XRP price rallies to $0.74, Coinbase exposes contradictory SEC stance in Ripple lawsuit

- XRP price climbed to $0.7440 on Monday, a new year-to-date high.

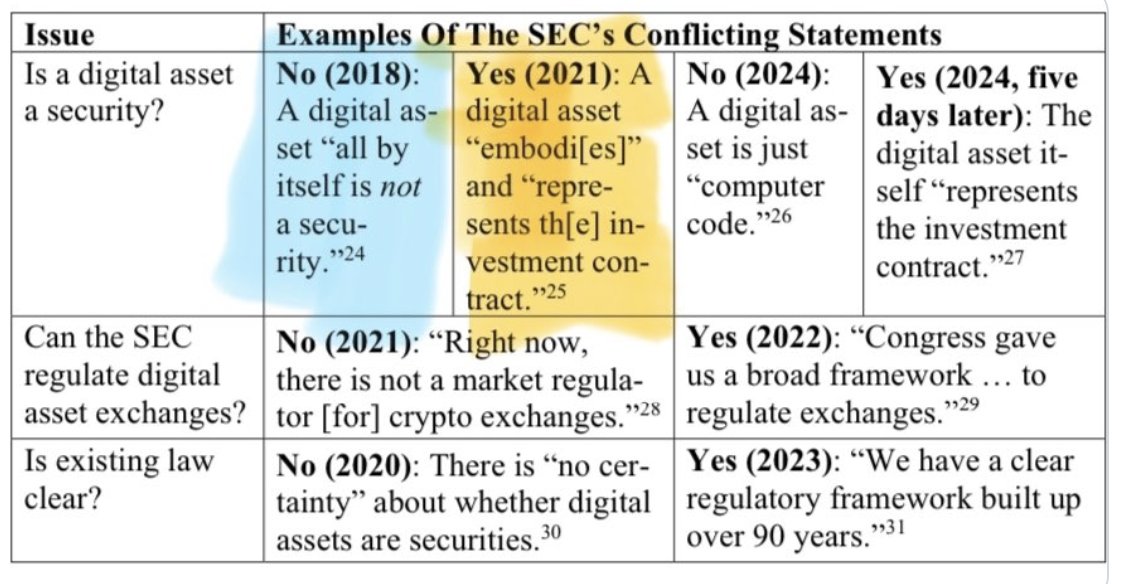

- Coinbase filing shows SEC’s contradicting statements on digital assets in the Ripple lawsuit and Hinman speech.

- XRP Ledger’s AMM amendment and the upcoming deadline in SEC vs. Ripple are likely behind the latest rally.

XRP price tagged the $0.7440 level on Monday, after trading below the $0.66 resistance for weeks. The altcoin’s rally to a new year-to-date high, which lost some steam on Tuesday, is likely catalyzed by XRP holders’ anticipation surrounding the upcoming opening brief deadline in the Securities and Exchange Commission (SEC) lawsuit against Ripple and the recently passed Automated Market Maker (AMM) amendment for XRP Ledger.

Meanwhile, Coinbase’s recent filing in its lawsuit against the US SEC highlighted the financial regulator's contradictory stance on digital assets. The XRP community and pro-Ripple attorneys commented on the exchange’s filing and its possible implications for the SEC vs. Ripple lawsuit.

Also read: XRPLedger’s AMM activation could have a positive effect on Ripple, XRP

Daily digest market movers: Coinbase filing shows inconsistencies in SEC’s stance

- Coinbase, one of the largest cryptocurrency exchanges by volume, filed a motion against the SEC and highlighted the regulator’s contradictory stance on digital assets. The exchange’s filing shows the SEC’s conflicting statements from 2018 and 2021.

Coinbase Filing. Source: X

- There is a direct relationship between Coinbase’s filing and the outcome of the Ripple lawsuit as Coinbase is challenging the SEC’s allegations that the exchange is involved in the sale of unregistered securities.

- On March 12, Coinbase filed an opening brief in the Third Circuit challenging the regulator’s denial of the rulemaking petition.

- The exchange’s Chief Legal Officer Paul Grewal says there are dozens of legitimate concerns that the exchange raises in their petition, and questions the SEC’s authority over digital assets.

- Coinbase’s filing has an impact on the SEC’s lawsuit against payment giant Ripple since the exchange also questions the regulator’s authority to rule over crypto assets.

- The SEC vs. Ripple lawsuit continues to influence XRP price and sentiment of XRP holders since the cross-border payment firm is one of the largest holders of the altcoin.

