Here is what you need to know on Thursday, June 26:

The US Dollar (USD) stays under bearish pressure in the second half of the week, with the USD Index slumping to its weakest level since March 2022 below 97.50. May Durable Goods Orders and Pending Home Sales data will be featured in the US economic calendar, alongside the weekly Initial Jobless Claims. Policymakers from major central banks will be delivering speeches throughout the day.

US Dollar PRICE This week

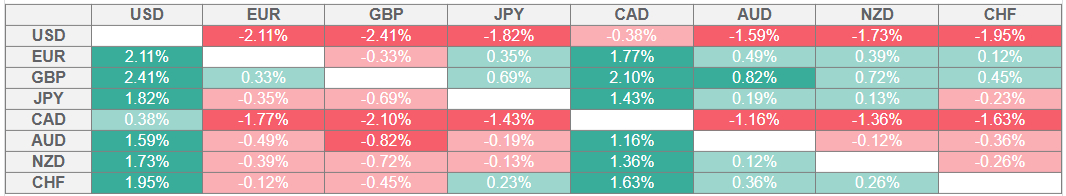

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The USD weakened against its rivals late Wednesday and struggled to find demand early Thursday on news claiming that United States (US) President Donald Trump is considering naming the next Federal Reserve (Fed) Chair candidate early, in a bid to undermine Fed Chair Jerome Powell. Citing people familiar with the matter, the Wall Street Journal reported that Trump could announce Powell's possible replacement by September or October. Kevin Hassett, Director of the National Economic Council, and Treasury Secretary Scott Bessent are among the names under consideration, with Trump evaluating their commitment to lowering interest rates. Meanwhile, US stock index futures trade marginally higher in the European morning.

EUR/USD benefits from the broad-based USD weakness and trades at its highest level since September 2021 above 1.1700 early Thursday.

After posting gains for the fourth consecutive trading day on Wednesday, GBP/USD preserves its bullish momentum and trades above 1.3700 for the first time since January 2022.

USD/CAD edges lower and tests 1.3700 in the European session. Statistics Canada will publish the monthly Gross Domestic Product (GDP) data for April on Friday.

USD/JPY stays on the back foot after posting small gains on Wednesday and trades near 144.00 on Thursday, losing nearly 1% on a daily basis.

AUD/USD extends its weekly rally and trades above 0.6500 in the European session on Thursday.

Following the sharp decline seen earlier in the week, Gold found support and registered small gains on Wednesday. XAU/USD continues to inch higher and closes in on $3,350 early Thursday.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.