EUR/USD rises to near 1.1630 as US Dollar corrects after Trump-Xi meeting

- Gold Price Forecast: XAU/USD slumps to near $4,000 on US-China trade progress

- Gold tumbles as traders book profits ahead of key US inflation data

- Gold declines as traders brace for trade talks, US CPI inflation data

- US CPI headline inflation set to rise 3.1% YoY in September

- Australian Dollar maintains position due to US-China trade optimism

- Fed’s October Rate Cut: Easing Cycle Continues, Gold Likely to Keep Rising

EUR/USD gains to near 1.1630 as the US Dollar retraces after meeting between US President Trump and Chinese leader Xi.

The ECB is expected to hold interest rates steady for the fourth time in a row.

Investors also await flash Eurozone Q3 GDP and German HICP data for October.

The EUR/USD pair trades 0.25% higher to near 1.1630 during the late Asian trading session on Thursday. The major currency pair attracts bids as the US Dollar (USD) corrects after United States (US) President Donald Trump and Chinese leader Xi Jinping concluded the meeting without signing a trade deal.

During the press time, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, retraces to near 99.00.

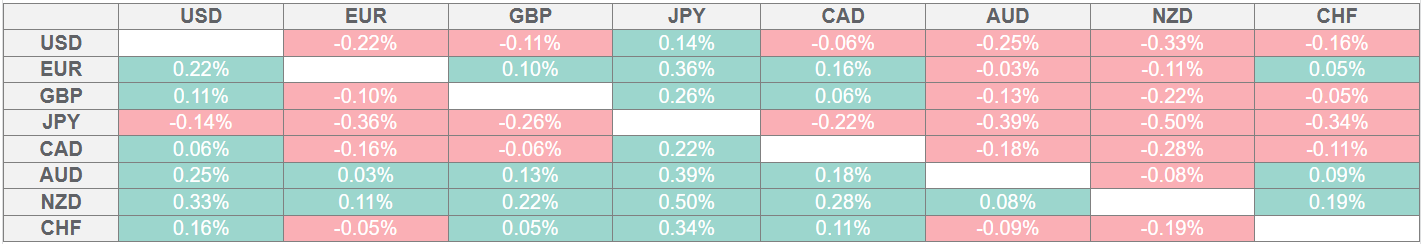

US Dollar Price Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

However, US president Trump has reduced tariffs on imports from China to 47% from 57% and has stated that Beijing will continue exporting rare earths to Washington.

Meanwhile, the Euro (EUR) trades firmly, except antipodeans, ahead of the monetary policy announcement by the European Central Bank (ECB) at 13:15 GMT. The ECB is expected to hold its Deposit Facility rate steady at 2% as inflationary pressures in the Eurozone economy have been broadly stable near the 2% target.

Ahead of the ECB’s policy announcement, investors will focus on the preliminary Q3 Eurozone Gross Domestic Product (GDP) and German Harmonized Index of Consumer Prices (HICP) data for October, which will be published at 10:00 GMT and 13:00 GMT, respectively.

On Wednesday, the Federal Reserve (Fed) reduced interest rates by 25 basis points (bps) to 3.75%-4.00%, citing it as “risk management cut” and argued against reducing again in the December meeting.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.