Copper Price Alert: U.S. Stockpiles 400,000 Tonnes; Goldman Sees $10,050 by August

TradingKey - On June 26, Goldman Sachs (GS), a Wall Street broker based in New York, released a research report adjusting its copper price forecast for the second half of 2025. This adjustment was based on factors such as the "copper rush" in the U.S. leading to supply shortages in non-U.S. regions and the resilience of the Chinese economy. The firm anticipates that copper prices will peak in August.

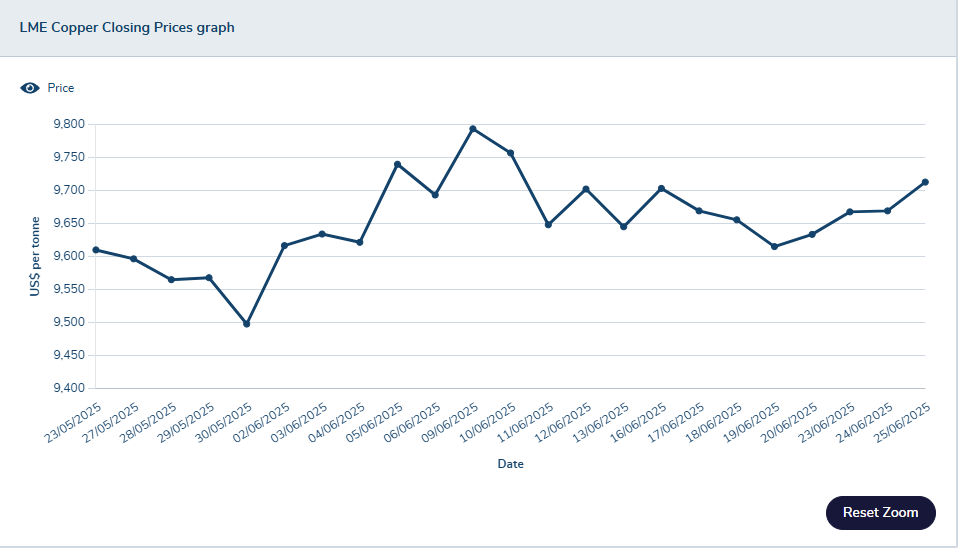

Goldman Sachs forecasts that the average LME copper price will reach $9,890 per ton in the second half of 2025, representing an 8.2% upward revision from previous estimates. The price is expected to peak at $10,050 per ton in August. Under the base scenario (with a 25% tariff expected to be implemented in September), the price is projected to be $9,700 per ton in December.

(Source: LME)

Due to the investigation into copper imports under Section 232 of the U.S. Trade Expansion Act and potential threats of a 25% tariff, the U.S. has excessively imported about 400,000 tons of copper this year, causing inventories to soar to over 100 days' worth of consumption. Meanwhile, inventories in non-U.S. regions have dropped below ten days’ supply; this "copper rush" by the U.S. has distorted the global supply-demand structure for copper.

Goldman Sachs emphasizes that the timing of U.S. copper import tariffs is a key variable influencing future copper price trends.

- Under the baseline scenario, if tariffs are implemented in September, "copper rushing" will cease, and the supply tension in non-U.S. regions may ease, although copper prices will remain elevated.

- In a risk scenario where tariff implementation is delayed, U.S. imports will continue, further tightening non-U.S. markets, potentially leading to copper prices exceeding expectations.

- In an extreme scenario where tariffs are completely abandoned, COMEX copper prices could fall below LME prices, resulting in a potential price decline.

Recently, LME copper prices have risen for five consecutive days and are hovering around $9,700 per ton. This increase is primarily due to tightening supplies in non-U.S. regions, such as declining copper inventories in Europe and Asia. Additionally, there is significant demand for copper driven by data center construction and growing needs for AI computing infrastructure. Market reactions to upward revisions of copper price forecasts by institutions like Goldman Sachs have also contributed to supporting copper prices.