on-year), was down to higher pricing for VMWare’s existing product suite.

Investors will be keen to see whether Broadcom can continue to see strong growth in that division as demand for its cloud infrastructure solutions and various networking capabilities are still likely very strong.

Meanwhile, on the semiconductor side of the business, investors will be eyeing AI revenue growth. Last quarter, Broadcom’s AI revenue from Semiconductors amounted to US$12.2 billion – up an incredible 220% year-on-year. Investors will be hoping for similar gains when the company reports on Thursday.

Guidance for Q2 FY2025 will be key

As always, sentiment for Broadcom stock will hinge on whether the AI semis party can keep going. This is going to come down to maintaining or increasing demand for the semis and software that Broadcom is selling to clients.

Broadcom’s own guidance for Q1 FY2025 – reported in mid-December – was calling for revenue of approximately US$14.6 billion, a figure that analysts have also projected. Broadcom also said that Q1 FY2025 adjusted EBITDA would be around 66% of projected revenue.

For Q2 FY2025, investors will be looking to see whether Broadcom’s revenue growth can keep up and, particularly, whether AI revenue and Infrastructure Services will be a big part of that.

What else to monitor from Broadcom?

Cash flow wise, Broadcom is doing really well with its Q4 FY2024 free cash flow coming in at US$5.48 billion, up from the US$4.72 billion in Q4 FY2023.

That was partly why the company was able to raise its dividend per share to US$0.59 in December and Broadcom shares now yield over 1.2%, not a bad dividend yield for a high-growth “Big Tech” company.

Meanwhile, outside of the traditional demand and supply metrics, analysts will surely be focused on whether export restrictions will have any impact on demand for its semis from key clients in markets such as China. If more advanced restrictions come in on exports to the world’s second-biggest economy, Broadcom will certainly feel the impact.

While Broadcom shares have taken a hit so far this year, they’re still up over 41% in the past 12 months. With solid free cash flow and a growing AI/infrastructure services business, any post-earnings sell-off could be a golden opportunity to pick up Broadcom shares – a top-quality tech stock.