Telcoin Price Prediction 2025-2031: Will TEL reach $0.1?

Key takeaways

- Our Telcoin price prediction anticipates a high of $0.0116 by the end of 2025.

- In 2026, it will range between $0.0113 and $0.0118 with an average price of $0.0128.

- In 2030, it will range between $0.0251 and $0.0291 with an average price of $0.0280.

Since its launch in 2017, Telcoin (TEL) has created a stir in the crypto and fintech industries. Being the original gas token of the Telcoin Network, TEL fuels a one-of-a-kind ecosystem at the intersection of blockchain, telecommunications, and digital banking. Telcoin is a borderless, instant, and low-cost financial service to mobile users globally operated by the Telcoin Association, a Swiss non-profit representing the interests of telecom stakeholders worldwide.

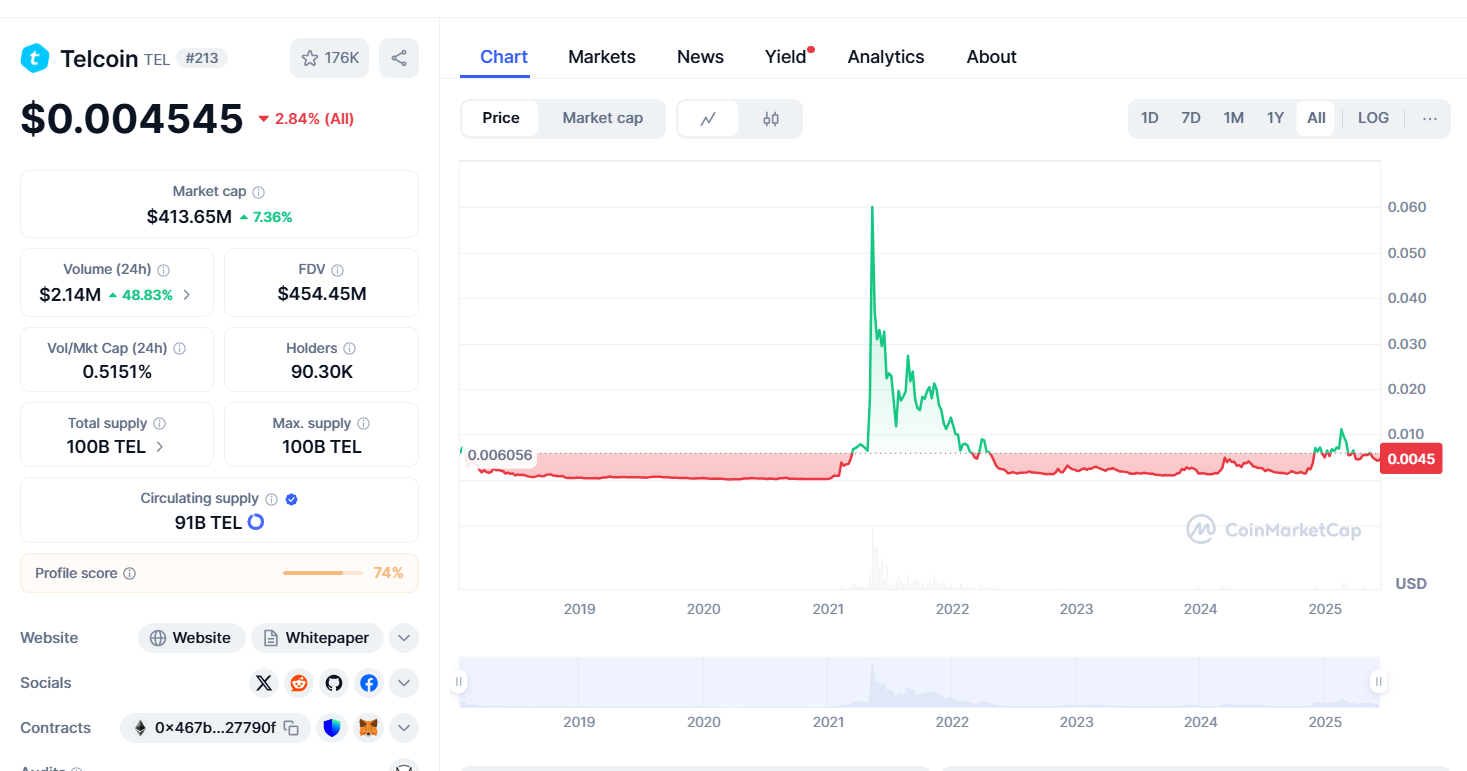

Having received regulatory greenlights in most major jurisdictions and preparing to launch Telcoin Bank, the first crypto-native bank in the U.S., Telcoin is establishing itself as a disruption in digital finance. Having skyrocketed to a new all-time high of $0.0649 in 2021, TEL has been quite volatile yet is constantly supported by the community and institutions. But what will TEL be in 2025 and further on? Let’s dive into Telcoin price prediction from 2025 to 2031.

