Breaking: Bitcoin halving concludes successfully as BTC miner rewards reduce to 3.125

- Bitcoin has undergone its fourth halving ticking over at a block height of 840,000

- BTC miners’ block issuance rewards have been cut in half from 6.25 BTC to 3.125 Bitcoin per block.

- Bitcoin price is trading for $64,188 at the time of writing

Bitcoiners and cryptocurrency market enthusiasts are celebrating the fourth successful execution of the Bitcoin halving, done at a block height of 840,000.

Miners will henceforth receive 50% fewer BTC for verifying transactions. Specifically, the reward for mining new blocks on the Bitcoin blockchain is now 3.125 BTC per block, halved for the fourth time. Miners previously received 6.25 BTC.

Effectively, Bitcoin’s inflation rate has reduced, as strides toward the 21 billion maximum supply continue. So far, more than 19.5 million has already been mined, leaving fewer than 1.5 million left to be created.

Bitcoin’s creator, Satoshi Nakamoto, designed the concept to effectively reduce by half the reward that BTC miners receive. The idea is that by cutting in half the amount miners currently make for their efforts, fewer Bitcoins will enter the market, creating more scarcity of the cryptocurrency.

The most recent Bitcoin halving took place in May 2020, reducing the block reward from 12.5 BTC to 6.25 BTC. Then, Bitcoin price was around $8,602. Look how far we’ve come!

Why BTC halving is bullish for Bitcoin price

With reduced frequency at which new BTCs are generated, there will be lesser propensity for miners to sell. Historical data indicates a positive effect of the expected scarcity on the investors’ psychology. This translates to expectation of a rise in the value of Bitcoin and more buys to follow.

The #Bitcoin Pi Cycle top indicator is an indicator people look at to determine where $BTC might top for the cycle.

— Daan Crypto Trades (@DaanCrypto) April 19, 2024

It uses the Daily 111 Moving Average (111DMA) and the Daily 350MA x 2.

When the 111MA crosses the 350MAx2 you tend to see cycle tops formed. pic.twitter.com/FyNx3M4wv8

Notably, while past mining events have seen positive effects, the effect of halving events on Bitcoin price is prone to variations, depending on prevailing market condition.

Much of the credit for the recent rally in Bitcoin price is given to the early success of a new way to invest in the asset, by way of spot BTC exchange-traded funds (ETFs), approved in a landmark decision by the US Securities and Exchange Commission (SEC) on January 10.

Expert predictions about Bitcoin price post halving

To some, the fourth BTC halving is already priced in, saying that it could be a non-event for Bitcoin price because of the massive run already experienced in 2024, leading BTC to an all-time high of $73,777.

Others say there could still be a bump, at least longer-term, fueled by growing demand due to the spot ETFs, and reinforced by the supply shock of the next halving, potentially driving Bitcoin price even higher. “Consensus estimate" according to Bitwise senior crypto research analyst Ryan Rasmussen is closer to the $100,000-$175,000 range.

Implication for Bitcoin halving for miners

Moving forward, Bitcoin miners are likely going to be compelled to become more energy efficient.

They may also have to raise new capital, with historical data showing that total miner revenue dropped one month after each of the three previous BTC halving events. However, those figures had rebounded significantly after a full year, ascribed to spikes in Bitcoin price along with larger miners expanding their operations.

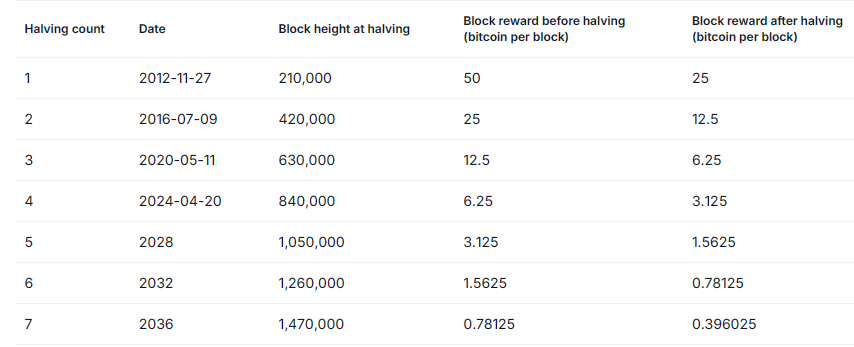

The next halving is expected around April 17, 2028, and while there is no specific calendar, the event is scheduled to occur regularly after the creation of every 210,000 blocks. This generally works out to roughly once every four years.

BTC halving dates