Today’s Market Recap: Silver Spikes, Gold Breaks $5,000 as U.S. Stocks Edge Higher

Track the Market Trend

TradingKey - On January 26, 2026, U.S. equities advanced across major benchmarks on the back of solid macroeconomic data, helping offset market unease ahead of the upcoming Fed policy meeting and a packed earnings calendar. The S&P 500 climbed 0.50% to 6,950.15, the Nasdaq Composite added 0.43% to 23,601.36, and the Dow Jones Industrial Average rose 0.64% to 49,412.41, with all three indices closing at multi-day highs.

Still, weakness persisted in select areas of the market. Small-cap stocks and semiconductor shares underperformed, diverging from the broader positive momentum. Apple (AAPL) gained nearly 3%, while Tesla (TSLA) extended its slide, down more than 3%. Elsewhere, USA Rare Earth surged nearly 8% on news of a federal investment, and CoreWeave rallied close to 6% after receiving additional backing from Nvidia (NVDA).

In FX markets, the Japanese yen logged a second consecutive day of strong gains, rising over 1% intraday to its strongest level in more than two months, amid speculation of government intervention aimed at stabilizing the currency.

Commodities saw heightened volatility, with precious metals grabbing headlines. Gold briefly crossed the historic $5,000 per ounce mark for the first time, rising more than 2%, before giving back much of the gain. Silver rallied as much as 14% intraday to just shy of $118—the sharpest move since 2008—before retracing to end the session little changed.

In the tech sector, investor appetite for AI-driven stocks remained strong, though not without exception. Shares of The Trade Desk (TTD) fell sharply after analysts raised concerns about intensifying competition and increased client switching costs in a generative-AI-dominated landscape. The unexpected resignation of CFO Alex Kayyal added downward pressure, despite the company naming an interim replacement effective immediately. Management reaffirmed its Q4 guidance in an attempt to reassure markets.

Looking ahead, markets widely anticipate the Federal Reserve will leave interest rates unchanged at its January meeting. However, investor focus has pivoted toward the pending nomination of the next Fed chair. The appointment comes at a time of mounting U.S. fiscal concerns and soaring demand for alternative assets, with gold’s recent breakout signaling renewed search for capital protection.

Market Headline

Silver surged as much as 14% to nearly $118 before trimming gains to less than 1%. Silver rallied up to 14% intraday to an all-time high near $118, marking its sharpest single-day move since 2008, before retreating sharply to end with a gain of less than 1%. Analysts warn that the risk of a short-term correction remains elevated, citing signs of fragile sentiment and waning momentum after the rally was largely driven by fear of missing out (FOMO) and speculative trades. While the pullback signals a pause in the speculative phase, analysts note that medium- to long-term drivers—including a softening U.S. dollar and geopolitical uncertainty—continue to offer underlying support for precious metals.

Nvidia commits additional $2 billion to CoreWeave, launching a standalone CPU initiative. Nvidia has committed an additional $2 billion to CoreWeave, focusing initially on deploying a next-generation standalone CPU. The capital injection will help CoreWeave expand its AI infrastructure capacity by more than 5 gigawatts by 2030. As part of the partnership, CoreWeave will be among the first to roll out Nvidia’s upcoming products, including advanced storage solutions and a new central processing unit designed for generative AI workloads.

Microsoft (MSFT) upgrades in-house AI chip to reduce reliance on Nvidia, claims it outperforms Amazon’s (AMZN) Trainium and surpasses Google’s (GOOG) TPU. Microsoft has launched Maia 200, its highest-performing in-house AI inference chip to date, manufactured using TSMC’s 3nm process. Targeting reduced reliance on Nvidia, Maia 200 reportedly outpaces Amazon’s Trainium and Google’s TPU in both efficiency and cost-performance. At FP4 precision, it runs three times faster than Amazon’s latest chip, and outperforms Google’s seventh-generation TPU at FP8. The chip will support OpenAI’s GPT-5.2 and is now available in preview to developers via Microsoft’s cloud. The company confirmed that its next-gen chip, Maia 300, is currently in development.

