Why Alphabet Stock Jumped 65% in 2025

Key Points

Alphabet has delivered steady growth on the top and bottom lines.

A legal ruling allowed it to maintain control of Chrome.

Gemini 3 has been well-received.

- 10 stocks we like better than Alphabet ›

Shares of Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) soared last year as the company's AI investments paid off with the release of Gemini 3, and a favorable antitrust ruling that did not result in the company being broken up alleviated a key risk, sending the stock higher.

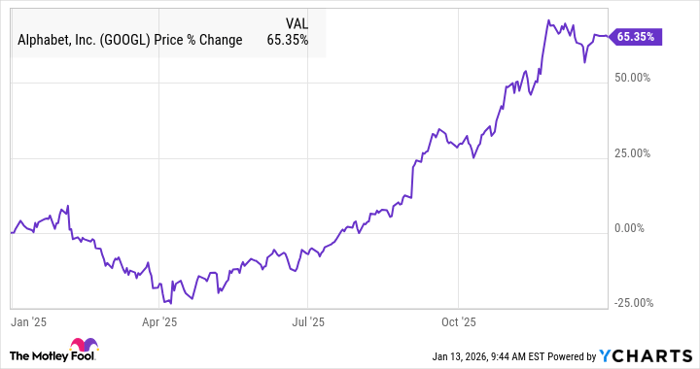

According to data from S&P Global Market Intelligence, the stock finished the year up 65%. As you can see from the chart below, the stock was in the red for most of the first half of the year before things turned around and sentiment around the stock shifted dramatically.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

GOOGL data by YCharts

Alphabet's big turnaround

Coming into this year, Alphabet's AI strategy had long been a cloud hanging over the company. After the launch of ChatGPT in November 2022, Alphabet responded with Bard, but the product underwhelmed in its debut presentation, and investors believed that Google Search suddenly faced a mortal threat.

However, in the intervening years, Alphabet has acquitted itself well, delivering consistent growth, maintaining its dominant market share in search, turning in Google Cloud, and reassuring investors. Through the first three quarters, revenue rose 14% to $289 billion, and operating income grew by a similar percentage to $93.1 billion. That's an impressive growth rate for such a large company.

One of the biggest catalysts for the stock last year, and the biggest one-day gain for the stock in 2025 came on Sept. 3 in response to a court ruling as Judge Amit Mehta ruled that Google could retain control of its Chrome web browser and the Android mobile operating system.

The stock jumped 9% on that news and continued to move higher on the momentum as the biggest risk facing the stock had been removed.

In November, the stock jumped again, climbing 6% on Nov. 24 as investors reacted positively to Gemini 3 and news that Warren Buffett's Berkshire Hathaway's taking a stake in the company.

Image source: Getty Images.

What to expect from Alphabet in 2026

In early 2026, Alphabet scored another big win as Apple said it would use Gemini as the brains behind Siri.

Some reviews say that Gemini 3 is now the leading frontier model in AI, and Google seems to have turned the earlier fears about AI on its competition on its head. Meanwhile, its Waymo autonomous vehicle service continues to expand and could become its next major revenue stream.

2026 is shaping up to be another strong year for the tech giant.

Should you buy stock in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $482,209!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,548!*

Now, it’s worth noting Stock Advisor’s total average return is 968% — a market-crushing outperformance compared to 197% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 13, 2026.

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Apple, and Berkshire Hathaway. The Motley Fool has a disclosure policy.