The Simple Reason Why I Won't Buy Quantum Computing Stocks in 2026

Key Points

Emerging technology stocks in sectors like quantum computing have soared in the wake of the AI boom.

D-Wave Quantum and Rigetti Computing are both in the 100 most popular stocks on Robinhood, showing that retail investors have piled into the sector.

The technology is difficult to understand, and the sector still seems highly speculative at this point.

- 10 stocks we like better than IonQ ›

2025 will go down as the year quantum computing stocks went mainstream.

The sector was virtually unheard of through much of 2024, but a milestone achievement by Google with its Willow quantum chip in December of that year set off a gold rush into the futuristic technology.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

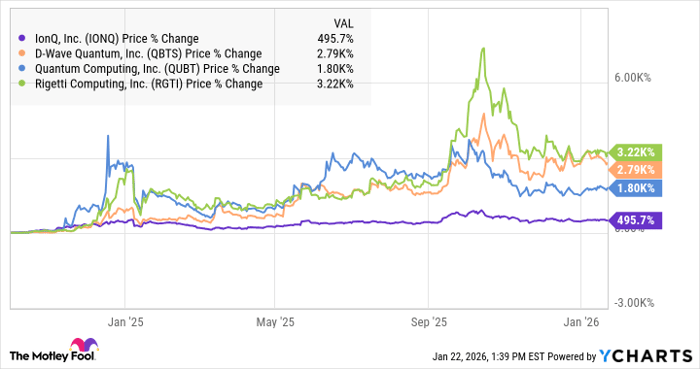

While Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) didn't move much on the news, pure-play quantum computing stocks like IonQ (NYSE: IONQ), D-Wave Quantum (NYSE: QBTS), Rigetti Computing (NASDAQ: RGTI), and Quantum Computing Inc. (NASDAQ: QUBT) all soared in the aftermath of Google's update. The chart below shows the impact of that event and how the stocks have done since then.

IONQ data by YCharts

Through 2025, those stocks continued to attract attention and mostly soared after a pullback at the beginning of the year as some investors speculated that quantum computing could be the next big technology to go mainstream after artificial intelligence.

Quantum computing stocks are one of several speculative emerging technology sectors that have soared in the wake of the AI boom, even though they are only making nominal revenue. Those include electric vertical takeoff and landing (eVTOL) stocks like Archer Aviation and Joby Aviation, and small modular reactor nuclear energy stocks like Oklo and NuScale Power.

The speculative bets and sky-high valuations fueled by AI enthusiasm for the emerging technologies have the feel of a bubble, and offer one reason to avoid quantum computing stocks. However, there's a better and simpler reason, which is that most investors buying quantum computing stocks have little to no understanding of the highly complex technology.

Image source: Getty Images.

What is quantum computing?

Quantum computing is based on the principles of quantum mechanics and uses quantum bits, or qubits, which can be formed in several ways, including by manipulating atoms or using extremely low temperatures.

Quantum computers are capable of solving problems much faster than classical computers, and the technology has the potential to lead to new discoveries in areas like pharmaceuticals and engineering. However, it's unclear how long it will take quantum computers to build the scale to be truly disruptive, if that happens.

Retail investors love quantum computing stocks

It's easy to see why quantum computing stocks would appeal to retail or novice investors, and, in fact, they have at times behaved like meme stocks.

First, as you can see from the chart above, these stocks have already delivered eye-popping gains to anyone who owned them before Google's Willow announcement. That makes it easier to believe they will do so again.

Second, there are big promises and expectations around the technology over the longer term. For example, McKinsey said that by 2035, quantum computing could add $1.3 trillion in value to a group of industries (automotive, chemicals, financial services, and life sciences) poised to benefit from the technology.

Third, it's an appealing story, and it fits in the mold of AI, a disruptive technology that investors are currently watching unfold.

Quantum computing stocks have gotten popular enough with retail investors that two of them, D-Wave Quantum and Rigetti Computing, are now among Robinhood's top 100 most popular stocks, or the hundred most owned among its investor base, which skews toward millennials and Gen Z.

Retail interest isn't a bad thing on its own, but there's not much else propping up the valuations of these stocks, as their revenue is still minimal, and big tech companies like Google and Microsoft seem to have made more meaningful developments in quantum.

Why retail interest looks like a red flag

Stocks can go up whether or not you understand the business model or technology, but typically, the share price reflects a reasonable understanding of the business. Biotech stocks, for example, can be difficult for an untrained investor to understand, but the sector doesn't typically draw herds of newbie investors looking for the next blockbuster growth stock, meaning the price of biotech stocks is more likely to reflect the best understanding of scientists and trained investors who can evaluate the potential of these companies.

Scott Aaronson, a professor of computer science who is considered by some to be an expert on quantum computing and blogs frequently on the subject, has mostly dismissed the batch of quantum computing stocks above, saying the stock gains from IonQ and its peers are driven more by successful marketing than technological advances. Aaronson also claims that privately held Quantinuum, a direct competitor to IonQ, is well ahead of IonQ in its hardware development.

Aaronson's opinion may not be reflected in the stock of IonQ, but it's much more valuable than that of the meme stock investors who have piled into the stock.

Quantum stocks could remain fashionable among the growth stock investors that populate platforms like Robinhood, but speculation and FOMO, especially for a stock that's already been significantly inflated, is a poor reason to invest.

I'm much more comfortable waiting on the sidelines as the quantum computing fervor runs its course. The technology may eventually be disruptive, but based on recent results from these stocks, we're still years from anything close to that happening.

Should you buy stock in IonQ right now?

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $460,340!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,123,789!*

Now, it’s worth noting Stock Advisor’s total average return is 937% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 23, 2026.

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, IonQ, and Microsoft. The Motley Fool recommends NuScale Power and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.