Forex Today: ECB is up next as markets assess Fed and BoJ policy decisions

- Gold Price Forecast: XAU/USD slumps to near $4,000 on US-China trade progress

- Gold tumbles as traders book profits ahead of key US inflation data

- Gold declines as traders brace for trade talks, US CPI inflation data

- US CPI headline inflation set to rise 3.1% YoY in September

- Australian Dollar maintains position due to US-China trade optimism

- Fed’s October Rate Cut: Easing Cycle Continues, Gold Likely to Keep Rising

Here is what you need to know on Thursday, October 30:

Following the volatile action seen in financial markets on Wednesday, investors take a short break, while gearing up for the European Central Bank's (ECB) policy announcements. Additionally, the European economic calendar will feature preliminary third-quarter Gross Domestic Product (GDP) growth figures for Germany and the Eurozone.

The Federal Reserve (Fed) cut the policy rate by 25 basis points (bps) to the range of 4%-4.25% following the October policy meeting, as anticipated. The Fed also announced that it will conclude the aggregate balance sheet drawdown on December 1 and will start reinvesting all mortgage-backed securities principal payments into Treasury bills from this date on. While responding to questions in the post-meeting press conference, Fed Chair Jerome Powell noted that another rate cut in December is "far from assured." He explained that the outlook for employment and inflation has not changed much since the September meeting, and added that they need to manage the risk of more persistent inflation.

The benchmark 10-year US Treasury bond yield rose more than 2% on the day and climbed above 4% on Wednesday. In turn, the US Dollar (USD) Index gained 0.4% on a daily basis. Early Thursday, the USD Index stays in a consolidation phase above 99.00, while US stock index futures trade mixed.

US Dollar Price This week

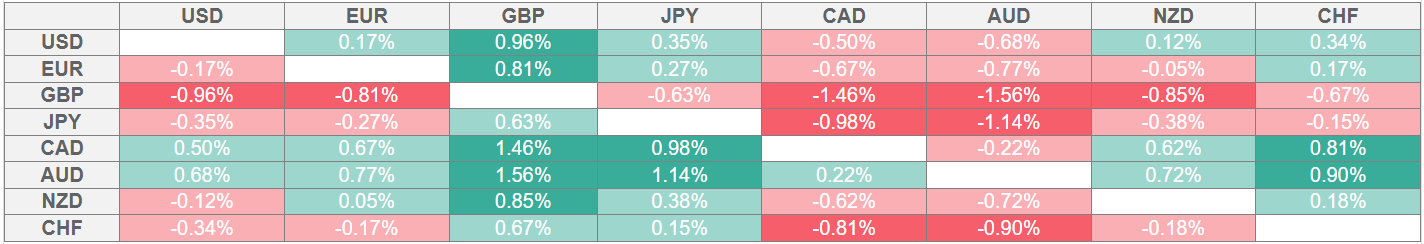

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The Bank of Japan (BoJ) left its monetary policy settings unchanged in October, matching the market expectation. In the policy statement, the BoJ reiterated that they will continue to raise the policy rate if the economy, prices move in line with their forecasts. Commenting on the policy outlook later, BoJ Governor Kazuo Ueda said that they want to take a little longer to see how the US' tariffs impact the Japanese economy and added that they have no preset ideas about the timing of the next rate hike. USD/JPY gathers bullish momentum in the European session and trades at its highest level since February near 153.50.

After falling to a new monthly low below 1.3900 in the early American session on Wednesday, USD/CAD reversed its direction and closed the day virtually unchanged. The pair stays relatively quiet and fluctuates in a tight range below 1.3950 early Thursday. The Bank of Canada (BoC) lowered its policy rate by 25 bps to 2.25%.

The European Central Bank (ECB) is forecast to leave key rates unchanged. Investors will pay close attention to comments from ECB President Christine Lagarde and will try to figure out whether the ECB could opt for a rate cut at the last meeting of the year. After losing more than 0.4% on Wednesday, EUR/USD stages a rebound and trades above 1.1600.

GBP/USD extended its slide in the American session on Wednesday and touched its lowest level in two months, below 1.3150. The pair holds steady at around 1.3200 in the European morning on Thursday.

Gold closed the fourth consecutive trading day in negative territory on Wednesday. Early Thursday, XAU/USD corrects higher and gains nearly 1% on the day, trading at around $3,970.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.