Crypto Today: SOL, XRP and ADA in danger zone as Bitcoin price anchors market above $3.4 trillion

- Cryptocurrencies market cap dips 4% on Thursday, but Bitcoin’s resilient performance signals an imminent rebound.

- BTC and ETH limit losses , while top altcoins XRP, Solana and Cardano saw more than 2% downturns.

- BNB price is up 0.4%, holding firm above the $650 psychological support, emergingas the only gainer among the top 10 ranked cryptocurrencies.

- After acquiring Deribit for $2.9 billion, Coinbase CEO Brian Armstrong stated that the exchange is open to new acquisitions.

The cryptocurrency sector declined 4% on Thursday, with aggregate market capitalization hovering precariously above the $3.4 trillion mark. Top altcoins XRP, Solana and Cardano booked losses higher than the market average, with the more resilient performance of BTC and ETH signaled a flight-to-quality trade.

Bitcoin market updates:

- Bitcoin price trades at $102,500 on Thursday, consolidating with a 0.5% narrow range between $101,769 and $103,810, according to Coingecko data.

- Bitcoin price is now on course to close above the $100,000 mark for eight consecutive days as corporate investors have maintained a positive outlook on BTC, amid escalating geopolitical conflicts and US trade policy swings.

- BTC’s resilient showing aligns with key corporate players like JP Morgan dialled down US recession predictions after the US and China announced a trade truce at the start of the week.

Chart of the day: US ETF markets hit $400B capital flows for 2025

The US ETF market has surged past $400 billion in net inflows year-to-date, according to Bloomberg analyst Eric Balchunas, marking a stunning $4.4 billion per day average. Balchunas notes that this blistering pace could send ETF inflows past $1 trillion for the second consecutive year, despite muted equity returns in 2025.

The demand for ETFs across the US markets appears to be spilling over into spot Bitcoin ETFs, which saw a strong recovery in net inflows on Wednesday.

