Bitcoin treasury companies accelerate buying pressure, but prices fail to react

- K33 Research claims that the rise of Bitcoin treasury companies has had little impact on BTC's price.

- Several companies have announced billions of Dollars in financing deals in the past months to adopt a Bitcoin treasury strategy.

- ProCap announced that it has acquired an additional 1,208 BTC as part of its $1 billion BTC treasury plan.

Bitcoin (BTC) saw slight gains on Wednesday as several public companies made strategic moves to expand their BTC treasuries, including ProCap's purchase of 1,208 BTC. This comes alongside GameStop and Metaplanet, which raised $450 million and $517 million, respectively, to boost their Bitcoin holdings. Despite the increasing treasury allocations to Bitcoin among companies in recent months, it has had no tangible impact on the top cryptocurrency's price, according to K33 Research.

ProCap, GameStop, Metaplanet strengthen Bitcoin bet

Anthony Pompliano revealed in an X post on Wednesday that ProCap BTC has purchased 1,208 BTC for roughly $128 million. The acquisition was done at an average price of $105,977 per BTC, boosting the company's total holdings to 4,932 BTC.

The purchase comes a day after Pompliano disclosed that the company bought 3,724 BTC at an average price of $103,785 per BTC. ProCap's Bitcoin purchases commenced just days after it announced plans to go public, along with a $1 billion Bitcoin treasury target.

The development comes as several companies race to implement a Bitcoin treasury strategy. Bitcoin treasury companies focus on purchasing BTC through share offerings and the issuance of convertible notes, a playbook popularized by Michael Saylor's Strategy.

Pompliano shared that ProCap now holds more Bitcoin than video game retailer GameStop (GME). However, GameStop revealed that it has secured an additional $450 million via the extension of a zero-coupon convertible senior notes offering, as per a filing submitted to the Securities and Exchange Commission (SEC) on Monday. The recent extension of the offering via a "Greenshoe Exercise" brings its total financing to $2.7 billion.

GameStop noted that proceeds from the offering will be allocated toward general corporate initiatives. It will also divert the funds into strategic investments aligned with the company's investment policy. GameStop recently kick-started its Bitcoin treasury strategy with a 4,710 BTC acquisition.

Meanwhile, Japanese firm Metaplanet raised $515 million to expand its Bitcoin holdings after EVO Fund, the company's major investor, converted 540,000 stock acquisition rights into 54 million shares, according to an X post on Wednesday. The funding comes after the company announced plans to issue 555 million shares to raise $5.4 billion to expand its Bitcoin balance. The firm holds 11,111 BTC and plans to boost that figure to 1% of Bitcoin's total supply by 2027.

Bitcoin treasuries fail to impact BTC's price despite accelerated purchases

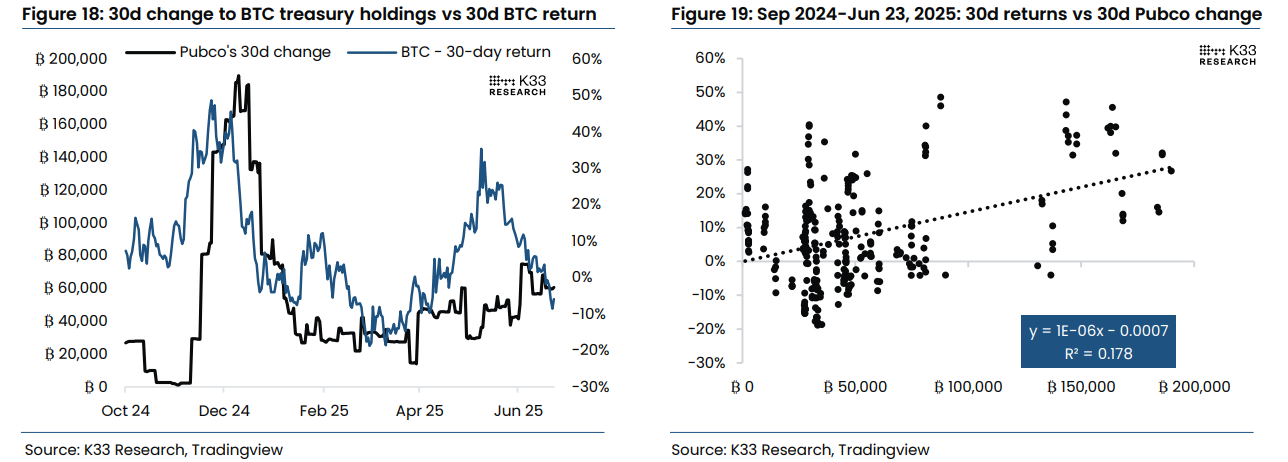

Despite the increasing treasury allocations to Bitcoin among companies in recent months, its price hasn't seen much gain. The correlation between the 30-day flows for public companies buying Bitcoin and 30-day returns has been weak, noted K33 Research analysts led by Vetle Lunde in a report on Tuesday.

K33 added that purchases by Bitcoin treasury companies typically have a neutral effect on the overall crypto market because most acquisitions have been made in-kind by large Bitcoin holders who swap their coins for shares.

BTC treasury holdings 30D change vs 30D BTC returns. Source: K33 Research

"With the massive momentum in BTC treasury companies of late, more investors are attracted to this trade and may seek to sell BTC spot to participate in ATM offerings or fund enterprises directly in-kind," the analysts wrote. "These structures weaken the supply impact of treasury company purchases and may explain the soft R^2 of 0.18 between 30-day treasury flows and BTC returns," they added.

Bitcoin is changing hands around $107,600, up 2% at the time of writing on Wednesday.