Down More Than 60% From Its High, Has Strategy Become a Cheap Stock?

Key Points

Strategy prides itself on being the largest corporate holder of Bitcoins.

That strategy, however, is now working against the stock.

It has oftentimes been a more volatile holding than Bitcoin itself.

- 10 stocks we like better than Strategy ›

Strategy (NASDAQ: MSTR) is the largest corporate holder of Bitcoin and one of the biggest bulls of the top cryptocurrency. But amid weakness in the crypto market of late, its shares have been in a free fall. And that's putting it lightly. In just the past six months, the stock has lost more than half of its value.

Heading into trading on Wednesday, the stock was down 60% from its 52-week high of $457.22, which it reached back in July. Is the sell-off in Strategy's stock overdone, and could this be a good time to invest in the tech company, or could there be more trouble ahead?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Strategy's performance has been correlated to Bitcoin's movements

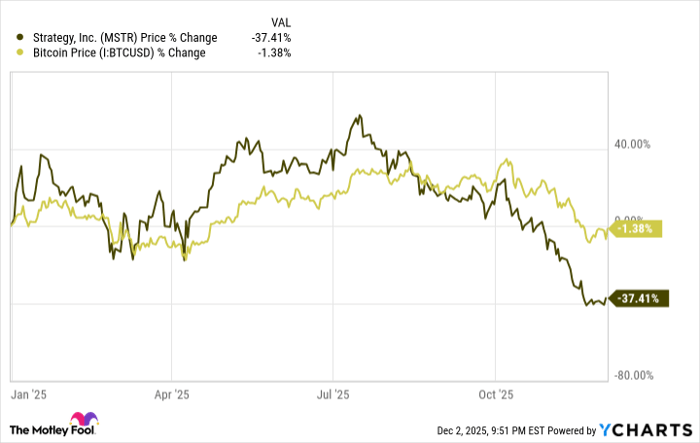

Shares of Strategy have soared in recent years because the business intelligence company has put its financial resources heavily behind the top cryptocurrency. Doing so has enabled it to generate strong gains when the price of Bitcoin has been rising. However, now that the digital currency is falling in value, Strategy's stock has experienced significant losses. From the chart below, it's clear that while there is a correlation, Strategy's swings tend to be more extreme than those of Bitcoin's.

MSTR data by YCharts.

It's also easy to see from Strategy's financials just how important its Bitcoin holdings are to its business. During the first nine months of the year, the company has reported unrealized gains on digital assets totaling a whopping $12 billion. By comparison, the business intelligence company's revenue during that stretch totaled just $354 million. The company's financial performance depends heavily on the gains and losses of its digital assets.

Strategy's valuation still looks high

If you were to look at Strategy's price-to-earnings (P/E) multiple of seven, you might be inclined to think it's a cheap stock to buy. But, due to the extreme volatility of its earnings as a result of its Bitcoin holdings, that metric doesn't give much insight into just how expensive the stock truly is.

Consider that Strategy's market cap is over $50 billion. That's a significant valuation for a company that generated less than $500 million in revenue over the trailing 12 months. It's trading at over 100 times its revenue. Even for fast-growing businesses (which Strategy isn't), that would be a high price to pay. Given the risk that Strategy's stock comes with, it should arguably trade at a discount rather than a hefty premium.

Strategy is a highly speculative stock that investors should avoid

If you're bullish on Bitcoin, you may be better off simply investing in the digital currency directly. Investing in Strategy can amplify your risk, as its volatility has been incredibly high. And with more companies trying to mimic its approach and add Bitcoins to their portfolios, there isn't anything special about what the company is doing; it's simply buying Bitcoins. Its core business isn't growing (sales have been declining for multiple years), and it produces low-quality earnings that are dependent on the value of its digital assets.

Strategy trades more like a meme coin than a stock as its valuation isn't tied to fundamentals. That can make this an incredibly risky investment to hang on to because of the unpredictability that comes with the stock. If Bitcoin recovers and starts to rise in value again, so too could Strategy's stock. But that's a speculative reason to invest in it, and unless you're comfortable with putting your portfolio on a potential roller-coaster ride, you may want to steer clear of the stock, as there's still plenty of room for shares of Strategy to fall even lower in the weeks and months ahead.

Should you invest $1,000 in Strategy right now?

Before you buy stock in Strategy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Strategy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $556,658!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,124,157!*

Now, it’s worth noting Stock Advisor’s total average return is 1,001% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

David Jagielski, CPA has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.