Canadian Dollar soars after upbeat labor report

- The Canadian Dollar climbed nearly 0.9% against the US Dollar on Friday.

- Canadian labor data came in well above expectations, bolstering the Loonie into ten-week highs.

- CAD traders will be bracing for fallout from next week’s critical Fed rate call.

The Canadian Dollar (CAD) found room on the high side on Friday, climbing nearly 0.9% and locking in a second straight week of firm gains for the Loonie. The CAD has gained nearly 2.2% bottom-to-top against the US Dollar (USD) since hitting seven-month lows in early November.

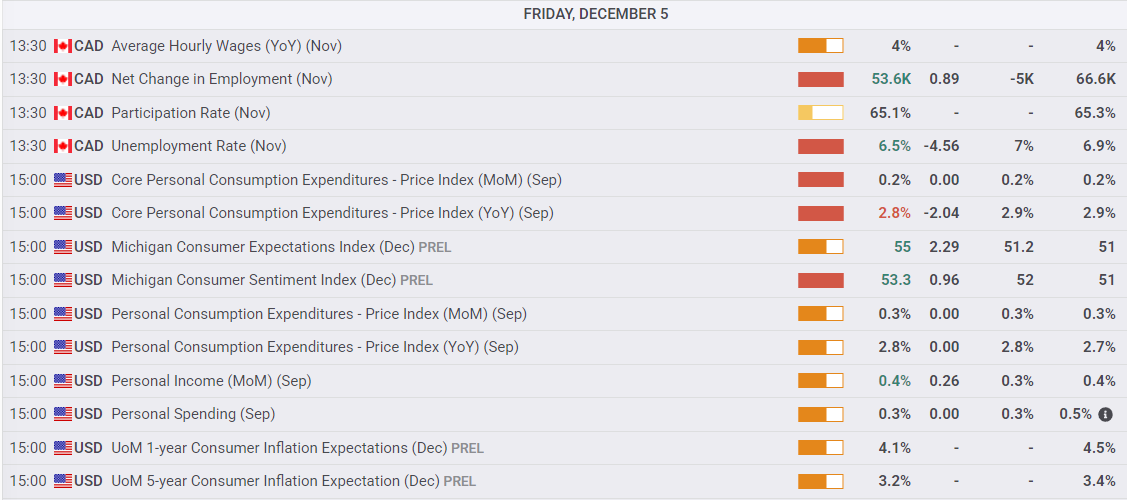

Canadian labor data came in broadly stronger than expected in November, with the Canadian economy adding far more jobs than expected. The Canadian Unemployment Rate tumbled to its lowest level since August 2024.

US Personal Consumption Expenditures Price Index (PCE) inflation data from September also came in slightly better than expected, helping to keep broad-market risk appetite on the high side as investors expect a third straight Federal Reserve (Fed) rate cut in December. The Greenback is swooning across the board on Friday, providing further support for Loonie bulls.

Daily digest market movers: Canadian employment figures flaunt expectations, boost Loonie

- The Canadian Dollar rose 0.85% against the US Dollar on Friday, pushing the Loonie into fresh ten-week highs against the Greenback.

- Loonie strength combined with a waffling US Dollar has pushed the USD/CAD pair back down from the 1.4000 handle, and price action is now back on the bearish side of the 200-day Exponential Moving Average (EMA) near 1.3925.

- The Canadian Unemployment Rate sank to its lowest levels in nearly a year, falling to 6.5%.

- Canadian Net Change in Employment showed 53.6K net new job gains in November, well above the forecast 5K contraction.

- Key US PCE inflation came in cooler than expected and US consumer sentiment trackers also rebounded more than expected, cementing market hopes for a third straight Federal Reserve (Fed) interest rate cut on December 10.

Canadian Dollar price forecast

Friday’s strong showing for the Canadian Dollar has pushed the USD/CAD deeper into bear country. Price action is now on the low side of the 200-day EMA. Although technical oscillators are beginning to flash warning signs of oversold conditions, a bullish return to the mean is unlikely to reclaim the 1.4000 without a structural shift in market sentiment.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.