Here’s Why Shiba Inu Price Drop Could Trigger $50 Million In Liquidations

Shiba Inu (SHIB) has seen a significant drop in price over the past week, triggering bearish sentiment among traders. This has led to a wave of selling pressure in the market.

However, should SHIB recover, it could cause substantial losses for short traders who are betting against the altcoin.

Shiba Inu Traders Should Be Aware

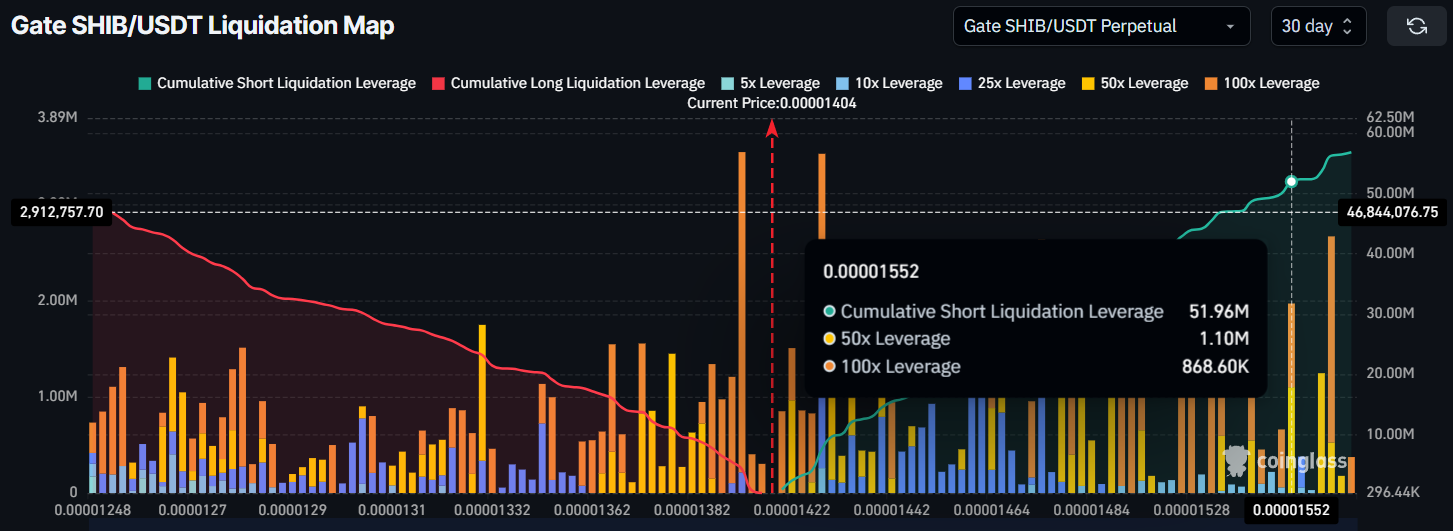

The liquidation map shows a fascinating development: if Shiba Inu recovers the 10% losses it has sustained, it could trigger over $52 million worth of short liquidations. Short sellers have been betting on a decline, but if SHIB rebounds, these traders will face considerable losses.

As traders exit their short positions due to losses, the market will likely see a surge in buy orders, which can propel SHIB’s price upward. This scenario is beneficial for SHIB holders, especially if the altcoin manages to secure a recovery, thereby validating the bullish outlook for the token.

