How Does the Stock Market Historically Perform During Thanksgiving Week?

Key Points

Thanksgiving week performed better than would be expected, relative to the S&P 500's annual performance, in seven out of the past 10 years.

The data for the last decade bodes well for Thanksgiving week 2025.

- These 10 stocks could mint the next wave of millionaires ›

This week is Thanksgiving week, which is a holiday-shortened week for the U.S. stock market. The market will be closed on Thanksgiving Day -- Thursday, Nov. 27 -- and will close at 1 p.m. on the following day, known as "Black Friday."

From an investing standpoint, investors have reason to be thankful. In 2025 through Friday, Nov. 21, the S&P 500 index and the tech-heavy Nasdaq Composite index have gained 12.3% and 15.3%, respectively. Their total returns (which include dividends) are 13.6% and 16%, respectively, over this period. These returns are somewhat higher than the stock market's long-term historical average of about 10%.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

I was wondering whether the stock market tends to outperform, underperform, or perform about as expected during Thanksgiving week, relative to the year in general. So, I decided to dig into this question.

To be clear -- The Motley Fool espouses long-term investing. Moreover, timing the market is very difficult, so I don't recommend it. Nonetheless, I believe all knowledge is beneficial.

Image source: Getty Images.

Does the stock market tend to outperform, underperform, or perform about as expected during Thanksgiving week?

There are usually 52 weeks in each year (every five or six years, there are 53 weeks in a year). So, there are usually 52 trading weeks (of varying lengths) each year. Thus, if the stock market performed about as expected on a given Thanksgiving week, it would roughly correspond to 1/52nd of that year's performance. For example, if, in a given year, the S&P 500 index (the best proxy for the overall U.S. stock market) gained 26%, a Thanksgiving week gain of roughly 0.5% would be about as expected.

I looked at the past 10 years to determine an answer to my question. While 10 years is not a very long time, it at least includes both up and down years, so it has some variability.

I'll give you my findings upfront: The stock market tends to outperform during Thanksgiving week, relative to its annual performance, based on data from the past 10 years. There are likely several reasons for this phenomenon, though I won't speculate on them.

Let's examine the data for the past decade. I'll be using stock market index gains and losses, rather than returns. My source for all charts is YCharts.

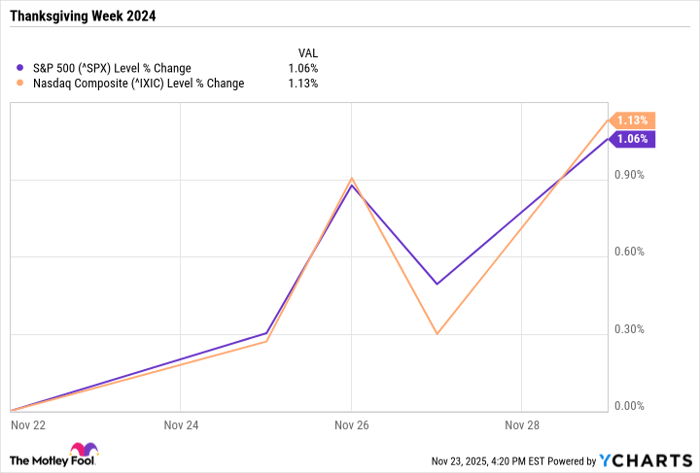

Year 2024

- S&P 500 annual performance: Gain of 23.3%.

- Nasdaq Composite annual performance: Gain of 28.6%.

- Thanksgiving week (see chart below) performed better than expected, relative to the annual performances.

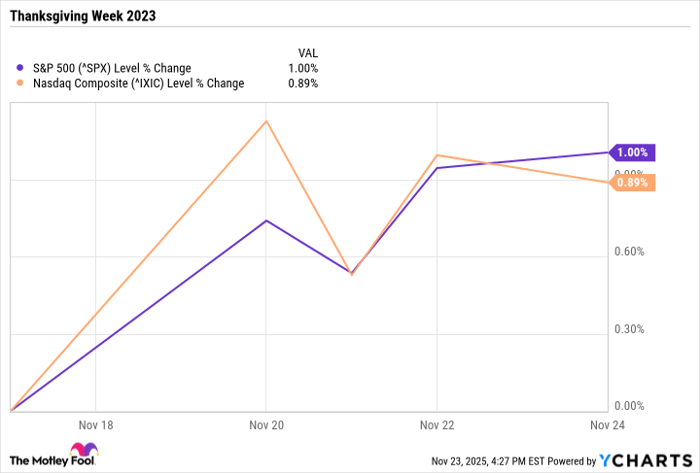

Year 2023

- S&P 500 annual performance: Gain of 24.2%.

- Nasdaq annual performance: Gain of 43.4%.

- Thanksgiving week performed better than expected for the S&P 500 and about as expected for the Nasdaq, relative to the annual performances.

