3 Reasons to Buy Amazon Stock Like There's No Tomorrow

Key Points

The company plans to add more computing power to Amazon Web Services.

Advertising has been the fastest-growing segment in the past couple of years.

The shift to regional fulfillment centers has improved delivery speed and margins.

- 10 stocks we like better than Amazon ›

For many years, Amazon (NASDAQ: AMZN) was a poster child for growth stocks and the returns they can deliver. However, over the past 12 months, Amazon's shares have cooled a bit, underperforming the S&P 500 by a narrow margin.

Just in the first 11 months of 2025, Amazon has also underperformed the S&P 500 (7.1% to 16.1%), as well as every "Magnificent Seven" stock except Tesla. So the company has seen better stretches (though, to be fair, it has seen worse, too).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Despite the stock's recent lackluster performance, it remains one of the best long-term choices in the market. Here are three reasons I would buy it like there's no tomorrow.

Image source: Getty Images.

1. Amazon Web Services continues to be the cloud leader

Amazon Web Services (AWS) has always been the leading cloud platform. It has lost market share to platforms like Microsoft Azure and Alphabet's Google Cloud in recent years, but it still holds a commanding lead in market share at 29%, compared to the other two platforms' 20% and 13%, respectively.

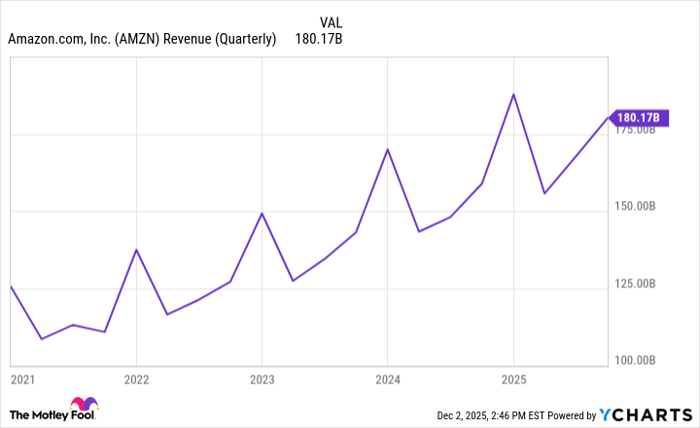

The third quarter was a key period for AWS, as some investors grew concerned about its slowing growth. However, it managed to increase revenue by 20% year over year, its highest rate since the fourth quarter of 2022. Its $33 billion in revenue accounted for just over 18% of Amazon's total revenue, but AWS' $11.4 billion in operating income was over 65% of Amazon's total operating income.

AMZN Revenue (Quarterly) data by YCharts.

AWS' impressive quarter can largely be attributed to growing demand for generative AI services and its expanding infrastructure for companies looking to run AI applications.

It also plans to add cloud-computing capacity, providing more computational power and resources for its customers. The plan is to add at least a gigawatt of capacity in the fourth quarter and double its capacity through 2027. According to calculations from investment bank Oppenheimer, each additional gigawatt of capacity could add $3 billion in revenue.

2. Advertising is becoming a tangible business

One segment that seems to fly under the radar for Amazon is its advertising business. Over the past few years, Amazon Ads has been the company's fastest-growing segment, and that continued in the third quarter. With a leading e-commerce business, a booming Prime Video, Twitch streaming, and Fire TV, it has plenty of first-hand data to help potential advertisers create effectively targeted campaigns.

Management has also announced partnerships that allow Amazon Ads customers to buy space on Netflix, Spotify, and Sirius XM, increasing its appeal to advertisers looking to showcase their products and services beyond just Amazon properties.

Using Amazon Ads goes beyond just getting products and services in front of customers. The company has a suite of tools and resources -- like analytics and cloud marketing -- that provide advertisers with a full in-house stack of solutions. Advertising is shaping up to be a productive, high-margin business for Amazon.

3. E-commerce is still going strong

At the end of the day, Amazon's bread and butter remains its e-commerce business. It's what has made it a household name and what continues to generate revenue to fund capital-intensive, high-growth opportunities. Without the cash-flow-producing e-commerce business, segments like AWS and advertising likely wouldn't be at their current scale.

A major move the company has made is to shift away from a central fulfillment center and toward regional fulfillment centers, which help improve speed and lower logistics costs. As a company that built its e-commerce brand on speed and convenience, this is another step to continuing that.

E-commerce has historically been a low-margin business for Amazon (it spent a lot of time as unprofitable), but management has been steadily improving its margins by using more automation and robotics rather than human labor. Of course, this has led to layoffs, which shouldn't be celebrated, but it has also improved the company's operational efficiency.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $556,658!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,124,157!*

Now, it’s worth noting Stock Advisor’s total average return is 1,001% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Netflix, Spotify Technology, and Tesla. The Motley Fool has a disclosure policy.