US Treasury Yields surge on hot PPI and mixed Retail Sales

- US Treasury yields jump as inflation report cools expectations for immediate Fed rate cuts.

- February's Retail Sales rebound highlights consumer spending strength despite falling short of forecasts.

- Producer Price Index (PPI) data and lower-than-expected jobless claims reinforce views of strong economic activity.

US Treasury yields made a significant leap on Thursday, a direct response to a hot inflation report in the United States. This development is expected to deter the Federal Reserve from cutting rates in the March and May meetings, as traders have also reduced their bets for a rate cut in the June meeting.

Market adjust rate cut expectations amid strong US economic data

On Thursday, the US Commerce Department unveiled a positive trend in Retail Sales. Despite a -1.1% contraction in January, sales rebounded in February, expanding by 0.6% MoM. While this figure fell short of the estimated 0.8%, it underscores the resilience of US consumers, who continue to be the mainstay of the robust US economy.

Other data revealed by the US Bureau of Labor Statistics (BLS) showed that inflation remains high. The Producer Price Index (PPI) exceeded forecasts of 1.1% and climbed 1.6% YoY in February, while the core PPI expanded by 2% YoY, unchanged, though a tick higher than the estimated 1.9%.

At the same time, Initial Jobless Claims for the week ending March 9 rose by 209K, missed estimates of 218K, and stood below the previous week's reading of 218K.

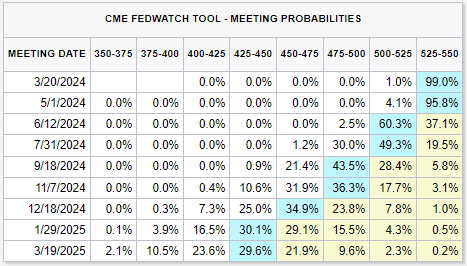

Given the fact that Fed policymakers stressed during the last week that they would remain patient on cutting interest rates bets, after the data, traders pared bets that the Fed would slash rates in the June meeting from 72% at the beginning of the week to 62%.

The US 10-year Treasury bond yield has risen nine and a half basis points (bps) to 4.288%, while 2s edged up five bps to 4.689%, reducing the curve's inversion to 40 bps.

Interest Rates probabilities

What to watch?

In the meantime, traders brace for further US economic data on Friday. The calendar would feature Industrial Production, the New York Fed Empire State Index, and the University of Michigan Consumer Sentiment.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.