The Best High-Yield Stocks to Buy With $1,000 Right Now

Key Points

Federal Realty is the only REIT to have achieved Dividend King status.

Rexford Industrial is out of favor, but its business remains quite strong.

Bank of Nova Scotia looks like a long-term, low-risk turnaround for investors.

- 10 stocks we like better than Federal Realty Investment Trust ›

Dividend investors have one big blind spot (I know, I fight it all the time). A huge dividend yield can lead dividend lovers to ignore problems that should probably disqualify companies from their portfolios. It is far better to focus on a good business and accept a lower, but more reliable, dividend.

If you have $1,000 to invest, take a look at Federal Realty (NYSE: FRT), Rexford Industrial (NYSE: REXR), and Bank of Nova Scotia (NYSE: BNS). Comparing each to an ultra-high-yield stock like AGNC Investment (NASDAQ: AGNC) will help highlight their positives.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

1. Federal Realty is a Dividend King REIT

Federal Realty and AGNC Investment are both classified as real estate investment trusts (REITs). Federal Realty owns strip malls and mixed-use developments. These are physical properties that it leases out, just like you would do if you owned a rental property. AGNC owns a portfolio of mortgages that have been pooled together into bond-like securities. That's very different from what most investors could do on their own.

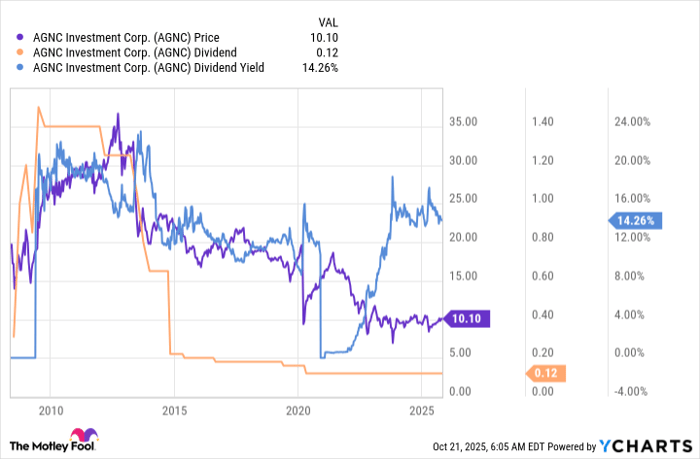

But here's the big story: Federal Realty has increased its dividend annually for more than five decades, making it a Dividend King. It is the only REIT to have achieved that elite status. AGNC investment's dividend has been highly volatile and has trended lower over the past decade. Sure, AGNC's yield is a massive 14% while Federal Realty's yield is "only" 4.5%. But if you need a reliable income stream to pay for your living expenses, history tells you that Federal Realty's simple property-owning business model is going to be a better bet.

A $1,000 investment will get you around 10 shares of Federal Realty.

Image source: Getty Images.

2. Rexford Industrial has a historically high yield

Rexford Industrial is another property-owning REIT, though its focus is on industrial assets located in Southern California. That's a highly focused approach, but the Southern California market has a long history of performing strongly. It is supply constrained, a vital gateway between Asia and the United States, and Rexford is one of the largest players in the region.

Right now, however, investors are worried about the impact of tariffs on global trade. And there has been some softening within the industrial sector, too. That has pushed Rexford's stock price down and its dividend yield up to around 3.9%. That's tiny relative to what AGNC Investment is offering, but Rexford has increased its dividend annually for more than a decade.

And here's the big one: Rexford's yield is toward the high end of the company's historical yield range. AGNC's yield is high but, like most mortgage REITs, it is pretty much always high.

It actually looks like Rexford is on sale right now even though its business remains well-positioned over the long term. In fact, it is still growing strongly, with new and renewal leases in the third quarter of 2025 coming in with a net 26% rent bump. AGNC Investment's mortgage REIT model has proven to be highly volatile from quarter to quarter and year to year. For example, the value of AGNC's mortgage portfolio fell in three of the last four quarters.

If you are looking for a reliable business, out-of-favor Rexford will be the better choice. A $1,000 investment will get you roughly 22 shares of Rexford.

AGNC data by YCharts

3. Bank of Nova Scotia is in turnaround mode

Perhaps you are a risk-taker and you are willing to own turnaround stocks. Given the long downtrend in AGNC's dividend and stock price, you could foresee a future in which the stock recovers and the dividend starts to grow again. That's entirely possible, but history suggests that recovery will be followed by more turbulence, given the nature of mortgage REITs.

A better high-yield turnaround play would be Bank of Nova Scotia. This Canadian bank has a lofty 4.9% dividend yield. And its core business is running one of the largest banks in Canada. Canadian banks are highly regulated, which has effectively provided the largest players with entrenched industry positions. This is a solid foundation for the business. The turnaround opportunity is found in its non-Canadian operations.

Outside of Canada, Scotiabank, as it is more commonly known, chose to invest in Central and South America for growth. That didn't work out as well as hoped and the bank is now working on fine-tuning its exposure to those regions while expanding its presence in the United States, bringing it more in line with its peers. The goal is to boost growth, though it could take a little time to get there. While you wait, you get the big dividend yield and the comfort of knowing that Bank of Nova Scotia has a solid foundation in Canada (and that it has paid dividends continuously since 1833).

As far as turnarounds go, Scotiabank is a much more attractive risk/reward opportunity than any turnaround that might take place at AGNC. A $1,000 investment in Bank of Nova Scotia will get you around 15 shares of the Canadian bank.

AGNC Investment is not a bad company

Here's the interesting thing: AGNC Investment is actually a fairly well-run mortgage REIT. The problem is really that investors who need reliable dividends, perhaps to pay bills in retirement, shouldn't really rely on AGNC's historically volatile dividend. That's a statement that could be made about just about all mortgage REITs and a huge dividend yield doesn't change that fact.

If you have $1,000 to invest in dividend stocks, you'll probably be better off with a reliable payer like Federal Realty. Or an out-of-favor and historically high-yielding REIT like Rexford. Or a fairly low-risk turnaround story like the one on offer from Bank of Nova Scotia.

Should you invest $1,000 in Federal Realty Investment Trust right now?

Before you buy stock in Federal Realty Investment Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Federal Realty Investment Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,380!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 20, 2025

Reuben Gregg Brewer has positions in Bank Of Nova Scotia and Federal Realty Investment Trust. The Motley Fool recommends Bank Of Nova Scotia. The Motley Fool has a disclosure policy.