Overview

| Cryptocurrency | Telcoin |

| Ticker | TEL |

| Current price | $0.00467 |

| Market cap | $413.65M |

| Trading volume | $2.14M |

| Circulating supply | 100B TEL |

| All-time high | $0.0649 on May 11, 2021 |

| All-time low | $0.00006516 on Mar 13, 2020 |

| 24-hour high | $0.004813 |

| 24-hour low | $0.004275 |

Telcoin price prediction: Technical analysis

| Metric | Value |

| Volatility (30-day variation) | 12.83% |

| 50-day SMA | $ 0.005322 |

| 200-day SMA | $ 0.00492 |

| Sentiment | Bearish |

| Fear and greed index | 72 (Greed) |

| Green days | 11/30 (37%) |

Telcoin price analysis

TL; DR Breakdown:

- Telcoin is trading above $0.00468, showing buyers are defending this key support level.

- The resistance sits at $0.00485, and a break above it could trigger further gains.

- If sellers return, the next strong support lies near $0.00450, where the price previously stabilised.

As of June 11 2025, Telcoin (TEL) is trading around $0.00472, showing a slight upward movement after holding above key support at $0.00468. The price remains within a narrow range, with buyers attempting to push toward the resistance at $0.00485. This steady action reflects growing interest, setting the stage for a potential breakout or continued consolidation in the near term

TEL/USD 1-day chart: TEL holds steady, with fading bullish momentum.

As of today, Telcoin (TEL) is trading around $0.004679, showing slight upward movement after bouncing from support at $0.00468. The price is holding within a narrow range, with buyers attempting to break through the next key resistance at $0.00485. The Relative Strength Index (RSI) is at 53.11, placing TEL in a neutral zone. This suggests the market is neither overbought nor oversold, leaving room for further movement in either direction.

The MACD indicator reflects a weakening bullish trend. The MACD line remains above the signal line, signalling ongoing positive momentum, but the shrinking histogram bars indicate that the buying pressure is fading. If the MACD crosses below the signal line, it could trigger a short-term bearish correction.

Telcoin (TEL) 4-hour price: Telcoin holds on a tight range on the 4-hour chart

Telcoin is currently trading around $0.00465, showing mild upward momentum after testing key support at $0.00452. Price action is approaching a resistance level near $0.00470, where sellers previously stepped in. If TEL breaks this level, the next resistance lies near $0.00480.

The Relative Strength Index (RSI) sits at approximately 58, indicating neutral-to-slightly bullish strength, with room before reaching overbought conditions. The MACD shows a narrowing gap between the MACD and signal lines. Although still above the zero line, the shrinking histogram bars signal waning bullish momentum.

TEL technical analysis: Levels and action

Daily simple moving average (SMA)

| Period | Value | Action |

| SMA (10) | $0.00417 | BUY |

| SMA (20) | $0.00437 | SELL |

| SMA (30) | $0.00473 | SELL |

| SMA (50) | $0.00511 | SELL |

| SMA (100) | $0.00537 | SELL |

| SMA (200) | $0.00608 | SELL |

Daily exponential moving average (EMA)

| Period | Value | Action |

| EMA (10) | $0.00424 | BUY |

| EMA (20) | $0.00442 | SELL |

| EMA (30) | $0.00460 | SELL |

| EMA (50) | $0.00487 | SELL |

| EMA (100) | $0.00528 | SELL |

| EMA (200) | $0.00528 | SELL |

What to expect from the TEL price analysis next?

Telcoin (TEL) may continue its upward momentum if bullish indicators hold. If the price fails to break above the $0.00470 resistance, a short-term pullback toward $0.00450 support is possible.

Is TEL a good investment?

The telecommunications business is expected to grow rapidly, which could lead to better user-owned financial products for mobile phones and a bigger market cap for Telcoin.

Despite the Telcoin project’s strong foundation, mobile network operators and other telecom firms have not yet adopted it widely. A factor that may explain its past poor performance.

Will TEL recover?

Telcoin operates in a highly growing field; with increasing adoption. As a result, it might soon recover and cross its previous highs.

Will TEL reach $0.005?

According to the Cryptopolitan price prediction, TEL will cross the $0.005 mark in 2031.

Will TEL reach $0.01?

According to the Cryptopolitan price prediction, TEL will reach $0.01 in 2029, with a maximum price of $0.0126 for the year.