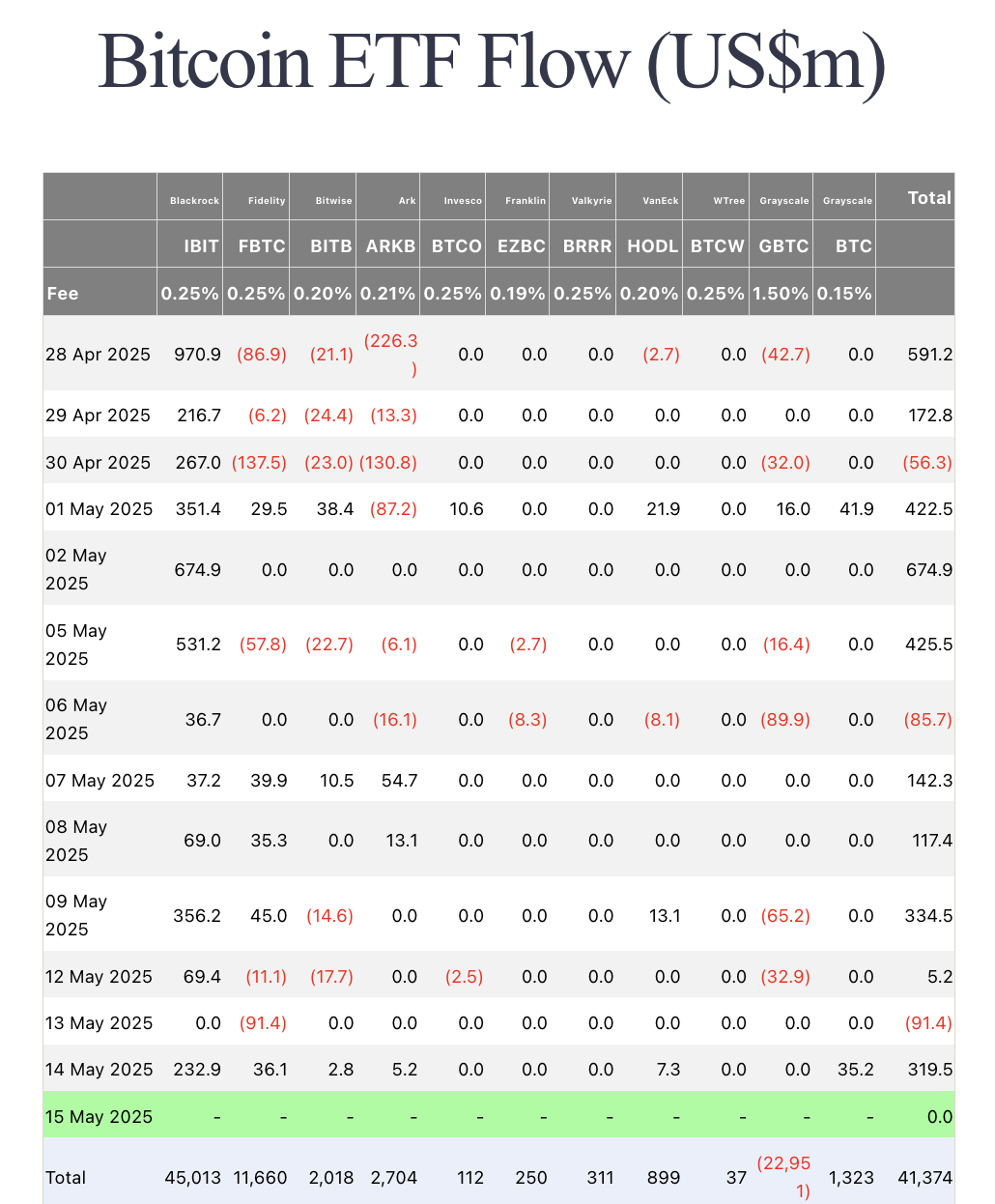

According to data from Farside, US-listed Bitcoin ETFs raked in $319.5 million in net inflows on Wednesday, marking a major positive turnaround from Tuesday’s $91.4 million in net outflows.

BlackRock’s IBIT led the charge, pulling in $232.9 million, followed by Fidelity’s FBTC at $36.1 million, and Ark’s ARKB with $5.2 million.

Bitcoin ETF Flows, May 15, 2025 | Source: Farside

This spike in Bitcoin ETF inflows on Wednesday suggests that institutional appetite for BTC exposure remains resilient and may be closely linked to the broader trend of rising ETF demand among US investors as reflected by the $400 billion milestone.

Aggregate BTC holdings by spot Bitcoin ETFs have exceeded $41.3 billion, and BlackRock's IBIT nearing 40% dominance at $15 billion AUM.

Altcoin market updates: BNB gains spark rebound hopes as SOL, XRP ADA fall behind BTC and ETH

Top altcoins are lagging behind BTC and ETH on Thursday, signaling active capital rotation across the cryptocurrency markets.

While Bitcoin and Ethereum held losses below 2% amid a broader pullback, XRP, Solana, and Cardano posted steeper declines.

Meanwhile, Binance Coin (BNB) defied the trend, climbing 0.3% to become the day’s only top10 gainer, sustaining above the $650 psychological support and reinforcing its role as a liquidity anchor during periods of heightened volatility.

