Why NuScale Power Stock Is Plummeting in December

Key Points

NuScale Energy is the only U.S. company with a small modular reactor design approved by the Nuclear Regulatory Commission.

The company has not gotten its first official customer, and it's deeply unprofitable.

- 10 stocks we like better than NuScale Power ›

NuScale Power (NYSE: SMR) was one of the market's hottest stocks earlier in 2025. Before mid-October, the company had gained 200% on the year, driven by its first-mover advantage and its potential to power artificial intelligence (AI) data centers.

Since then, the nuclear stock's historic run has turned into a big loss. The stock was trading at about $57 at its peak. It now trades for roughly $14 -- a 75% decline from its all-time high. It's down 30% in December.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

What's happening with NuScale, and is now the time to buy the dip?

Image source: Getty Images.

First-mover advantage means nothing without a first customer

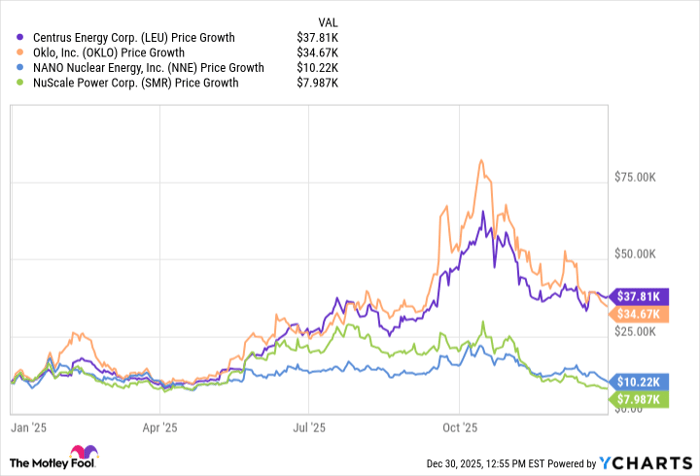

NuScale wasn't the only nuclear company to plummet in mid-October. Oklo (NYSE: OKLO), Centrus Energy (NYSE: LEU), and Nano Nuclear Energy (NASDAQ: NNE) have all seen significant sell-offs amid larger concerns over an AI bubble. Out of this group of advanced nuclear companies, NuScale has been the worst-performing this year.

Here is how much a $10,000 investment earlier this year would be worth now in each of these four companies.

LEU data by YCharts

NuScale is currently the only U.S. reactor developer that has Nuclear Regulatory Commission design certification for a small modular reactor. On the other hand, the company has yet to ink its first major deal. While it has a potential first customer in Romanian company RoPower, the lack of a first sale has certainly weighed heavily on the company's valuation.

NuScale posted a larger-than-expected loss and net income of negative $532 million in its most recent quarter. On the bright side, it had about $754 million in cash and equivalents, though about $475 million came from selling 13.2 million in shares.

A big concern right now is share dilution. In mid-December, shareholders approved a measure to increase the number of authorized shares from 332 million to 662 million. Although approval doesn't mean new shares will be issued today, it gives NuScale the freedom to issue them if it needs fresh capital.

At this point, approach NuScale with caution: It could have growth potential if it gets a customer, but success isn't guaranteed.

Should you buy stock in NuScale Power right now?

Before you buy stock in NuScale Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and NuScale Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $505,749!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,149,658!*

Now, it’s worth noting Stock Advisor’s total average return is 979% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 31, 2025.

Steven Porrello has positions in Centrus Energy, NuScale Power, and Oklo. The Motley Fool recommends NuScale Power. The Motley Fool has a disclosure policy.