Bitcoin Could Make Its Next Major Move This Week — Time To Buy?

Following its blistering performance in the first week of October, the Bitcoin price action has been pretty much tame all month. In fact, the premier cryptocurrency has witnessed moments of bearish action in what is widely regarded as the historically bullish month of “Uptober.”

With the substantial downward pressure in recent weeks, the Bitcoin price looks set to close the month in the red. However, a recent evaluation shows that the market leader might be gearing up for its next major price move in the coming week.

Why BTC Could Make A Major Move Next Week

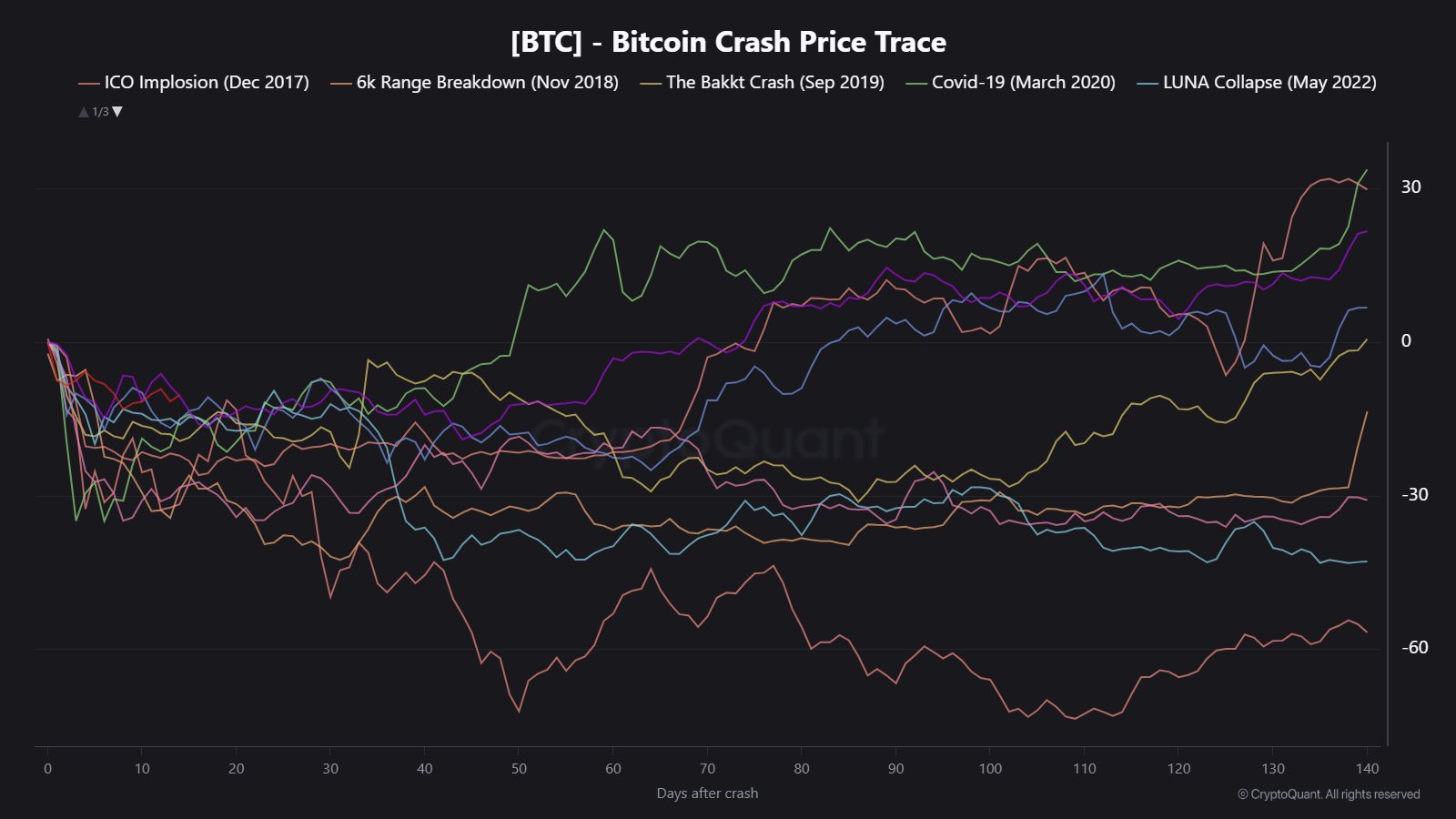

In a recent video on YouTube, crypto analyst Maartunn shared an exciting hypothesis around the Bitcoin price, saying that the coin could make its next big move in the coming week. This evaluation is based on the Bitcoin Crash Price Trace, which monitors BTC’s behavior after a major price downturn.

According to Maartunn’s analysis, the Bitcoin price tends to enter a period of consolidation or sideways movement after a sharp crash for about two to four weeks, before making its next major move. This has been the case for the flagship cryptocurrency since it fell more than 16% on October 10.

Maartunn noted that the market leader is currently 14 days into this consolidation phase, meaning that the next move could come anytime from now.

The analyst went further to provide clues in the data, highlighting that market volatility is shrinking for the premier cryptocurrency. Maartunn believes that this decline in volatility signals that investors are waiting on the sidelines for the next significant price move.

As of this writing, Bitcoin is valued at around $111,690, reflecting a mere 0.6% jump in the past 24 hours.

Level To Watch For The Next Move

Maartunn went further by revealing $112,500 as a critical level to watch in case the Bitcoin price makes its next major move. This price level is the short-term holders’ (STHs) realized price, which often acts as a dynamic support and resistance level.

Typically, with BTC’s value beneath this STH realized price, it means that the most reactive set of Bitcoin investors is in the red. These short-term investors are likely going to offload their assets at breakeven price—when the Bitcoin price returns to their cost basis.

Ultimately, this sell-off would put downward pressure on Bitcoin’s price, making the STH realized price (currently at $112,500) a significant resistance level.