Will TEL reach $0.1?

It remains highly unlikely that TEL will cross the $0.1 mark before 2030.

Does Telcoin have a good long-term future?

According to Cryptopolitan price predictions, TEL will trade higher in the years to come. However, factors like market crashes or difficult regulations could invalidate this bullish theory.

Recent news

Telcoin Bank in Norfolk is set to become the first federally regulated digital asset bank in the U.S. following the Senate’s approval of the GENIUS Act. The legislation aims to provide federal oversight for cryptocurrencies, especially stablecoins backed by fiat currency.

Telcoin President of Banking Operations, Patrick Gerhart, said the bank is developing a U.S. dollar-backed stablecoin under the new framework. Once chartered by the Nebraska Department of Banking and Finance, the bank will offer customers blockchain-based financial services.

Telcoin price prediction June 2025

Telcoin’s value is forecasted to increase, potentially reaching an average price of $ 0.00625. The price is predicted to fluctuate between a low of $ 0.004 and a high of $ 0.007635

| Month | Potential low ($) | Potential average ($) | Potential high ($) |

| June | $ 0.004 | $ 0.00625 | $ 0.007635 |

Telcoin price prediction 2025

In 2025, Telcoin (TEL) is anticipated to range between $0.0038 and $0.0116, leading to an average annualised price of $0.0104. This could result in a potential return on investment of 72.42% compared to the current rates

| Year | Potential low ($) | Potential average ($) | Potential high ($) |

| 2025 | $0.0038 | $0.0104 | $0.0116 |

Telcoin price predictions 2026 – 2031

| Year | Potential low ($) | Potential average ($) | Potential high ($) |

| 2026 | $0.00981 | $0.0110 | $0.0118 |

| 2027 | $0.0134 | $0.0151 | $0.0164 |

| 2028 | $0.0175 | $0.0201 | $0.0206 |

| 2029 | $0.0175 | $0.0201 | $0.0206 |

| 2030 | $0.0216 | $0.0241 | $0.0250 |

| 2031 | $0.0308 | $0.0331 | $0.0341 |

Telcoin price prediction 2026

Telcoin’s price prediction for 2026 is a high of $0.0118. It will reach a minimum price of $0.00981 and an average price of $0.0110.

Telcoin TEL price prediction 2027

The Telcoin price forecast shows it will range between $0.0134 and $0.0164, with an average price of $0.0151.

Telcoin price prediction 2028

Telcoin price prediction according to the predictions, it will range between $0.0175 and $0.0206, with an average price of $0.0201.

Telcoin price prediction 2029

Our Telcoin price prediction indicates a further acceleration in the price. It will trade between $0.0175 and $0.0206 and have an average of $0.0201.

Telcoin price prediction 2030

According to the TEL coin price prediction for 2030, the price of TEL will range from a minimum price of $0.0216 to a maximum price of $0.0250. The average price will be $0.0241.

Telcoin price prediction 2031

According to the Telcoin price prediction for 2031, TEL price will range from $0.0308 to $0.0341 with an average price of $0.0331.

Telcoin market price prediction: Analysts’ TEL price forecast

| Platform | 2025 | 2026 | 2027 |

| Digitalcoinprice | $0.0118 | $0.01392 | $0.0193 |

| Changelly | $0.00736 | $0.0101 | $0.0154 |

| Swapspace | $0.00659084 | $0.00737239 | $0.00844391 |

Cryptopolitan’s TEL price predictions

In 2025, Telcoin (TEL) is anticipated to range between $0.0038 and $0.0116, leading to an average annualised price of $0.0104. In 2031, TEL price will range from $0.0308 to $0.0341 with an average price of $0.0331.Note that the predictions are not investment advice. Seek independent consultation or do your research.

Telcoin historic price sentiment

- Telcoin was introduced in 2017 with a maximum token supply of 100 billion TEL. One-quarter of the tokens were distributed to investors in a crowd sale, and another 15% was reserved for the development team, including a 5% liquidity fund.

- The coin had attained its all-time low of $0.00006516 on March 13, 2020.

- It had its best performance in the 2021 bull run. On May 11, the coin achieved an all-time high of $0.0649.

- A year later, in 2022, it had fallen to $0.002484.

- The drop continued into 2023, falling to as low as $0.0009 in November.

- It recovered in 2024, reaching a high of $0.005456 in March. It was later corrected and trades at the $0.00148 mark.

- In April 2025, Telcoin (TEL) opened at $0.0049676 and traded at $0.0053183, marking an 11.20% increase.

- As of June 11, 2025, Telcoin (TEL) is trading at approximately $0.004545, reflecting a slight pullback from its April high of $0.0053183.