Up 948%, Should You Buy Sandisk Right Now?

Key Points

Investors have been rushing to capitalize on the fast-growing demand for flash storage memory in data centers.

Sandisk's results are on track to jump impressively, and investors have been buying the stock hand over fist.

Yet, the shares are still available at an attractive valuation even after its stunning surge in the past year.

- 10 stocks we like better than Sandisk ›

Flash storage products company Sandisk (NASDAQ: SNDK) was spun off from digital storage giant Western Digital in February last year. The stock has shot up a stunning 948% since then, driven by the favorable dynamics of the memory market, where demand is exceeding supply due to artificial intelligence (AI) applications.

Investors may now be wondering if it's a good idea to buy Sandisk following the phenomenal rally it has seen in less than a year. We will examine the company's growth potential and valuation to determine if this high-flying tech stock is worth buying in anticipation of further upside.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Sandisk's sunny prospects point toward better times

Sandisk supplies its flash storage products, such as solid-state drives (SSDs), memory cards, flash drives, and embedded memory chips, to the data center, consumer device, and edge device markets. The company points out that the demand for its storage products is outpacing supply. That's not surprising, as the proliferation of AI across different applications is creating the need for more storage.

For instance, the company's revenue from edge devices such as personal computers (PCs) and smartphones increased by 30% year over year in the first quarter of fiscal 2026 (which ended on Oct. 3, 2025). This business produced 60% of Sandisk's revenue in the quarter, and the good news is that it can keep flourishing thanks to the growing demand for AI PCs and an increase in the average storage capacity of smartphones.

Sandisk estimates that PC shipments could increase by a low single digit percentage this year. Additionally, the storage capacity in each PC is expected to increase by mid-single digits. However, stronger growth cannot be ruled out as AI-capable PCs that can run models and inference applications locally require much higher storage. For example, computer magazine PCWorld recommends an AI PC to have at least 1 terabyte (TB) of storage to run AI models on-device, much higher than the 256 gigabytes (GB) of storage that Microsoft recommends for AI-specific PC models.

A similar story is unfolding in the smartphone market, where on-device AI capabilities are expected to drive a high single-digit improvement in storage capacities. Meanwhile, the demand for SSDs deployed in data centers is spiking as well to handle AI workloads in the cloud, owing to their superior performance, power efficiency, and larger capacities.

Not surprisingly, Sandisk is seeing strong interest in its SSDs from hyperscalers. The company pointed out in November last year that its data center SSD products are in the qualification stage at a couple of hyperscalers, while the qualification process at another hyperscaler is expected to begin this year. Sandisk points out that it is "working with five major hyperscale customers through active sales and strategic engagements" in the data center segment.

The data center segment produced just 11% of Sandisk's revenue in fiscal Q1. However, it is likely to receive a major shot in the arm as the buildout of AI infrastructure focused on inference applications is expected to be a major growth driver for enterprise SSDs. As such, it is easy to see why Mordor Intelligence is expecting the data center SSD market's size to jump to $167 billion in 2031 from $49 billion last year.

Moreover, the booming demand for SSDs has created supply constraints, as Sandisk management remarked on the November 2025 earnings call. This has led to a jump in the price of flash storage memory, with Sandisk expecting a double-digit increase in price on a sequential basis in the recently concluded fiscal Q2.

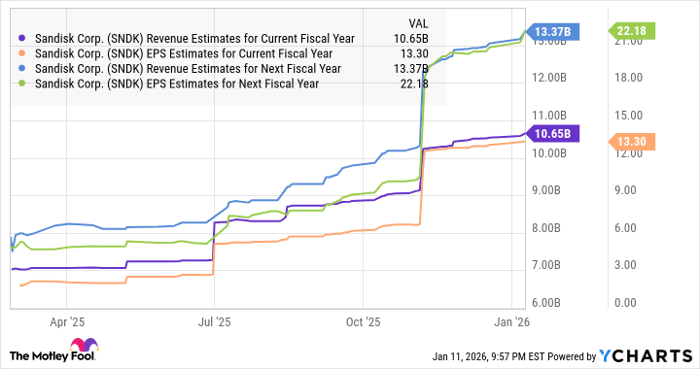

Market research firm TrendForce, for instance, is forecasting a 33% to 38% increase in flash memory prices in the first quarter of 2026, suggesting that the positive pricing environment is likely to persist. As a result, Sandisk seems primed to clock a solid increase in both its top and bottom lines.

SNDK Revenue Estimates for Current Fiscal Year data by YCharts

But what about the valuation?

Sandisk stock is trading at an attractive valuation despite its red-hot rally in the past year. It can be bought at just 7 times sales right now, a discount to the U.S. technology sector's average price-to-sales ratio of 8.7. Moreover, Sandisk's earnings are expected to jump by an impressive 344% this year, followed by another big jump of 67% in the next fiscal year.

This makes Sandisk a no-brainer buy given its forward earnings multiple of 28, which is a tad higher than the tech-laden Nasdaq-100 index's forward earnings multiple of 26. The pace of Sandisk's earnings growth suggests that it could be trading at a premium valuation going forward, which is why investors are getting a good deal on this AI stock right now.

So, buying Sandisk looks like a smart thing to do as it seems capable of flying higher even after the terrific gains it has clocked in the past year.

Should you buy stock in Sandisk right now?

Before you buy stock in Sandisk, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sandisk wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $482,209!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,548!*

Now, it’s worth noting Stock Advisor’s total average return is 968% — a market-crushing outperformance compared to 197% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 13, 2026.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.