The Falcon Recalibration: Why CrowdStrike's Flex-Led AI Pivot Is Misunderstood

- CrowdStrike reached $4.44 billion ARR in Q1 FY26, with 22% YoY growth and strong 97% customer retention rates.

- Falcon Flex drove $774 million in Q1 bookings, growing 124% YoY, with 60% of deals sourced via partners.

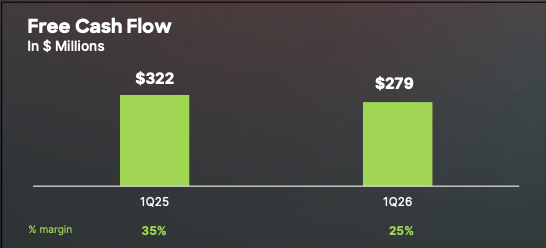

- Free cash flow reached $279 million in Q1, with management guiding for >30% FCF margin by FY27.

- Platform expansion into AI-native SIEM, identity, and cloud security targets a $250 billion TAM by 2029, enhancing revenue durability.

TradingKey - While Wall Street persists in measuring CrowdStrike (CRWD) based on a conventional endpoint security company metric, the Q1 FY26 results paint a different picture: CrowdStrike is purposefully redefining itself as an AI-native cybersecurity platform with modularity, flexibility, and resilience in monetization. In spite of slightly lower-than-expected revenue and free cash flow, the quiet response of the stock underappreciates the larger transformation in progress.