Shiba Inu Liquidation Map. Source: Coinglass

Shiba Inu Liquidation Map. Source: Coinglass

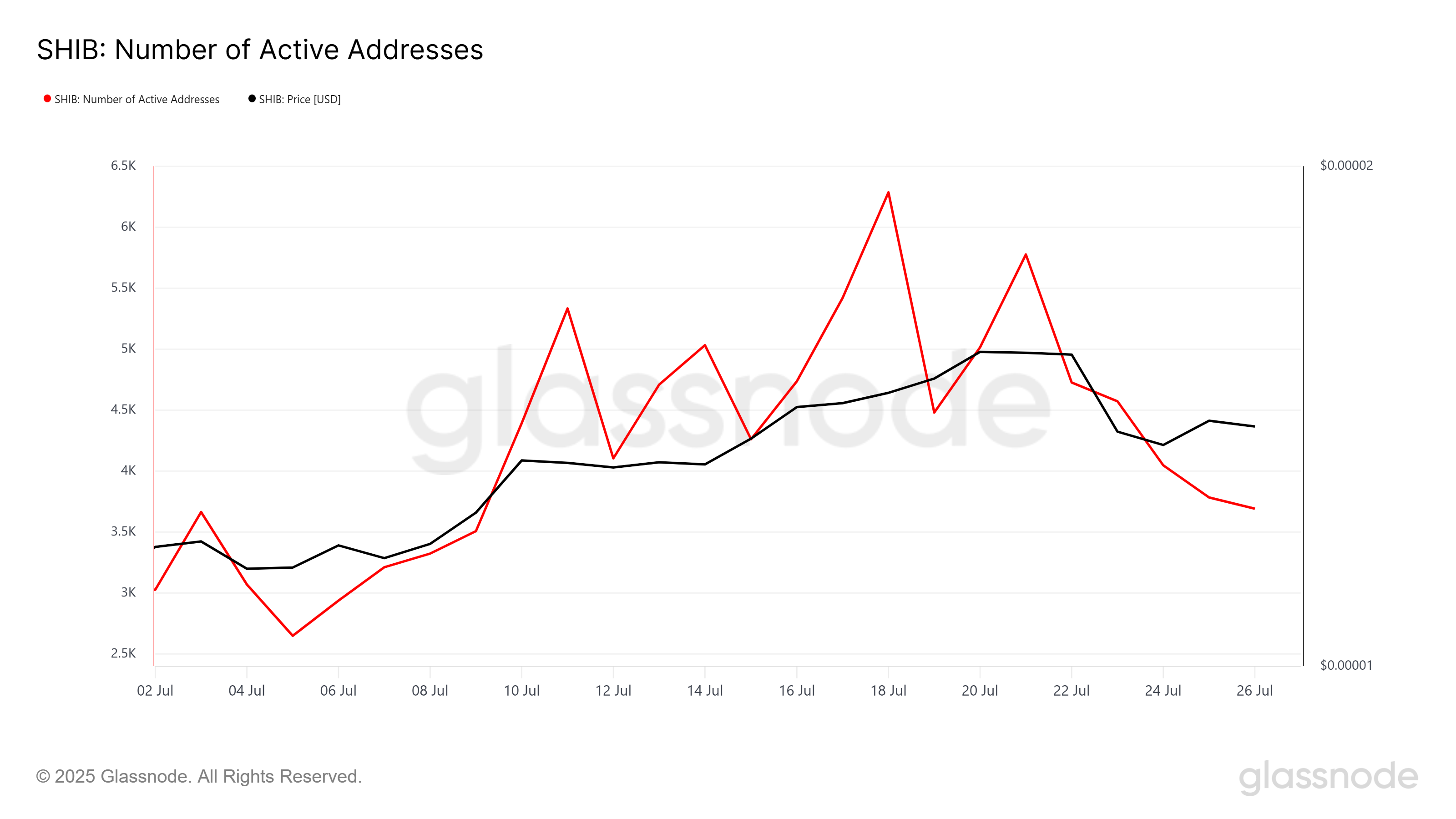

However, the broader market signals suggest some concerns. Active addresses for Shiba Inu have seen a decline of 36% over the last 48 hours. This indicates that investors may be losing hope in a quick recovery for the altcoin and are swiftly exiting their positions.

The decreasing number of active addresses reflects a lack of confidence in the altcoin’s short-term prospects. As more investors exit, the buying pressure necessary to trigger a recovery becomes harder to build.

Shiba Inu Active Addresses. Source: Glassnode

Shiba Inu Active Addresses. Source: Glassnode

SHIB Price Needs To Breach Resistance

At the time of writing, Shiba Inu’s price is $0.00001407, sitting just below the resistance level of $0.00001435. The altcoin has been facing mixed signals, with both bearish and bullish factors playing a role in its price action.

The key resistance level of $0.00001435 needs to be broken for a potential recovery.

If SHIB continues to hover within the consolidation range of $0.00001435 and $0.00001317, traders will remain safe from liquidation risks. This sideways movement will keep the altcoin within a neutral zone, avoiding drastic price changes in the immediate term.

Shiba Inu Price Analysis. Source: TradingView

Shiba Inu Price Analysis. Source: TradingView

However, if Shiba Inu’s price manages to break the resistance at $0.00001435 and flips it into support, SHIB could potentially climb back to $0.00001553. This would mark a 10% recovery, invalidating the current bearish sentiment and shifting the outlook to a more optimistic tone.