BNB price forecast: Binance Coin surges to record highs as Windtree plans $520M acquisition

- BNB hit an all-time high of $855 on Monday, extending the double-digit gains from Sunday.

- Windtree’s $520 million commitment for a BNB corporate treasury fuels the buying pressure.

- The technical outlook indicates a bullish tilt as momentum gains and OI reach a record high.

BNB (BNB), formerly known as Binance Coin, edges lower after hitting a new all-time high of $855 at press time on Monday. The Centralized Exchange (CEX) token enters uncharted territory on the back of Windtree’s $250 million commitment to build a BNB corporate treasury.

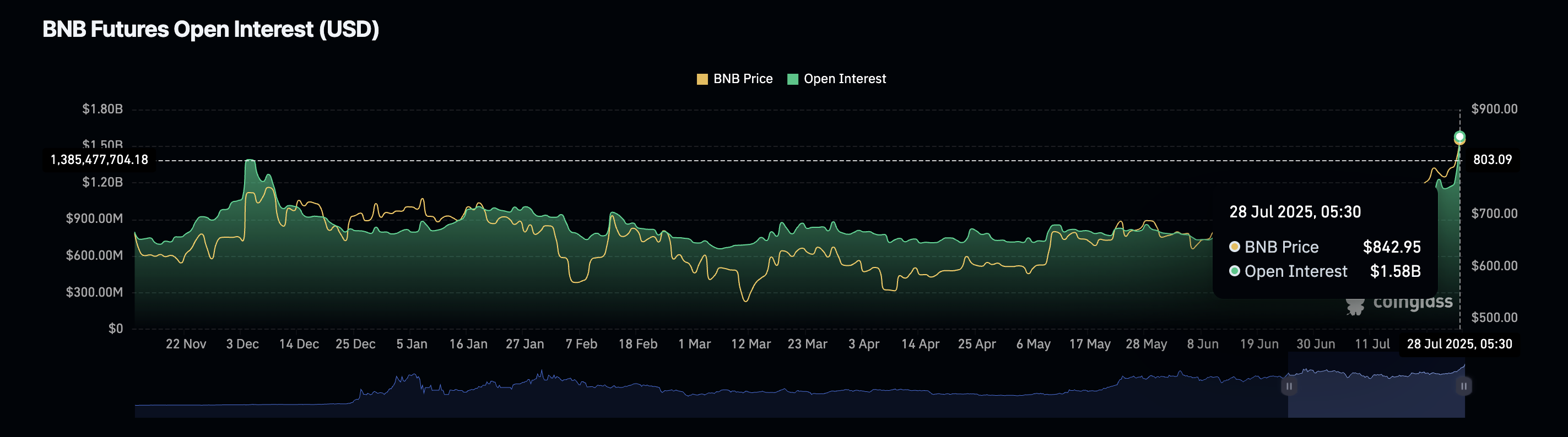

Furthermore, the BNB Open Interest has crossed above $1 billion, as optimism surrounding BNB fuels traders’ sentiment in derivatives markets. The technical outlook suggests continued gains amid heightened optimism and bullish momentum.

Windtree plans to set up a BNB corporate treasury

Windtree Therapeutics, a NASDAQ-listed company, announced $520 million commitment to acquire BNB tokens on Thursday. The announcement fueled a renewed bullish run in the CEX token over the last four days, resulting in a new all-time high of $855 on Monday.

Windtree plans to create an equity credit line of up to $500 million to purchase BNB alongside an additional $20 million stock purchase agreement with Build and Build Corp. However, the equity credit line still requires approval from stockholders.

BNB targets $907 amid record-high open interest

Binance Coin edges lower from the $855 level at press time on Monday while battling to avoid losing the Sunday gains. BNB remains in a price-discovery mode with the Relative Strength Index (RSI) at 85 on the daily chart signaling an overbought condition. The RSI trends sideways, indicating persistent buying pressure; however, investors must exercise caution as overbought conditions often forecast a quick correction.

Investors are likely to flock towards BNB as it gains trend momentum, indicated by the rising Moving Average Convergence Divergence (MACD) and its signal line. A rising trend of the green histogram bars from the zero line reflects the bullish nature of the increasing trend momentum.

A continuation of the uptrend in BNB could target the $907 level, aligning with the R3 pivot level and projecting double-digit gains ahead.

BNB/USDT daily price chart.

The BNB Open Interest (OI) hits an all-time high of $1.58 billion, up from $1.20 billion on Sunday. The $380 million capital inflow in BNB derivatives reflects increased interest from traders.

BNB Open Interest. Source: Coinglass

On the flip side, a reversal in BNB could retest the R2 pivot level at $802.