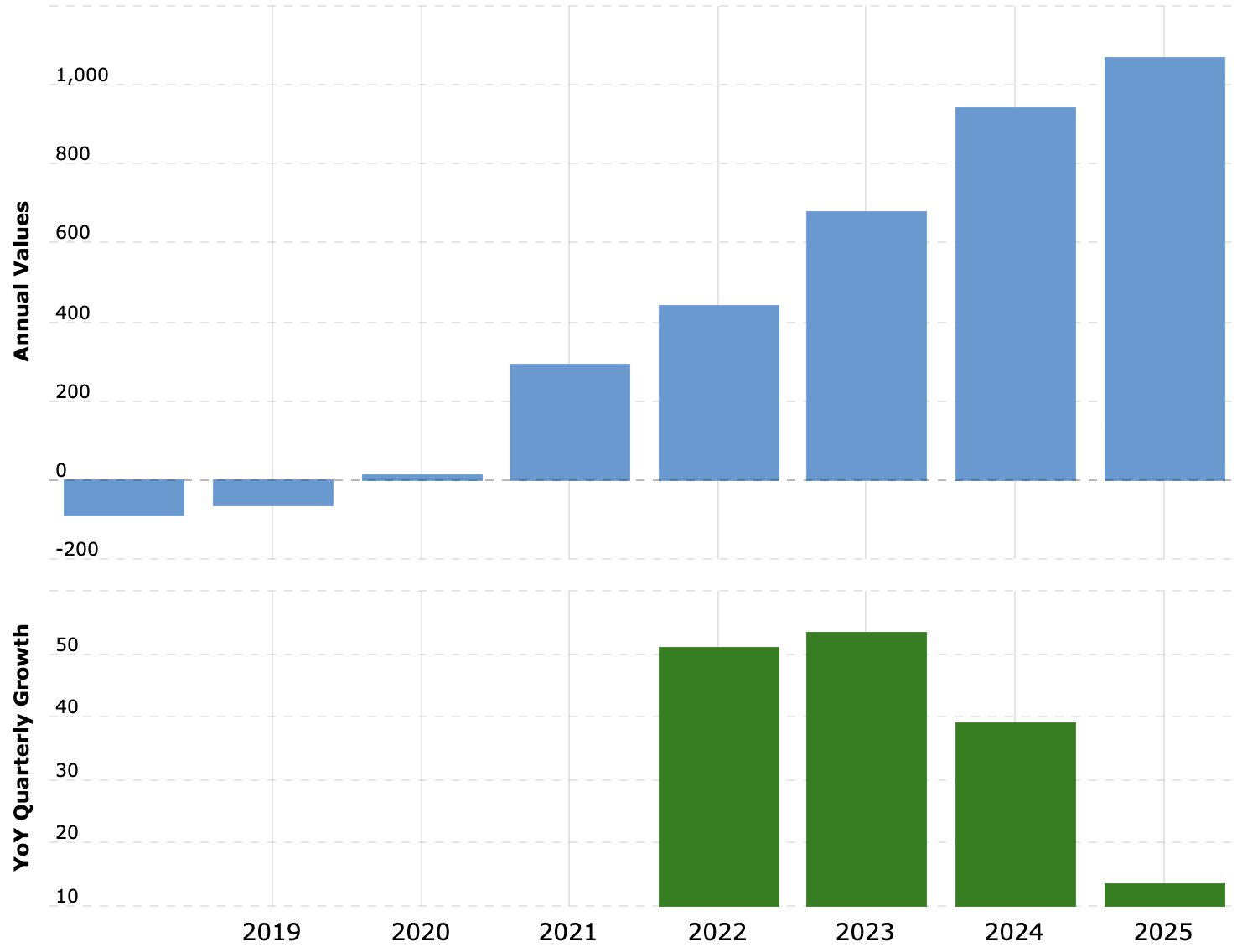

With more than $4.44 billion in Annual Recurring Revenue (ARR), a partner-fueled sales engine, and the growing power of Falcon Flex, CrowdStrike is redesigning the economic model of cybersecurity. The dominant bear thesis centers on a modest drop in subscription gross margin (80% non-GAAP, down from 81% YoY) and a transitory disconnect between ARR expansion and recognition of revenue. But this divergence is a function of a deliberate strategy, not a flaw.

.png)

Source: CrowdStrike Financial Results

Flex deals, giving customers increased usage time and choice, pre-pay ARR while deferring revenue. Mix in 97% retention and 124% YoY expansion in deals of $10 million+, and a different picture appears: a company sacrificing near-term linearity in favor of long-term flywheel speed. With CrowdStrike racing towards a target of $10 billion ARR and positioning Falcon as the go-to platform of next-gen SIEM, identity, cloud, and AI-driven breach protection, we are of the opinion that the market underappreciates the latent value and strategic leverage in the company's current model.

Platform in Transformation: Flex is the Trojan Horse for AI-Native Consolidation

CrowdStrike's Falcon platform has matured to a suite of more than 30 capabilities, but the real driver of today's monetization strategy is Falcon Flex. Its flexible license model fuels platform adoption through an offering of multiple modules under terms favorable to customers, allowing rapid expansion and deeper partner integrations.

In Q1 FY26, Flex accounted for $774 million in value sold, 124% YoY growth, with more than 75% of Flex contracts already deployed and 39 customers renewing to renegotiate or expand in the same cycle. Critically, Flex Deals contributed a record $3.2 billion in total value to date, and over 15% of Q1 bookings originated in Managed Security Service Providers (MSSPs), expanding broader market reach. More than 60% of deals were partner-sourced, demonstrating a high level of leverage in the ecosystem and reducing marginal CAC.

This is indicative of a flywheel model: Flex drives adoption, partner velocity gains exposure, and modularity expansion enhances net revenue retention (in excess of 120%). Still, Flex adds amortization timing that produces a divergence between ARR and subscription revenue that is mistakenly interpreted by some investors as slowing.

.jpg)

Source: App Economy Insights

In actuality, Q1’s $194 million of net new ARR, though down from $212 million YoY, came in ahead of internal expectations, considering the one-time $11 million headwind from delayed CCP-related revenue recognition. This is expected to continue through Q3 before resuming in Q4.

.png)

Source: CrowdStrike Financial Results

With customers gravitating towards multi-module Flex bundles, module adoption is on the rise: 48% of subscription customers utilize six or more modules, 32% utilize seven or more, and 22% utilize eight or more. This scale speaks to the development of Falcon into an operating system for next-generation security, not an endpoint solution.

Unifying Identity, Cloud, and SIEM: From Fragmentation to Full-Stack Security

Competitive friction lessens when Falcon unifies identity, SIEM, and cloud. The cybersecurity industry is well-known for being fragmented, but CrowdStrike's recent successes indicate it's concentrating power in cloud, identity, and SIEM.

In Q1 FY26, it rolled out several AI-native capabilities such as Falcon Privileged Access, Falcon Data Protection, and agentic automation functionalities like Charlotte AI Workflows and Response. These are not bolt-on features; these are foundational layers that move Falcon from detection to real-time orchestration and zero-trust enforcement.

Falcon's unification of third-party threat detection through OverWatch Next-Gen SIEM is most disruptive. In contrast to traditional SIEMs, such as Splunk, that involve a tremendous amount of tuning, the next-gen platform of CrowdStrike uses AI/ML natively in correlation automation. Recent cooperation with Microsoft in threat actor tracking ties the platform even deeper into security operations.

Additionally, CrowdStrike was identified as a leader in GigaOm's 2025 reports on XDR and ITDR, further establishing its lead in emerging segments. Simultaneously, Frost & Sullivan named CrowdStrike a top cloud and app runtime security innovator, indicating its positioning strategy in runtime enforcement, an area being key to AI workloads and to multi-cloud infrastructure.

This convergence is not merely substituting traditional endpoint vendors but also taking over roles played by identity, SIEM, and cloud security point solutions. Combining a $250 billion TAM by 2029 (according to company forecasts), CrowdStrike is in an excellent position to seize the expanding share of cybersecurity spend migrating towards integrated platforms.