Year 2022

- S&P 500 annual performance: Loss of 19.4%.

- Nasdaq annual performance: Loss of 33.1%.

- Thanksgiving week performed significantly better than expected, relative to the annual performances.

The stock market had a bad year in 2022. Many companies were plagued by supply chain issues following the early stages of the COVID-19 pandemic. This stemmed mainly from the fact that the U.S. and much of the world depended on China for parts and, in some cases, finished goods. And China completely shut down its economy several times during the pandemic.

Many of the stocks that surged during the initial periods of the pandemic (discussed further in the 2020 section below) got clobbered in 2022.

Inflation -- which began increasing in 2021-- was surging in 2022 and peaked in June 2022. The rising inflation was probably mainly due to two factors -- the supply chain issues and government stimulus spending during the pandemic.

Another lesser factor in 2022's poor stock market performance may have been Russia's invasion of Ukraine in late February 2022.

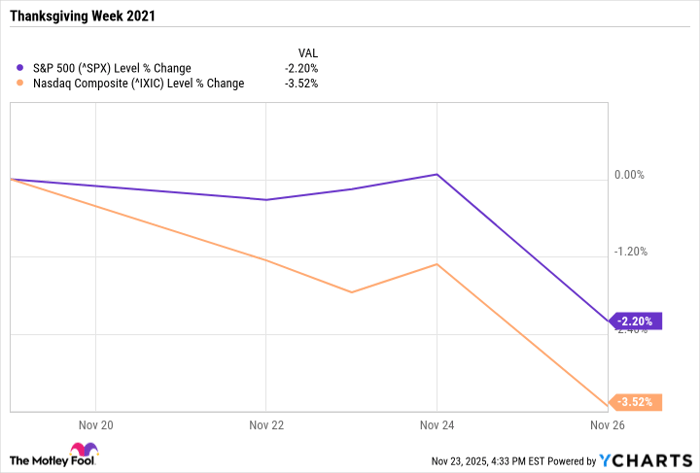

Year 2021

- S&P 500 annual performance: Gain of 26.9%.

- Nasdaq annual performance: Gain of 21.4%.

- Thanksgiving week performed worse than expected, relative to the annual performances.

2021 was a strong year for the stock market, which experienced a particularly bad Thanksgiving week. What appeared to happen here is that the market became very choppy, with notable ups and downs, in late November and December 2021. The market's struggles at the end of 2021 were prescient of the poor 2022 that was to come. Indeed, the market began a steady decline as the calendar turned from 2021 to 2022.

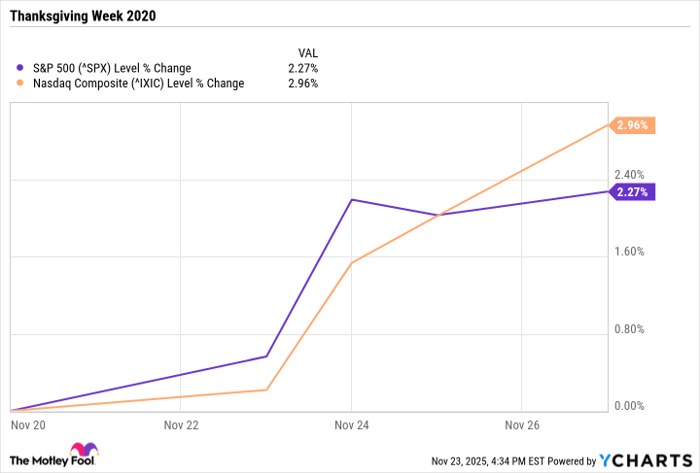

Year 2020

- S&P 500 annual performance: Gain of 16.3%.

- Nasdaq annual performance: Gain of 43.6%.

- Thanksgiving week performed much better than expected, relative to the annual performances.

Stocks fell sharply from mid-February through late March due to the start of the COVID-19 pandemic. However, it didn't take long for them to come roaring back. The Nasdaq index significantly outperformed the S&P 500 because most of the stocks that benefited from the pandemic -- dubbed "coronavirus stocks" or "stay-at-home stocks" -- are listed on the Nasdaq index. These stocks included image-sharing social media company Pinterest and videoconferencing specialist Zoom Communications.

Artificial intelligence (AI) chip leader Nvidia is another Nasdaq-listed stock that benefited from the pandemic, with its shares soaring 122% in 2020. Not only was its data center platform growing rapidly, but its gaming platform also experienced significant growth, as many people were staying home more during the pandemic. At that time, the company's gaming platform generated more revenue than its AI-driven data center platform.

Year 2019

- S&P 500 annual performance: Gain of 28.9%.

- Nasdaq annual performance: Gain of 35.2%.

- Thanksgiving week performed better than expected, relative to the annual performances.

