Evaluating KHC Stock's Actual Performance

Key Points

The conglomerate is anchored by an enviable collection of familiar brands.

Many of these are quite mature, though.

- 10 stocks we like better than Kraft Heinz ›

Kraft Heinz (NASDAQ: KHC) is a food conglomerate anchored by its two familiar namesake brands. Kraft and Heinz, however, are only two product lines in a large food and beverage portfolio that includes assets such as Kool-Aid, Oscar Mayer, and Jell-O.

But it isn't easy to cook up a tasty stock from such a disparate collection of veteran brands. Kraft Heinz hasn't been all that delicious for its shareholders -- at least, in its present form.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

A chronic underperformer

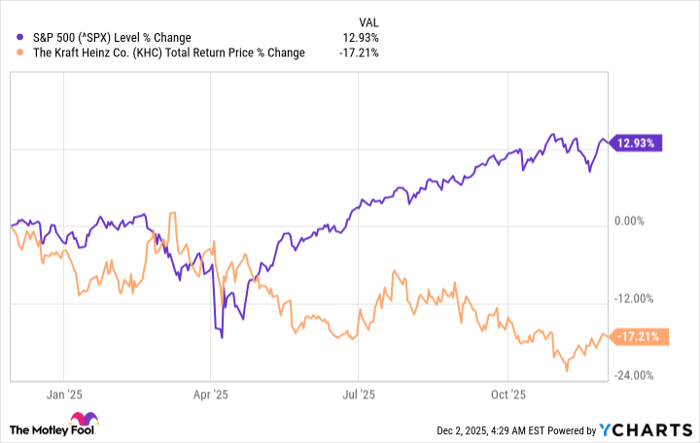

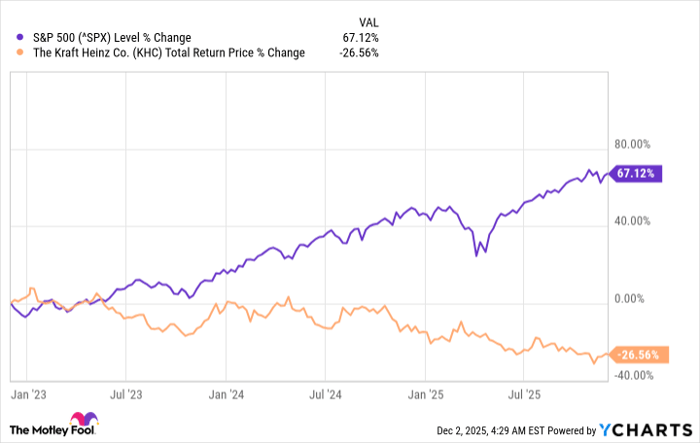

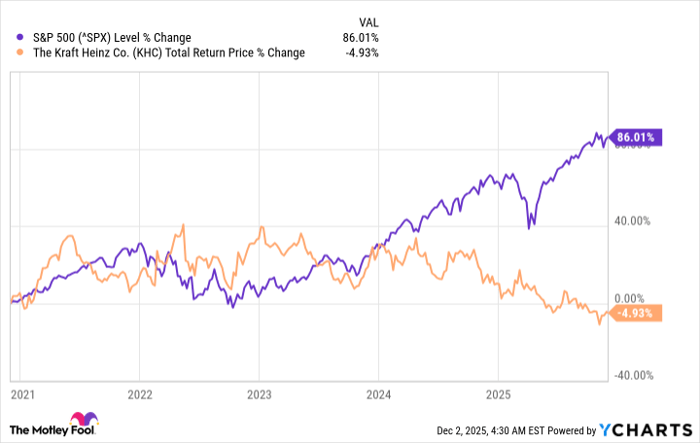

When looking at a trio of trailing time periods -- one, three, and five years -- what's striking is how consistently Kraft Heinz has underperformed the market (represented here by the S&P 500 index). That's when accounting for the stock's total return, which includes both capital gains and the company's regular quarterly dividend payments.

^SPX data by YCharts.

To me, the two main challenges for Kraft Heinz are: 1) the bulk of its portfolio is mature (some might even say stale), and 2) most of these products aren't as favored as they once were, since a great many people have shifted to healthier or more exotic choices over the years.

As a result, the company hasn't managed to gain any altitude on the top line. Since 2020, it has posted only two increases in annual revenue. The 2024 take of $25.8 billion represented a 3% slide from the previous year's result, and was also notably below the 2020 figure ($26.2 billion).

Splitsville

In September, management announced plans to divide the present Kraft Heinz into two separate businesses.

It's essentially attempting to split up the company's billion-dollar (in terms of annual sales) brands. One company will be anchored by Heinz, along with Kraft Macaroni and Cheese and Philadelphia Cream Cheese. The other is to be led by Oscar Meyer, Lunchables snacks, and the Kraft Singles cheese line.

Kraft Heinz essentially stated that the split will enable its successors to devote more resources and attention to the respective products in their portfolios.

I'm not sure I buy this, since those uninspiring revenue numbers don't feel like they're the result of brand neglect. Personally, I see Heinz, Philly, Lunchables, and Singles nearly everywhere I shop. To me, the problem is that these products are steady, unexciting refrigerator mainstays in a world where tastes have evolved and broadened.

One major attraction of Kraft Heinz stock (at least in its present form) is its high-yield dividend, which presently pays out at 6.3%. While top-line growth is lacking, the portfolio certainly generates a lot of the green stuff. The company's free cash flow was just under $3.2 billion in 2024, far more than enough to fund that juicy payout.

While I'm a dividend fan, I wouldn't yield to temptation with this one. In the likely event that Kraft Heinz (and its successors) continue to post mediocre results, the stock's price is unlikely to tread water. The same goes for the total return.

Kraft Heinz has its advantages as a business. It isn't easy to build and maintain a robust portfolio of high-visibility brands, and that high-yield dividend is tantalizing. Neither looks like it'll push the stock higher, though, and that makes it a pass for me.

Should you invest $1,000 in Kraft Heinz right now?

Before you buy stock in Kraft Heinz, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Kraft Heinz wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $556,658!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,124,157!*

Now, it’s worth noting Stock Advisor’s total average return is 1,001% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool recommends Kraft Heinz. The Motley Fool has a disclosure policy.