Alibaba (BABA) releases Qwen3-Max-Thinking, matching global front-runners in AI benchmarks. Alibaba has rolled out Qwen3-Max-Thinking, its most advanced AI inference model yet, with over 1 trillion parameters and 36TB of pre-trained data. The model demonstrates performance comparable to OpenAI's GPT-5.2 and Google’s Gemini 3 Pro across 19 international benchmarks. Designed for agentic reasoning, factual synthesis, and human preference alignment, the model is part of Alibaba’s open-source Qwen ecosystem. According to Hugging Face, Qwen has become the world’s first open-source model with over 200,000 derivative projects and has exceeded 1 billion cumulative downloads—firmly securing its place as the most active open-source LLM globally.

Trump administration to take up to 16% stake in USA Rare Earth (USAR) with a $1.6 billion investment. The Trump administration plans to acquire an 8–16% equity stake in USA Rare Earth through a $1.6 billion mix of debt and equity funding. The company’s shares surged nearly 30% intraday on the news. USA Rare Earth is currently developing a major rare earths mine in Sierra Blanca, Texas, slated to begin production in 2028. It also owns a magnet manufacturing facility in Stillwater, Oklahoma, expected to come online within the year. The move underscores the administration’s broader push to build a domestic critical minerals supply chain and reduce dependence on foreign rare earth sources.

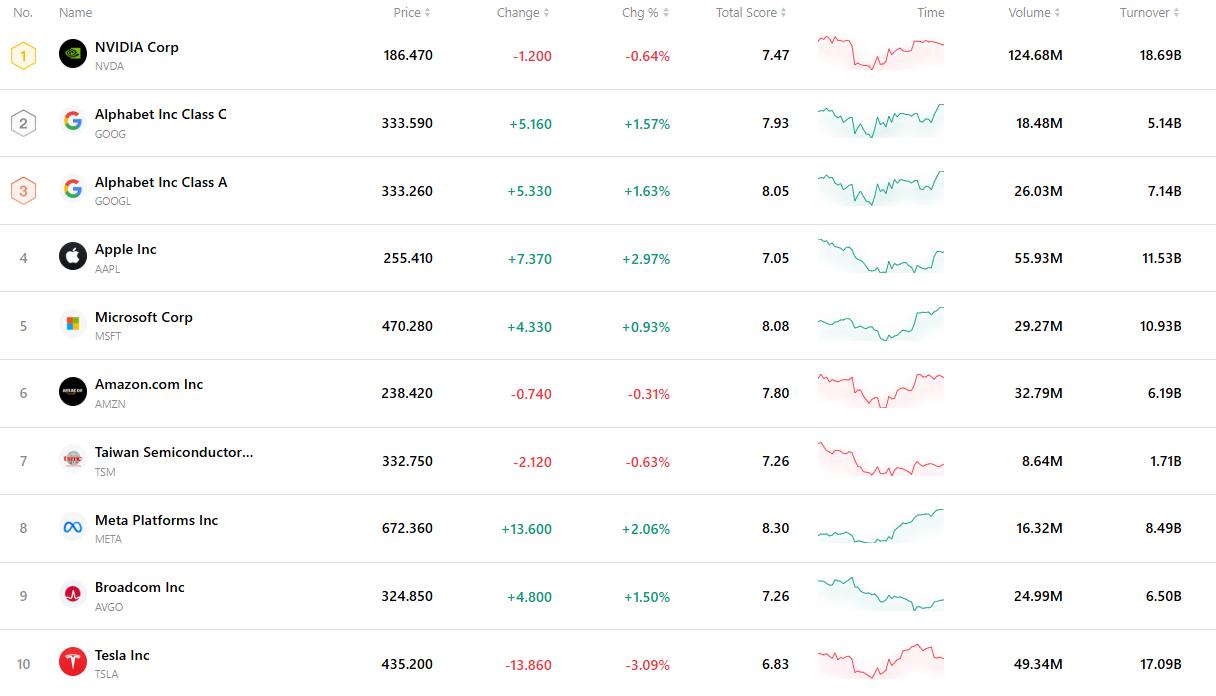

Top 10 Most Traded Stocks

The chart below highlights the ten most actively traded stocks in the current market. With their substantial trading volumes and high liquidity, these names serve as key benchmarks for tracking global market dynamics.