Bitcoin Exchange Balances Hit Record Lows — What Is the Market Waiting For?

TradingKey – Bitcoin Exchange Balances Reach Historic Lows as Investors Hold Steady.

On Monday, June 9, Bitcoin (BTC) price remained stable around $105,000, following a volatile week where BTC ranged between $100,000 and $105,000, forming a V-shaped recovery pattern. Despite the fluctuations, investors are choosing to hold rather than sell off their assets.

Bitcoin Price Chart – Source: TradingView.

Bitcoin Supply on Exchanges Falls to All-Time Low

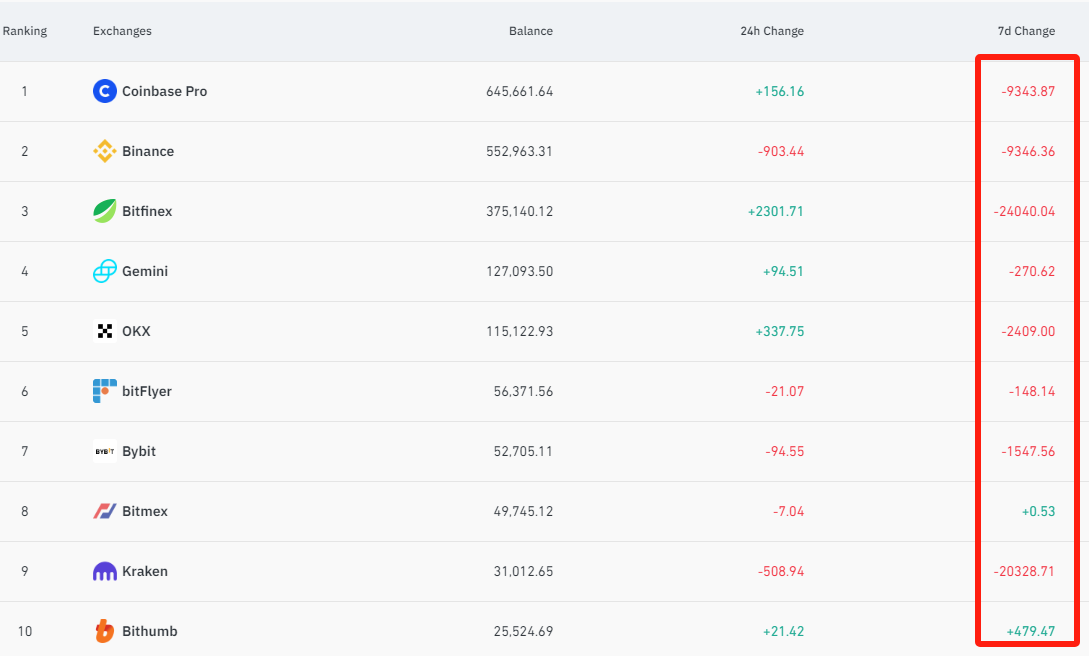

According to Coinglass data, 65,000 BTC flowed out of major exchanges in the past week, including:

- Bitfinex: 25,700 BTC outflow

- Coinbase Pro: 9,300 BTC outflow

- Binance: 8,700 BTC outflow

These withdrawals pushed the total exchange-held BTC down to 2.09 million BTC, marking a historic low.

Bitcoin Exchange Flow Data Across Top Platforms – Source: Coinglass.

What Does This Massive Bitcoin Outflow Mean?

Typically, a decline in exchange balances suggests BTC is being moved to private wallets. Investors typically handle BTC in two ways:

- Sell on decentralized exchanges (DEXs)

- Hold in cold storage wallets

However, according to Crypto Quant analyst Axel, BTC has not been sold on centralized exchanges (CEXs), nor does on-chain data show significant transfers — suggesting investors are entering a strong holding phase.

Investors Are Betting on Higher Bitcoin Prices

With BTC hovering near its record high of $110,000, most holders remain in profit:

- 97% of BTC investors are currently profitable

- 2% are at breakeven

- Only 1% are in a loss position (Source: IntoTheBlock)

But why aren’t investors selling to lock in gains? The market anticipates further price surges.

- Standard Chartered’s Geoff Kendrick forecasts BTC will hit $500,000 by 2028

- ARK Invest CEO Cathie Wood predicts BTC could rise 15x over the next five years — potentially surpassing $1 million

Companies Are Reinforcing the Bullish Sentiment

Alongside market predictions, major corporations are actively stockpiling Bitcoin:

- Metaplanet and Strategy(MSTR) continue to raise capital to acquire BTC

- Matador, K Wave, and SolarBank have followed suit by adding BTC to their balance sheets

U.S. Debt Crisis & Interest Rate Cuts Could Drive BTC Higher

The growing U.S. debt crisis is also boosting Bitcoin’s status as a hedge. Coinbase CEO Brian Armstrong warned, "If the U.S. Congress fails to resolve the $37 trillion debt issue, Bitcoin could replace the dollar as the world’s reserve currency."

Additionally, persistent high interest rates in the U.S. have fueled expectations that the Federal Reserve will cut rates this year — a major bullish factor for BTC.