Here is what you need to know on Monday, June 9:

Markets adopt a cautious stance to start the week as investors await headlines coming out of the next round of US-China trade talks, which is set to take place in London on Monday. The European economic calendar will feature Sentix Investor Confidence data for June. In the second half of the day, Wholesale Inventories for April will be the only data release from the US.

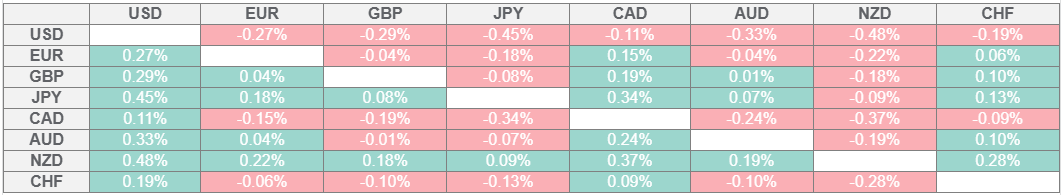

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The US Bureau of Labor Statistics reported on Friday that Nonfarm Payrolls (NFP) in the United States (US) rose by 139,000 in May. This reading came in slightly better than the market expectation of 130,000. In this period, the Unemployment Rate remained unchanged at 4.2% as expected. On a negative note, NFP readings for March and April were revised down by 65,000 and 30,000 respectively. The US Dollar (USD) Index edged higher after the May employment report and closed in positive territory on Friday. The USD Index stays under modest bearish pressure and fluctuates slightly below 99.00 in the European morning on Monday. Meanwhile, US stock index futures were last seen losing between 0.2% and 0.25%, reflecting a risk-averse market atmosphere.

European Central Bank (ECB) President Christine Lagarde said over the weekend that interest rates will have to remain restrictive for as long as necessary to ensure price stability on a lasting basis. "There is still a long way to go until inflation is squeezed out of the economy," Lagarde added. After losing about 0.4% on Friday, EUR/USD holds its ground and trades in positive territory above 1.1400 in the European morning on Monday.

The data from China showed in the Asian session that the trade surplus widened to $103.22 billion in May from $96.18 billion in April. On a yearly basis, Exports rose by 4.8%, while Imports declined by 3.4%. In the meantime, the Consumer Price Index (CPI) fell by 0.2% on a monthly basis in May. AUD/USD stretches higher early Monday and holds above 0.6500.

GBP/USD fell about 0.3% on Friday but ended the previous week in positive territory. The pair regains its traction early Monday and trades above 1.3550. The UK's Office for National Statistics will publish the labor market data for April on Tuesday.

Japanese Prime Minister Shigeru Ishiba said on Monday that the economy is shifting to a phase where interest rates rise as a trend and noted that rising rates could push up the government’s debt-financing costs and affect its spending plans. After posting gains for two consecutive days to end the previous week, USD/JPY turns south early Monday and declines toward 144.00.

Gold started the week under pressure and dropped below $3,300 after losing more than 1% on Friday. XAU/USD corrects higher and stabilizes above $3,300 in the European morning.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.