Up 47%, Should You Buy IonQ Right Now?

Key Points

Quantum computing is a critical future technology, and IonQ is racing to make it commercially viable.

While IonQ has developed impressive technology, useful quantum computing could still be a decade away.

Tech giants like IBM and Alphabet are also in this race, and it will be tough for IonQ to win.

- 10 stocks we like better than IonQ ›

Despite a recent decline, shares of quantum computing company IonQ (NYSE: IONQ) have surged roughly 47% this year. While artificial intelligence (AI) is the hot technology of the day, quantum computing has the potential to revolutionize the computing industry by exponentially speeding up certain types of computations. Potential applications include drug discovery, materials science, logistics, and many other areas.

With quantum computing increasingly on investors' radars, it could make sense to bet on IonQ. However, there are reasons to avoid the stock as well.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

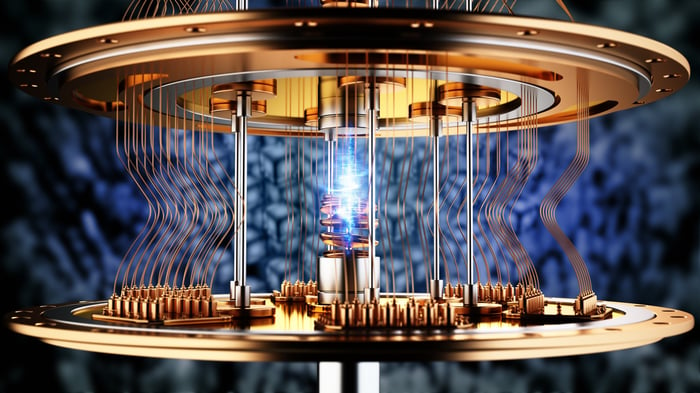

Image source: Getty Images.

Quantum computing is having a moment

It's important to note that quantum computing is not currently commercially viable. There are no real-world applications, in industry or academia, where a general-purpose quantum computer is beating out classical computing techniques. IonQ, along with other pure-play quantum computing companies and tech giants like IBM and Alphabet, are all pushing toward that goal, and they're all taking somewhat different approaches.

IonQ expects to produce as much as $100 million in revenue this year, with that revenue coming from quantum system sales, maintenance, support, access to quantum-computing-as-a-service offerings, and consulting services. These quantum systems are being used for experimentation and research rather than real-world commercial applications, but that's the case across the quantum computing industry.

There have been some significant breakthroughs recently, including an IBM quantum computer being used to accelerate a computation related to bond trading in conjunction with classical methods, and Alphabet demonstrating a speedup for a particular quantum algorithm. IonQ has been making progress as well, working with the University of Washington on quantum simulations and drug development applications with AstraZeneca.

The Trump administration is rumored to want equity stakes in quantum computing stocks, similar to other deals made in the past few months. While this may or may not come to pass, it's a sign that quantum computing is increasingly being viewed as a critical future technology.

A race against time for IonQ

The fundamental problem with investing in IonQ comes down to time. While it's hard to pin down exactly when quantum computing becomes commercially viable, it could be five to 10 years away. IBM sees full-scale fault-tolerant quantum computers arriving after 2033, for example. If industry roadmaps turn out to be overly optimistic, the timeline could stretch out further.

IBM and Alphabet can fund their quantum computing efforts indefinitely, but IonQ requires continual injections of capital to keep the lights on. The company recently announced a $2 billion offering, so at the moment, it's not having any trouble getting its hands on more cash, albeit at the expense of shareholders via dilution.

This situation could change quickly. What happens if the stock market tumbles or the economy enters recession? What happens if investor enthusiasm around quantum computing wanes? Or if quantum roadmap milestones start to get pushed out? It could become more difficult for IonQ to raise cash in the future.

IonQ has enough cash for the moment, especially after its recent equity sale, but losses are mounting. In the second quarter of 2025, IonQ reported a net loss of $177 million, while free cash flow was -$90 million for the first six months of the year. Costs are ramping up much faster than revenue, so this situation is likely to get worse before it gets better. The company poured more than $100 million into research and development during the second quarter, five times its revenue.

Another issue is competition. Companies like IBM and Alphabet are pushing hard toward useful quantum computers, and there's no guarantee that IonQ gets there first or eventually produces superior systems. You must be right about the potential of quantum computing, IonQ's technology, and the general timeline for commercial viability for this investment to work in the long run. That's a tall order.

IonQ is a speculative investment, plain and simple. It's high risk, high reward. For some investors, that's going to be appealing. For others, it's best to stick with tech giants like IBM and Alphabet for quantum computing exposure.

Should you invest $1,000 in IonQ right now?

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,442!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,269,127!*

Now, it’s worth noting Stock Advisor’s total average return is 1,071% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Timothy Green has positions in International Business Machines. The Motley Fool has positions in and recommends Alphabet and International Business Machines. The Motley Fool recommends AstraZeneca Plc. The Motley Fool has a disclosure policy.