The Smartest Growth Stock to Buy With $1,000 Right Now

Key Points

SoFi has a thriving lending business that's flourishing as interest rates come down.

Growth is accelerating, and profits are increasing.

SoFi has a long growth runway in monetizing its user base.

- 10 stocks we like better than SoFi Technologies ›

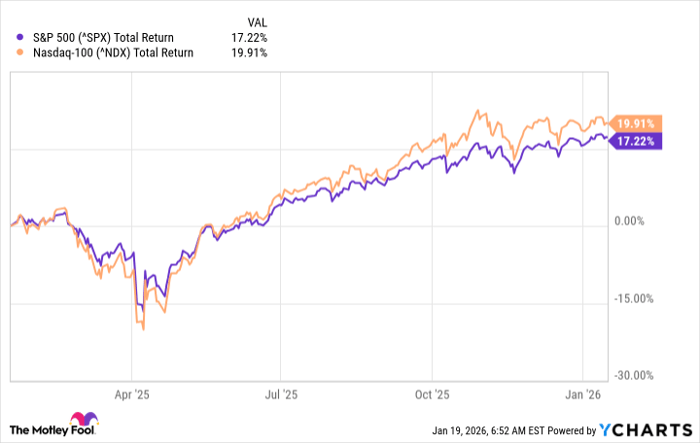

In what has become the norm over the past several years, when the market is thriving, it's being led by high-growth stocks. These are often disruptive tech stocks that have incredible opportunities. You can chart this as gains in the Nasdaq-100, a group of 100 tech stocks, versus the S&P 500.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Data by YCharts.

Many high-growth tech stocks are riskier than your average S&P 500 stock, but they can grow your money much more, too. That's the risk versus reward proposition. If you have $1,000 available to invest, and you're looking for a top growth stock, I recommend SoFi Technologies (NASDAQ: SOFI). It's past its riskiest point, becoming solidly profitable and making a name for itself as a stable player in banking. Here's why it could be the smartest growth stock to invest your money in.

Image source: Getty Images.

SoFi is the new player in banking

SoFi has built itself up from a student loan co-op into a full-service online bank. Although lending is still its core business, it now offers a large assortment of financial services products that appeal to its target market of students and young professionals.

Its digital interface and easy-to-use app are attracting new customers in droves, driving high growth. In the 2025 third quarter, adjusted net revenue growth accelerated to 38% over last year, and adjusted net income increased 129% to $139 million. It added 905,000 new accounts in Q3, a quarterly record and a 35% increase year over year. It also added 1.4 million new products, a 36% increase, for a total of 18 million.

There's growth throughout the enterprise. The lending segment is thriving as interest rates come down, and SoFi had a record $9.9 billion in originations in the third quarter. Lending revenue increased 25% year over year; financial services revenue, which includes the non-lending products, increased 76%; and tech platform, the business-to-business product, was up 12%.

SoFi stock has massive long-term potential

Management sees massive long-term opportunities in monetizing its existing customers, in addition to adding new customers. It envisions a strong cross-selling strategy where customers grow with SoFi as they have greater financial management needs, leaving a long growth runway.

To that end, it's adding new products all the time. It's specifically focusing on innovation, especially with blockchain technology, such as a new stablecoin. One of its most exciting new offerings is the Smart Card, which connects all the user's accounts, already connected on the app, in one card.

SoFi is growing and profitable, and it could add incredible value to a growth-oriented portfolio.

Should you buy stock in SoFi Technologies right now?

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $470,587!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,091,605!*

Now, it’s worth noting Stock Advisor’s total average return is 930% — a market-crushing outperformance compared to 192% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 21, 2026.

Jennifer Saibil has positions in SoFi Technologies. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.