This Stock Is Up 1,500% Since Its IPO: Here's Why It Might Split in 2026

Key Points

This tech company has become a major player in the artificial intelligence space.

This stock has delivered fantastic long-term gains, but its performance has lagged behind other tech players this year.

- 10 stocks we like better than Meta Platforms ›

Over the past few years, some of the world's biggest and most well-known companies have launched stock splits, from Amazon and Nvidia to Walmart and Chipotle Mexican Grill. This was after these companies saw their stock prices soar, and they made a move to bring the price of each individual share down to a more reasonable level. Companies generally execute a split so that a broader range of investors may access the stock.

Though stock splits themselves aren't catalysts for stock performance, investors love to watch for which company will be next on the list. This may be because such a move suggests management is optimistic about the future, holding the belief that the stock, from its new lower price, will surge once again.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

So, which company may be next on the stock split list? A good candidate is the following player that's seen its shares rise more than 1,500% since its initial public offering (IPO). Let's find out why it may split in 2026.

Image source: Getty Images.

More shares for current holders

First, though, let's talk briefly about how a stock split works. In such an operation, a company issues additional shares to current holders according to the ratio of the split. So, in a 10-for-1 stock split, for example, you would receive nine shares for every one share you already own. The total value of your holding and the market value of the company remain unchanged -- only the value of each individual share drops.

As a result, stock splits don't change anything fundamental about a company, and that's why a split isn't a reason to buy or sell a particular stock. But they do play a positive role in a company's overall story over time as they make it easier for smaller retail investors to invest.

Now, let's consider this stock that's soared in the quadruple digits since its IPO back in May of 2012. This company is Meta Platforms (NASDAQ: META), which originally launched under the name Facebook, then its primary social media app. Today, Meta is known for its ownership of Facebook as well as other apps such as WhatsApp and Instagram, and also is building a major presence in the world of artificial intelligence (AI).

The company's social media prowess has helped it grow earnings well into the billions of dollars -- this is as advertisers flock to Meta to advertise their products and services across its apps. Meanwhile, Meta is investing heavily in AI with the goals of using the technology to make its apps even better, transform the advertising experience, and develop new revenue-generating products.

The "Magnificent Seven" player that hasn't split its stock

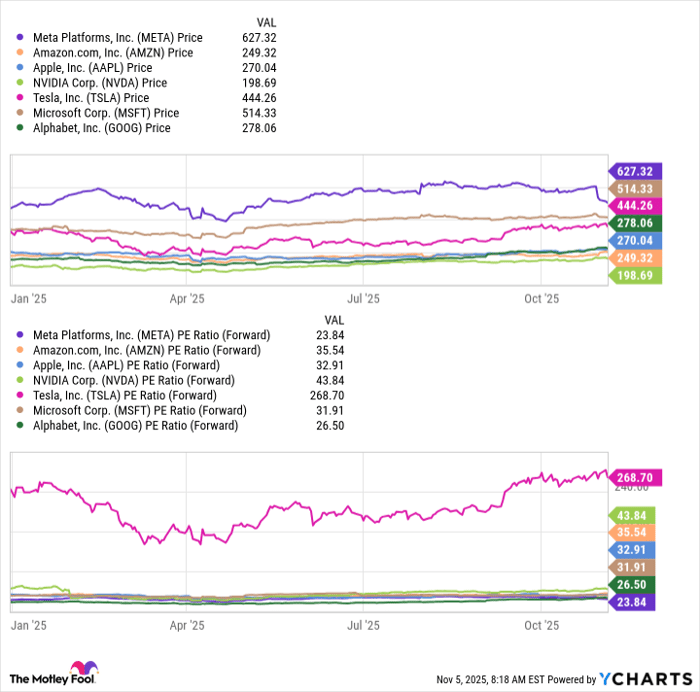

All of this has helped the stock to advance over time, bringing it to more than $600 today. It's important to note that Meta is the only company among the "Magnificent Seven" tech stocks that have driven market gains that has never launched a stock split.

So, why do I think Meta may make the move in 2026? Meta's shares haven't reached the level of $1,000, which sometimes represents a psychological barrier for investors -- even if valuation is fine, they perceive the stock as expensive. But, at today's level, though Meta actually is the cheapest of the Magnificent Seven stocks -- its per-share price is the highest.

META data by YCharts

Even though Meta stock is dirt cheap at this valuation, the per-share price tag may discourage some investors from buying. A stock split could solve this problem.

On top of this, a move to split its stock would offer investors a sign that management is confident about the future and its decision to invest significantly in the area of AI. The company already has predicted that to support its AI growth, capital expenditure "dollar growth will be notably larger in 2026 than 2025."

Meta, up about 7% this year, is lagging behind all of the other Magnificent Seven stocks when it comes to performance. So, a split, opening the investment opportunity to a broader range of investors and offering an optimistic message from the company, could be beneficial. All of these elements suggest that Meta, a company that hasn't yet split its stock, may finally make the move in 2026.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $592,390!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,196,494!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 3, 2025

Adria Cimino has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Chipotle Mexican Grill, Meta Platforms, Nvidia, and Walmart. The Motley Fool recommends the following options: short December 2025 $45 calls on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.