AUD/USD rallies to near 0.6530 as US Dollar slumps ahead of Sino-US trade talks

AUD/USD surges to near 0.6530 as antipodeans advance ahead of trade talks between the US and China.

Upbeat China Trade Balance data for May has also strengthened the Aussie Dollar.

Easing US labor market conditions have weighed on the US Dollar.

The AUD/USD pair is up almost 0.55% to near 0.6530 during European trading hours on Monday. The Aussie pair strengthens as antipodeans outperform ahead of trade negotiations between the United States (US) and China later in the day.

Australian Dollar PRICE Today

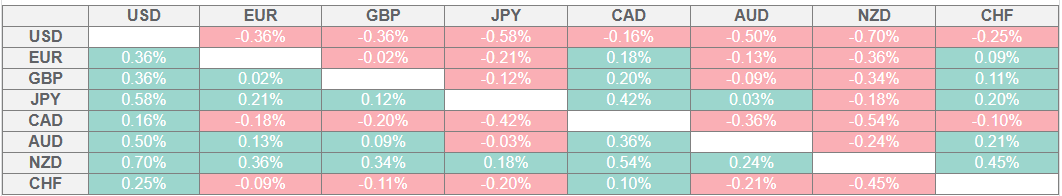

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

The Australian Dollar (AUD) gains on hopes that US-China trade discussions will be smooth and delegates from both nations will try to secure a bilateral deal soon. Over the weekend, US President Donald Trump expressed confidence in a post on Truth.Social, that meeting between his top negotiators and Chinese representatives will go very well.

Given that the Australian economy relies heavily on its exports to China, positive outcomes from Washington-Beijing talks will be favorable for the Australian Dollar (AUD).

Additionally, upbeat China Trade Balance data has also provided strength to the Australian Dollar. During Asian trading hours, the National Bureau of Statistics of China reported that the Trade Balance (CNY) came in higher at CNY743.56 billion in May, compared to the previous surplus of CNY689.99 billion seen in April.

Meanwhile, the US Dollar (USD) faces a sharp selling pressure ahead of US-China talks and signs of underlying weakness in the domestic labor market data. The US Nonfarm Payrolls (NFP) report for May showed that the cumulative addition of job-seekers in March and April was lower by 95K than what was previously reported. However, the addition of fresh workers in May was slightly higher at 139K, compared to estimates of 130K.

This week, investors will focus on the US Consumer Price Index (CPI) data for May, which will be released on Wednesday.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.