Prediction: 4 Stocks That'll Be Worth More Than Apple 5 Years From Now

Key Points

Amazon and Microsoft are nipping at Apple's heels.

Taiwan Semiconductor and Broadcom need the AI build-out to last for five years to surpass Apple's market cap.

- 10 stocks we like better than Microsoft ›

Apple (NASDAQ: AAPL) is the world's third-largest company, valued at $3.6 trillion. However, I think the next five years could see some other companies take over its high spot on the list, especially if it doesn't start growing at a faster rate. The four stocks I believe can pass Apple over the next five years are Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN), Taiwan Semiconductor (NYSE: TSM), and Broadcom (NASDAQ: AVGO).

These stocks fall into two primary categories: big tech and chip makers. All four can pass Apple over the next four years, and I think they make for a far better investment than Apple.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

What's wrong with Apple?

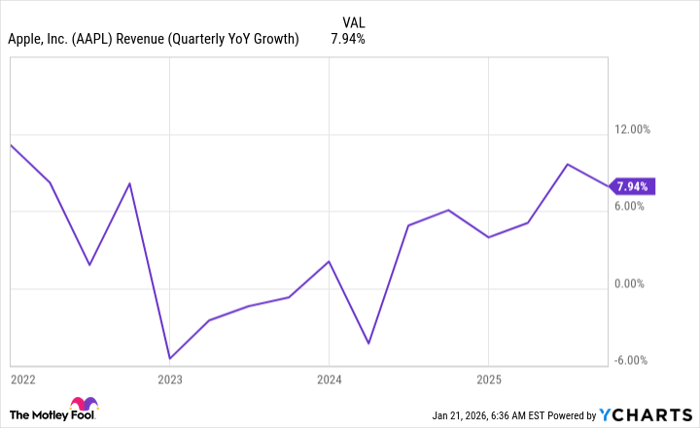

First, we need to tackle why Apple won't be a good investment in 2026 and beyond. It really boils down to one thing: When's the last time Apple launched something new or innovative that actually caught on? It has been a long time, and Apple is surviving on past performance rather than new business. This could open it up to losing market share to more innovative competitors. Apple's revenue is growing, but at a slower-than-market pace (10% year over year).

AAPL Revenue (Quarterly YoY Growth) data by YCharts.

Thanks to its aggressive stock buyback program, Apple delivers about 10% diluted earnings per share (EPS) growth each quarter, so that's the bar these companies will have to go up against to see if they can outperform Apple.

Microsoft and Amazon are within striking distance

Microsoft has a $3.4 trillion market cap, and Amazon has a $2.5 trillion one. So, it won't take much for each company to rise past Apple, especially as it's growing slowly.

Microsoft has capitalized on the massive generative AI spending spree thanks to its cloud computing service, Azure. Azure has become a strong option to build AI applications on, as it offers several different generative AI models to choose from, including OpenAI's ChatGPT. Microsoft has a 27% ownership stake in OpenAI, so it will also benefit when it eventually goes public. Microsoft has consistently delivered mid- to high-double-digit EPS growth over the past few years, and this will easily be enough to propel Microsoft past Apple over the next five years.

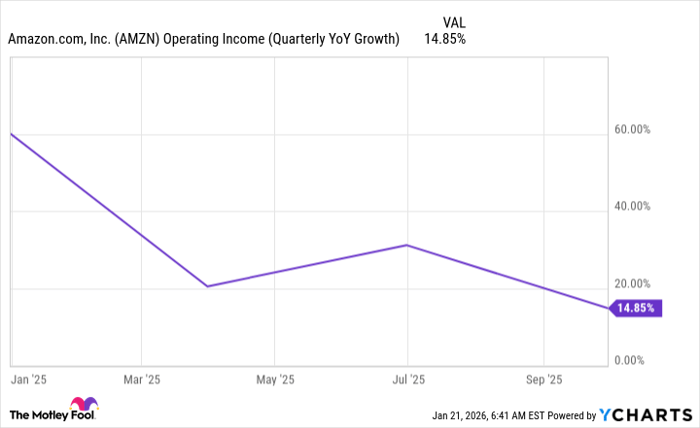

Amazon has a bit more work to do, but it's also growing at an incredibly fast pace. Revenue growth is the wrong way to assess Amazon's stock, as retail sales account for the majority of revenue, yet have poor margins. What investors should be focused on is how quickly its operating income is growing.

AMZN Operating Income (Quarterly YoY Growth) data by YCharts.

Although it slowed down in the third quarter, it should stay elevated as higher-margin divisions within Amazon are growing rapidly. This will allow Amazon's earnings to grow at a rapid pace and surpass Apple within five years.

AI spending is driving Broadcom and Taiwan Semiconductor higher

Broadcom and Taiwan Semiconductor have a long road ahead of them. They are each less than half the size of Apple, so they essentially need to triple over the next five years to surpass Apple. That's a tall task, but given how much is expected to be spent on artificial intelligence (AI) computing, these two can do it.

Taiwan Semiconductor believes it will grow its revenue at a 25% compounded annual growth rate (CAGR) through 2029. If we extend that growth rate a few years, which is possible if AI demand proves to be insatiable, that indicates its revenue could triple over the next five years. It won't be easy, but if it does, TSMC can be a larger company than Apple five years later.

Broadcom is in an even better space, as its custom AI accelerator chips are rapidly rising in popularity. For Q1, they expect 100% year-over-year growth for its custom AI chips, and that strength isn't expected to slow down anytime soon. Longer term, companies like Nvidia (NASDAQ: NVDA) have given projections that global data center capital expenditures (capex) will reach $3 trillion to $4 trillion by 2030, up from $600 billion in 2025. At the low end, that's a 38% CAGR.

We've already established that TSMC's 25% CAGR would be enough to surpass Apple, so if Broadcom can grow at the same rate as data center capex, it will easily surpass Apple over the next five years.

Should you buy stock in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $460,340!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,123,789!*

Now, it’s worth noting Stock Advisor’s total average return is 937% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 23, 2026.

Keithen Drury has positions in Amazon, Broadcom, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Amazon, Apple, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.