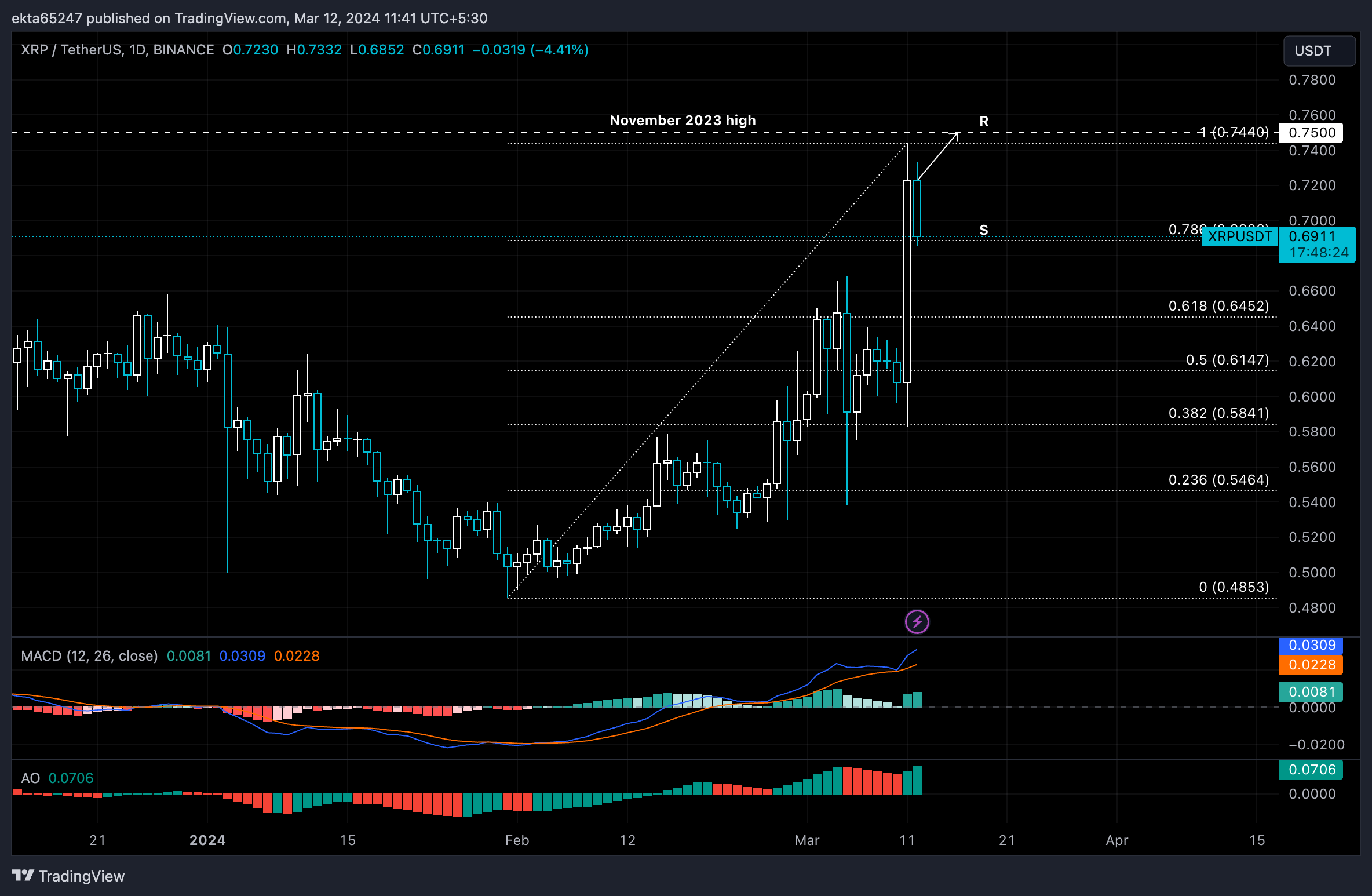

Technical Analysis: Towards November 2023 high

XRP price is in an uptrend. Looking at the daily chart, XRP price tagged a new year-to-date high of $0.7440 on Monday, and settled above support at $0.6886. This coincides with the 78.6% Fibonacci retracement level of the altcoin’s run to the new 2024 high. On the upside, the target for XRP price is the November 2023 high of $0.7500.

Still, XRP price has corrected to $0.6940 on Tuesday. The pair finds support at the 78.6% and 61.8% Fibonacci retracement levels at $0.6886 and $0.6452, respectively.

The Moving Average Convergence/Divergence (MACD) and Awesome Oscillator (AO) support the altcoin’s gains. The green bars in both momentum indicators signal the uptrend is intact and there is positive momentum in XRP/USDT.

XRP/USDT 1-day chart

If the daily candlestick closes below the 78.6% Fib retracement at $0.6886, the bullish thesis could be invalidated. XRP price could sweep the support at 50% Fib retracement at $0.6147 before attempting a recovery.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.