Could Buying Annaly Capital Stock Today Set You Up for Life?

Key Points

Annaly Capital is a mortgage real estate investment trust.

The mREIT boasts a substantial dividend yield of almost 13%.

Annaly Capital's goal may be different from what you think it is.

- 10 stocks we like better than Annaly Capital Management ›

Annaly Capital (NYSE: NLY) shows up prominently on yield-focused stock screens thanks to its huge 12.9% dividend yield. For reference, that's more than 10 times the roughly 1.2% yield on offer from the S&P 500 index (SNPINDEX: ^GSPC). However, take the time to get to know this real estate investment trust (REIT) before you jump into the ultra-high yield stock, thinking you're setting yourself up for a lifetime of reliable income.

What does Annaly Capital do?

Annaly Capital is a mortgage REIT. This is a unique and fairly complex niche of the broader REIT sector. Most REITs own physical properties that they lease out to tenants. They basically do what you would do if you owned a rental property, making the traditional REIT business model fairly easy to understand. Mortgage REITs like Annaly don't buy physical property; they buy mortgages that have been pooled together into bond-like securities.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

This is very different from a traditional REIT. To begin with, most mortgages are self-amortizing loans. So each payment made on the mortgage includes both interest on the loan and a small principal payment. At the end of a mortgage loan, the entire loan is paid off because the value of the mortgage loan has been reduced to zero. This dynamic flows through to the mortgage securities that Annaly owns, with each payment it receives consisting of interest and, effectively, a return of capital.

This is notable because Annaly's value is, basically, the value of the mortgage securities it owns. That's similar to a mutual fund, as Annaly reports its tangible book value quarterly. This figure is comparable to the net asset value (NAV) that mutual funds report on a daily basis. Since every payment that the mREIT collects consists of both interest and principal, the value of the business inherently declines over time. Essentially, all the dividends you collect will be a combination of interest and principal repayment.

Annaly's dividend is highly variable

There's nothing wrong with this dynamic, but you need to understand what you are buying before you make a purchase. Effectively, Annaly is slowly self-liquidating over time. It has to sell more shares so it can keep buying more mortgage securities. And that fact sits atop the impact that interest rate changes, housing market dynamics, and mortgage repayment trends can have on the value of the mortgage securities the mREIT owns.

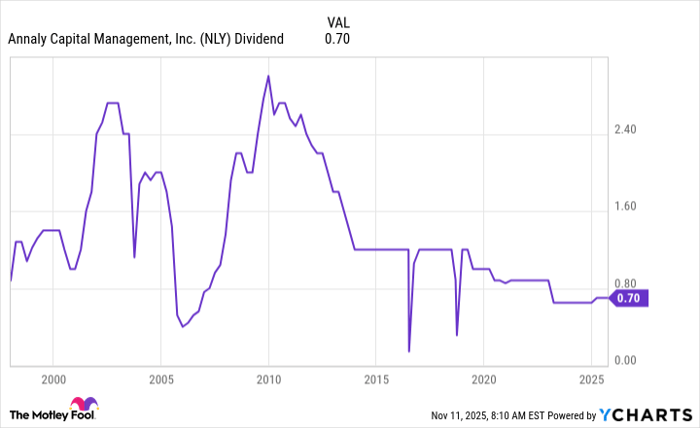

As the chart below highlights, Annaly's dividend is, to put it mildly, volatile. The swings have been huge over time, and from that perspective, dividend investors shouldn't buy this stock expecting to set themselves up for a lifetime of reliable income. This doesn't make Annaly a bad company; it simply means that it may not be the type of investment you think it is, based on its huge yield.

NLY Dividend data by YCharts

In fact, the company's primary focus when it explains its performance as a business is on total return. The problem with this for dividend investors is that total return assumes the reinvestment of dividends. If you spend the dividend, you won't reap those returns. But, over the long term, Annaly's total return has kept pace with that of the S&P 500 index, though Annaly's stock has performed notably differently from the S&P 500 index.

This is where the story gets interesting. If you are a total return-focused investor, adding Annaly could help increase your portfolio diversification. That's actually quite valuable if you take an asset allocation approach.

Annaly isn't bad, but it isn't a great dividend stock

Most dividend investors are likely seeking a dividend stock that pays a reliable and growing dividend. That's just not what Annaly does; history clearly shows this. If you spend the dividends you collect from Annaly instead of reinvesting them, you will probably end up disappointed. If, however, your goal is total return, well, Annaly could be worth a closer look. This is definitely a stock that requires a deeper understanding before you hit the buy button.

Should you invest $1,000 in Annaly Capital Management right now?

Before you buy stock in Annaly Capital Management, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Annaly Capital Management wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.