Big News Is Coming for Nvidia Investors on Nov. 19. Should You Buy Nvidia Stock Now?

Key Points

Nvidia works with the major hyperscalers that are building out their AI businesses to the tune of hundreds of millions of dollars.

The company has been announcing incredible demand from multiple new partnerships.

It tends to beat Wall Street's expectations.

- 10 stocks we like better than Nvidia ›

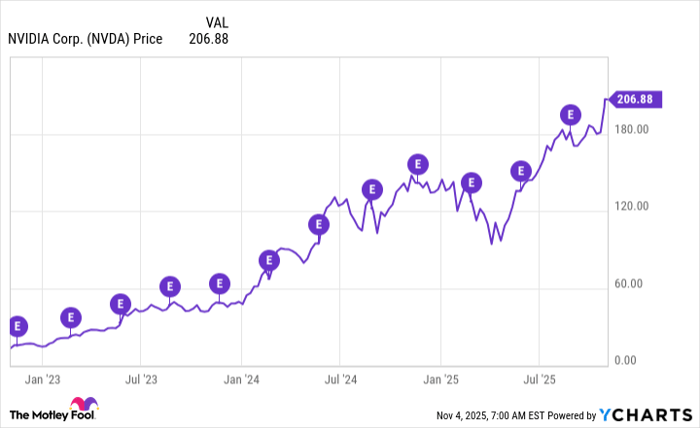

Nvidia (NASDAQ: NVDA) has been the stock of the moment for several years already as its artificial intelligence (AI) chips drive advances in the industry. Nvidia stock is up 1,230% over the past three years alone, and it's the first stock to reach $5 trillion in value.

However, it looks like the future is still wide open. The company is launching new and improved technology all the time, upping its game and delivering ever-more-powerful solutions for its clients.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

It recently announced a slew of new products and partnerships. Investors will get to see the results of some of these actions when Nvidia reports fiscal 2026 third-quarter earnings on Nov. 19. Let's see what might be on the table for the AI giant.

Image source: Nvidia.

Exploding demand for AI

AI continues to be at the forefront of new technology in almost every industry, and Nvidia is right at the center. It makes the most powerful graphics processing units (GPU), the chips that make generative AI possible.

Hyperscalers use Nvidia's chips and, increasingly, its other products to develop the large-language models (LLMs) and data loads necessary to run their AI systems. Amazon, for example, uses these chips to run its LLMs and offers its large clients the ability to use Nvidia chips to create their own LLMs on its platform.

The race between cloud service providers like Amazon, Microsoft, and Alphabet is a boon for Nvidia, which provides the infrastructure to make it all work. All the major AI players said they were going to increase AI spending next year in their earnings announcements last week, and that will put more money in Nvidia's coffers.

Although Nvidia has competition from the likes of Advanced Micro Devices and Intel, it controls about 90% of the market, a lead too large to lose in the near future.

Too many updates to follow

Nvidia has been announcing new deals like there's no tomorrow. It signed a deal with Oracle and the U.S. Department of Energy to build a supercomputer and was teaming up with Uber to develop a robotaxi. These were just two of the company updates in a very full week of news.

New partnerships are coming left and right as companies scramble to get on the AI bandwagon and upgrade their technology. According to IoT analytics, the AI market opportunity is expected to increase at a compound annual growth rate of 23% through 2030, and that includes Nvidia's opportunity today.

What to expect on Nov. 19

Here is how management's guidance looks for the fiscal third quarter (ended Oct. 28):

- Revenue of $54 billion, or 54% higher than last year

- Generally accepted accounting principles (GAAP) gross margin of 73.3% and non-GAAP gross margin of 73.5%

- GAAP operating expenses of about $5.9 billion and non-GAAP operating expenses of $4.2 billion

Over on Wall Street, analysts are expecting $1.25 in adjusted earnings per share (EPS), up from $0.81 last year, and $54.77 billion in revenue, a 56% increase year over year.

Nvidia tends to beat on EPS. However, there's more than that when the market reacts to a company's earnings update. It takes many things into account, including management's guidance for the next quarter and the full year. Although investors won't hear that until Nov. 19, the way the company's slate looks right now, it's likely to be strong.

In general, Nvidia stock moves higher after earnings:

NVDA data by YCharts.

However, investing before or after earnings won't make too much of a difference if you're a long-term investor. The most important thing is to get started as soon as you can.

Nvidia stock is already up 40% this year but could jump on strong earnings. If you're on the fence about Nvidia stock, now is a great time to buy. Whatever happens on Nov. 19, the company is well-positioned to succeed and reward shareholders for many more years.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $592,390!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,196,494!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 3, 2025

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Intel, Microsoft, Nvidia, Oracle, and Uber Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.