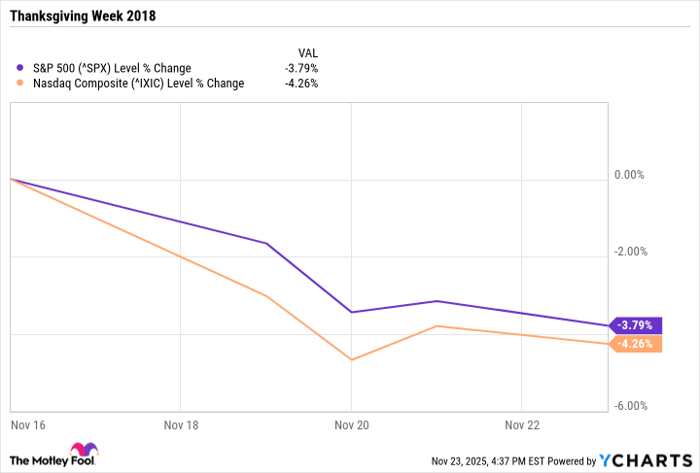

Year 2018

- S&P 500 annual performance: Loss of 6.2%.

- Nasdaq annual performance: Loss of 3.9%.

- Thanksgiving week performed much worse than expected, relative to the annual performances.

The stock market rose through most of 2018 but steadily declined from October through late December. Several factors contributed to this decline, including concerns about slowing economic growth and the Federal Reserve's interest rate increases, and rising trade tensions between the U.S. and China.

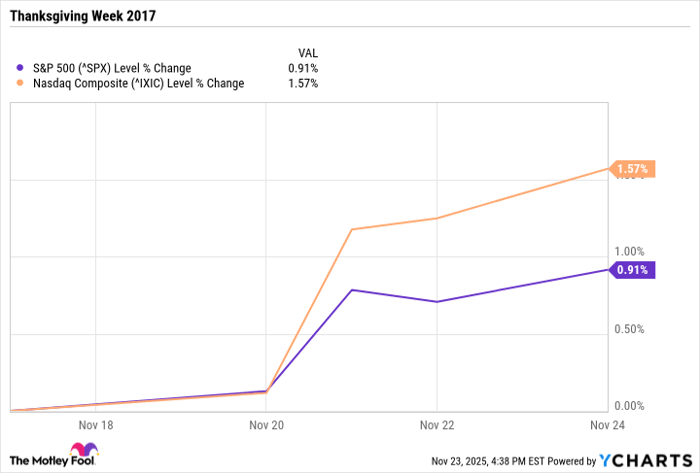

Year 2017

- S&P 500 annual performance: Gain of 19.4%.

- Nasdaq annual performance: Gain of 28.2%.

- Thanksgiving week performed better than expected, relative to the annual performances.

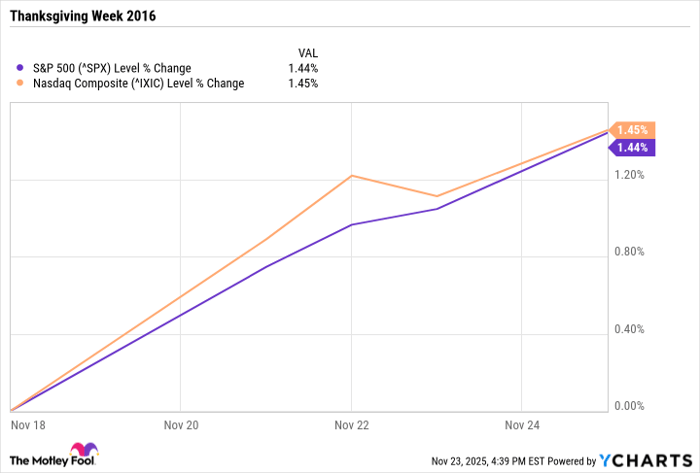

Year 2016

- S&P 500 annual performance: Gain of 9.5%.

- Nasdaq annual performance: Gain of 7.5%.

- Thanksgiving week performed significantly better than expected, relative to the annual performances.

Year 2015

- S&P 500 annual performance: Loss of 0.7% (essentially, flat).

- Nasdaq annual performance: Gain of 5.7%.

- Thanksgiving week performed about as expected for the S&P 500, and slightly better than expected for the Nasdaq, relative to the annual performances.

Summary

Over the past decade, the stock market (as represented by the S&P 500 index) has experienced gains in seven years, losses in two years, and remained essentially flat in one year. These numbers also apply to the week of Thanksgiving.

Thanksgiving week, however, performed better than would be expected, relative to the S&P 500's full-year performance, in seven out of 10 years. It underperformed in only two years and performed about as expected in one year, relative to the S&P 500's full-year performances.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 981%* — a market-crushing outperformance compared to 187% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

See the stocks »

*Stock Advisor returns as of November 17, 2025

Beth McKenna has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia, Pinterest, and Zoom Communications. The Motley Fool has a disclosure policy.