The Ultimate Growth Stock to Buy With $500 Right Now

Key Points

Alphabet benefits from a wide moat.

It has attractive growth avenues and a reasonable valuation.

- 10 stocks we like better than Alphabet ›

Even near all-time highs, the S&P 500 still offers plenty of stocks that can deliver outstanding returns to patient investors. Those looking for the best of the bunch to invest in right now should consider companies capitalizing on the rapid expansion of industries such as cloud computing and artificial intelligence (AI).

One such stock is none other than Google parent company Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). Here is why, for those with $500 to spare, Alphabet is one of the best growth stocks to park your money in.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

A wide-moat stock

While day traders may not care about a stock's competitive advantage, long-term investors should consider it before investing. Alphabet is a great example of a wide-moat stock, which stems from its brand name, network effects, and switching costs.

Alphabet's brand in the search engine niche is so strong that "Google" is now a verb that is listed in official dictionaries. It will be extremely challenging to shift consumer behavior away from Google in a significant way, given this advantage. AI chatbots gave it a shot, but Alphabet quickly adapted and has seen strong engagement in recent quarters with its AI overviews and AI mode.

The company also improves its search function by using data on user habits to fine-tune results. The better it gets, the more it attracts consumers, and the more search volume we see -- all examples of network effects. Alphabet's dominance in this market allows it to generate billions in ad revenue. That won't stop anytime soon.

Then there is Alphabet's cloud computing arm, Google Cloud, which is growing its sales faster than the rest of the business and benefits from high switching costs. Alphabet's strong economic moat is an important reason to buy the stock.

Multiple growth avenues

A wide-moat company could underperform the market, perhaps due to valuation or because it operates in a declining industry. Neither applies to Alphabet.

To the second point, Alphabet is a leader in multiple high-growth sectors, including digital advertising, cloud computing, AI, video streaming, and, perhaps down the line, autonomous vehicles. These should fuel significant revenue and earnings growth for the company for the foreseeable future. Investors can see that by looking at demand within its cloud business.

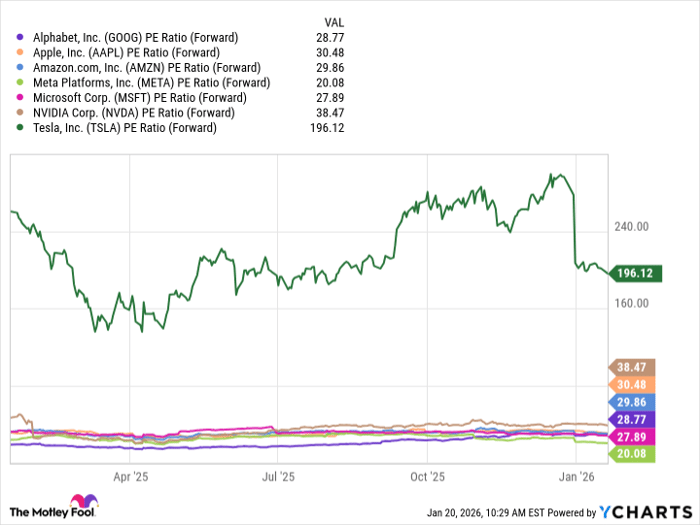

Alphabet's cloud backlog as of the third quarter was $155 billion, up 46% quarter over quarter (its revenue for the period was $102 billion). And that's just one business segment. There is ample fuel in Alphabet's growth engine. But what about valuation? Alphabet is trading at 28.77 times forward earnings, well in line with its "Magnificent Seven" peers.

GOOG PE Ratio (Forward) data by YCharts

However, it is the most profitable member of this group. Alphabet doesn't seem overvalued at all. That's another reason the stock could deliver excellent returns over the next five years and beyond. Shares are currently changing hands for just around $325 apiece, so $500 gets you one of them. It would be money well spent.

Should you buy stock in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $460,340!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,123,789!*

Now, it’s worth noting Stock Advisor’s total average return is 937% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 23, 2026.

Prosper Junior Bakiny has positions in Alphabet, Amazon, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.