Is Ondas Holdings Stock a Buy?

Key Points

Ondas Holdings generated $10.1 million in third-quarter revenue, up from $1.48 million in the prior-year quarter, driven by growing demand for counter-drone technology and industrial wireless systems.

The company holds approximately $451.6 million in cash, offset by just $11.3 million in debt, providing substantial financial flexibility for expansion and acquisitions.

Shares trade at over 25 times forward sales, a rich premium reflecting the market's recognition of the explosive growth potential in defense technology and autonomous systems markets, which are worth hundreds of billions of dollars.

- 10 stocks we like better than Ondas ›

Wall Street loves a momentum story, especially when it involves drones, defense contracts, and artificial intelligence (AI). Ondas Holdings (NASDAQ: ONDS) sits at the intersection of three powerful secular trends -- autonomous systems, counter-drone technology, and industrial wireless infrastructure.

The stock rewarded early believers with a nearly 1,000% gain over the past year as investors recognized the company's positioning ahead of accelerating defense budgets and digital infrastructure build-outs. For investors willing to accept early-stage execution risk, Ondas offers leveraged exposure to themes that could define the next decade of defense and industrial technology spending.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Is this drone stock a buy? Let's examine its core value proposition and key risk factors to determine the answer.

A dual platform play

Ondas operates two distinct business segments targeting high-growth technology markets. Ondas Networks provides private wireless infrastructure for industrial applications, including rail, utilities, and critical infrastructure. Ondas Autonomous Systems focuses on drone technology and counter-unmanned aerial systems (UAS) capabilities, recently strengthened by the acquisition of Israeli cyber-counter-UAS company Sentry CS Ltd.

Third-quarter revenue hit $10.1 million, up from $1.48 million in the prior-year quarter, reflecting accelerating commercial traction. The defense segment benefits from rising global spending on counter-drone technology as militaries and critical infrastructure operators confront proliferating UAS threats. The industrial wireless business targets a fragmented market where enterprises need dedicated spectrum and infrastructure for mission-critical operations.

The balance sheet backstop

The company's strongest asset is its war chest. Ondas holds approximately $451.6 million in cash and equivalents, against just $11.3 million in debt, as of the end of the third quarter. Following an October equity raise, the company has pro forma cash of roughly $840 million. That financial cushion gives management years of runway to execute its growth strategy without immediate financing pressure, providing flexibility to pursue strategic acquisitions like Sentry CS Ltd., fund aggressive product development, and build out infrastructure while competitors scramble for capital.

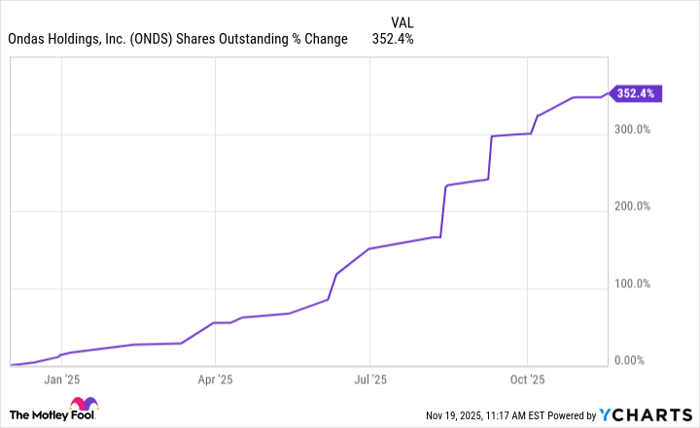

The share count increased 352% over the prior 12 months as the company funded expansion through equity raises. While dilution concerns short-term traders, it reflects management's willingness to aggressively fund growth during a window of extraordinary opportunity. With defense budgets rising globally and counter-drone technology becoming critical infrastructure, moving fast matters more than protecting near-term dilution.

ONDS Shares Outstanding data by YCharts

Valuation reflects explosive growth potential

The stock trades at over 25 times forward sales -- a rich premium for any valuation that assumes sustained hypergrowth. But the early evidence supports it. Third-quarter revenue grew 582% compared to the same quarter a year ago, and the company operates in markets experiencing structural tailwinds that could persist for years.

Defense and autonomous systems represent opportunities in the hundreds of billions of dollars. Global military spending continues to rise, counter-UAS technology addresses escalating security threats from adversaries deploying inexpensive drones at scale, and industrial wireless infrastructure supports digital transformation across utilities, rail, and critical infrastructure.

With a trailing-12-month revenue of just $24.7 million, Ondas captures a microscopic fraction of these addressable markets. The question isn't whether the valuation is expensive today -- it clearly is. The question is whether Ondas can execute on the massive opportunity ahead of it. At over 25 times forward sales for a business growing 500% or more year over year in expanding markets, the premium becomes defensible if management delivers.

The early stage opportunity

Ondas Holdings offers exactly what growth investors seek -- a well-capitalized company positioned ahead of powerful secular trends with early proof of commercial traction. The balance sheet provides years of runway to execute, recent revenue acceleration demonstrates the business model works, and the addressable markets dwarf the company's current scale.

Still, the risks are real. Early-stage companies miss targets, integrations stumble, and competitive dynamics shift. Negative operating margins mean profitability remains years away. But for investors seeking leveraged exposure to defense technology and autonomous systems, Ondas delivers that positioning with substantial financial resources to fund growth.

Should you invest $1,000 in Ondas right now?

Before you buy stock in Ondas, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ondas wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,222!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,143,342!*

Now, it’s worth noting Stock Advisor’s total average return is 1,013% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

George Budwell, PhD has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.