3 Stock Market Predictions for 2026

Key Points

With the market trading at elevated levels, I anticipate a correction at some point in 2026.

However, this doesn't mean the stock market will necessarily have a bad year.

The artificial intelligence trade may be fragile, but that doesn't mean it has run its course.

- 10 stocks we like better than S&P 500 Index ›

Another year has come and gone, and not without its fireworks. The stock market rocked up and down this year, from the big tariff announcements in April, which sent the market into free fall, to the months-long run-up in anticipation of lower interest rates. With just days remaining in the year, the broader benchmark S&P 500 index is barreling toward another spectacular year, up over 18% (as of Dec. 25).

If the market finishes around this level, it will cap off one of the best three-year stretches ever, following returns of 24% and 23% in 2023 and 2024, respectively. That said, uncertainty heading into 2026 seems as high as it has ever been, as investors ponder whether things are simply too good to be true.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Here are three stock market predictions I have for 2026.

Image source: Getty Images.

1. There will be a 10% correction at some point

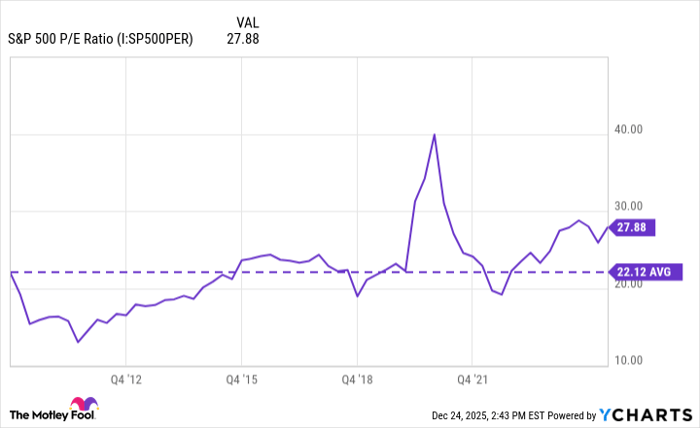

There are still reasons to like market conditions heading into 2026. The economy has held up, and by some measures, appears strong. Meanwhile, the Federal Reserve is lowering interest rates, and many surmise that the agency will continue to make favorable adjustments to the Fed's balance sheet, which will also continue to support stock prices. However, the S&P 500 remains elevated by a decent amount based on its historic price-to-earnings ratio.

S&P 500 P/E Ratio data by YCharts

This creates less margin for error, meaning it may not take much to spook investors. This could occur if inflation remains elevated, prompting the Fed to reconsider its trajectory and impose fewer future interest rate cuts than expected, or even hike interest rates. Unemployment could also rise, or consumer spending could decline, leading to concerns about a recession.

Investors may also be surprised to learn that market corrections of at least 10% are fairly common. According to a report from Charles Schwab, there have been 25 market corrections of at least 10% since 1974, with only six of these turning into outright bear markets.

2. The artificial intelligence bubble has more room to run

Over the past few years, artificial intelligence stocks have generated sparkling returns, from Nvidia to Palantir to Tesla. At this point, I believe a bubble has at least somewhat formed; just look at Palantir's and Tesla's valuations. Furthermore, hyperscalers have already spent hundreds of billions on AI infrastructure and are projected to spend trillions more in future years.

Meanwhile, it's unclear whether these investments will yield the kind of returns investors are looking for or whether the world has the resources needed to meet all the AI demand. However, it can be challenging to predict when a bubble will burst, and bull markets can persist much longer than anticipated, as seen during the internet boom in the mid- to late- 1990s.

Many of the companies driving AI are still in incredibly strong financial positions. While I wasn't an investor during the Great Recession, I don't think there were nearly as many people contemplating a bubble as there are now. So while one may materialize, I still think the bears may be early and that things can get much more inflated than they are now.

3. The market will finish 2026 in the green

I'm not going to make any S&P 500 price predictions, but I believe we are in for another green year. Why?

For one, the Fed is expected to maintain an accommodative monetary policy. Investors believe the Fed will drop interest rates a few more times in 2026. The Fed has also resumed asset purchases, with plans to expand its balance sheet, which effectively pumps money into the economy. Not labeled as quantitative easing, the Fed has begun purchasing $40 billion of short-term U.S. Treasury bills per month to alleviate some of the building pressure in the overnight lending markets. The plan is to eventually slow this pace sometime in 2026, although the exact timing is unclear. As billionaire investor David Tepper often says, "Don't fight the Fed."

Furthermore, I don't think a minor or moderate recession will completely derail the market, as this would likely support more rate cuts from the Fed. I would be much more concerned if inflation remains elevated or even starts to rise, which could drastically change the Fed's policies and certainly derail the market. But that's not the base case for many market strategists, who predict a rise in inflation during the year before it ultimately tapers off by year's end.

I also believe there can be continued rotation from AI into the rest of the S&P 500 companies, which have much tamer valuations. Tailwinds, including increased clarity on the impacts of tariffs, Trump's tax cuts, and further deregulation by the Trump administration, could continue to support stocks across various sectors.

Should you buy stock in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,470!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,167,988!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 30, 2025.

Charles Schwab is an advertising partner of Motley Fool Money. Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia, Palantir Technologies, and Tesla. The Motley Fool recommends Charles Schwab and recommends the following options: short December 2025 $95 calls on Charles Schwab. The Motley Fool has a disclosure policy.