Margin Compression Underestimates the Strategic Curve

On the face of it, Q1 FY26 reflected pressure: non-GAAP subscription gross margin decreased 100 basis points year-on-year to 80%, and free cash flow fell to $279 million from $322 million. These are numbers that need to be put in context, however.

Source: CrowdStrike Financial Results

Source: Macrotrends, CrowdStrike Free Cash Flow Trend

To begin with, CrowdStrike is taking the near-term cost of transitioning to Flex. Amortization delay, special partner programs based on CCP incentives, and one-time expense recognition through the strategic realignment (with a Q2 charge of $26 million) account for the margin squeeze. Crucially, CrowdStrike reaffirmed its full-fiscal-year FCF margin guidance of 27% in Q4 and expects >30% margins in FY27. Management specifically mentioned that the realignment should increase the FY27 non-GAAP operating margin by a minimum of 1%, with an aggregate goal of 28–32%.

Second, the company is not compromising on growth at the expense of margin. ARR increased 22% YoY to $4.44 billion, and CrowdStrike is guiding FY26 revenue to $4.74–4.81 billion and $878–909 million in non-GAAP net income. CapEx is still tight at 6–8% of sales, indicating operating leverage as scale effects are beginning to kick in.

.png)

Source: Seeking Alpha

Lastly, the balance sheet is a fortress: cash and equivalents of $4.6 billion, no near-term liquidity issues, and a freshly approved $1 billion authorization to buy back shares. This offers strategic flexibility to mitigate dilution or go after accretive acquisitions without sacrificing growth.

Valuation: Redefining Multiples Expansion through Embedded Operating Leverage

CrowdStrike is priced at about 24x forward EV/sales and ~134x forward non-GAAP EPS on FY26 guidance ($3.44–3.56/share). The multiples look rich but squeeze quickly when measured against normalized FY27 free cash flow.

Assuming FY26 closes at $4.78 billion in revenue and a 27% FCF margin (guidance-consistent), CrowdStrike would produce ~$1.29 billion in FCF. Scaling to 30% on FY27 revenue of $5.7 billion (a conservative ~20% YoY increase), FCF is at $1.71 billion. Using a 35x FCF multiple (supported by platform-level stickiness, ARR resilience, and cross-module expansion), fair value is in the range of ~$60 billion in EV, or ~$230 per share, approximately ~35% ahead of current levels.

Peers such as Palo Alto and Zscaler enjoy comparable or greater multiples in spite of having lower gross retention and less cross-sell traction. CrowdStrike's embedded Flex is more sticky and poised for greater net expansion, especially as traditional SIEM spend is redeployed.

Although GAAP income is still negative, reflecting SBC and amortization, non-GAAP income gives a truer reflection of cash profitability, where value is actually created. And with ARR to revenue conversion improving, long-term economics are even more favorable as amortization headwinds recede.

Risk: Short-Term Optical Weakness, Long-Term Platform Execution

CrowdStrike's greatest danger is ongoing investor misunderstanding of the timing of Flex-related revenues. While the management attempted to address the divergence of ARR and revenues, Wall Street's preoccupation with quarter-to-quarter linearity might obscure near-term sentiment.

Deceleration in net new ARR lower than the guided sequential ramp would be a concern regarding the sustainability of Flex. Furthermore, CrowdStrike's speed of platform expansion poses potential execution risk. Combining identity, SIEM, and agentic automation in one software stack raises technical and organizational complexity. If newer modules underperform or cannibalize current revenues, the general expansion thesis is lessened.

Competitive tension is also on the horizon. Palo Alto Networks, Microsoft, and Wiz are aggressively expanding into cloud workspace and identity security. CrowdStrike’s current advantage rests in platform convergence and implementation execution, but channel tension or cost pressures could eat into that advantage.

Lastly, GAAP unprofitability, fueled by excessive stock-based compensation, is a headline overhang even if FCF is healthy. Although the company is well-capitalized and has buyback flexibility, an ongoing GAAP vs. non-GAAP disconnect poses a limitation on institutional rotation.

Conclusion: Mispricing of Platform Optionality with Flex-Led Leverage

CrowdStrike is no longer merely an endpoint security company; it’s a cybersecurity operating system injecting itself into enterprise workflows. Temporary volatility is brought about by the Flex model but ends up leading to further monetization, greater customer lock-in, and increased partner alignment.

With wider AI-native capabilities in identity, SIEM, and cloud, CrowdStrike is poised to gain from the secular consolidation of cybersecurity tools. Currently valued at ~16x sales and with a trajectory towards $1.7+ billion in FCF by FY27, the current valuation is underestimating the embedded leverage and margin recovery of the platform.

Aside from Flex timing effects and the fact that ARR is not converting into sales quite so cleanly, this is a situation where misunderstood monetization dynamics are masking a platform at near critical mass.