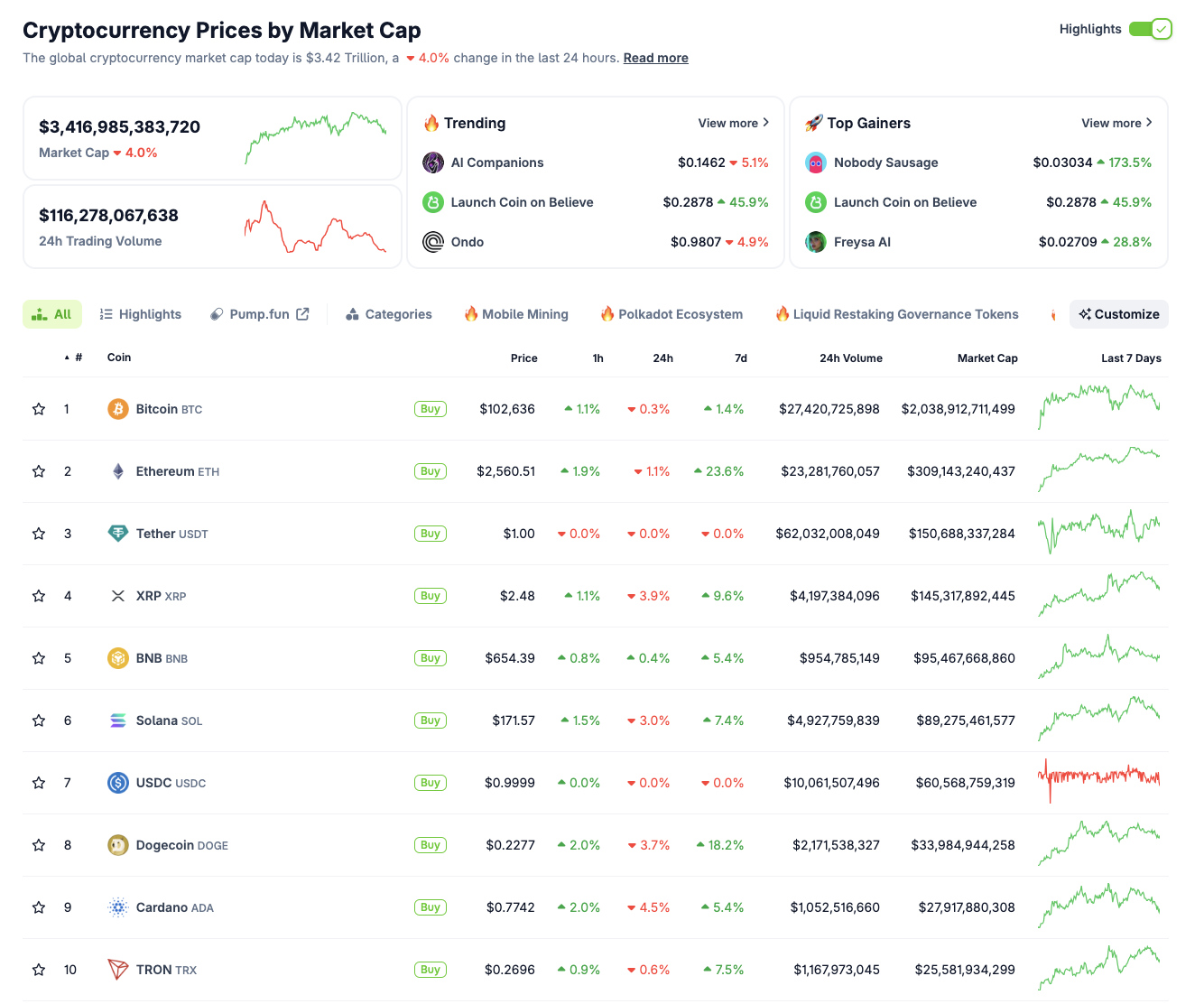

Top 10 Cryptocurrencies market performance, May 15 | Source: Coingecko

According to Coingecko data, the global cryptocurrency market capitalization dipped 4.0% over the past 24 hours, now at $3.42 trillion.

Trading volumes surged to $116 billion, indicating aggressive repositioning across portfolios.

Bitcoin currently trades at $102,636, down just 0.3%, while Ethereum is changing hands at $2,560, also only marginally lower.

In contrast, XRP fell 2.5% to $2.47, slipping below its recent support at $2.50. Solana dropped 1.5% to $171.61, breaching the $175 zone, and Cardano declined 2.3% to $0.7723, close to losing the $0.77 handle that had held for much of May.

BNB’s relative stability, despite sell pressure within XRP, SOL and ADA markets, suggests inflows from market makers or strategic traders executing large transactions, often using BNB to reduce fees or access platform liquidity during market uncertainty.

Coinbase signals continued acquisition appetite following $2.9B Deribit takeover

Coinbase CEO Brian Armstrong confirmed the company remains open to more acquisitions following its $2.9 billion deal to acquire crypto derivatives exchange Deribit.

Speaking to Bloomberg, Armstrong said Coinbase is actively exploring strategic opportunities, particularly with international firms that align with its growth goals.

He emphasized that while the company is not looking to pursue every available option, it is prepared to act when the right opportunities arise.

The Deribit acquisition, which includes $700 million in cash and 11 million shares of Coinbase stock, marks the largest in the company's history.

It expands Coinbase’s presence in the crypto derivatives market, where Deribit leads in Bitcoin and Ethereum options trading.

Armstrong did not rule out potential interest in stablecoin issuer Circle but said there was “nothing to announce today.” Coinbase shares rose 2.5% on Wednesday following news of its pending inclusion in the S&P 500 index.

Singapore High Court approves Sonic Labs’ petition to liquidate Multichain Foundation

The High Court of Singapore has approved a petition filed by Sonic Labs to liquidate the Multichain Foundation, following a $210 million exploit that occurred in July 2023.

The ruling comes after Multichain failed to provide accountability for the breach, which affected assets across several blockchain networks.

KPMG Singapore has been appointed as the joint liquidators to oversee the recovery process.

Sonic Labs initiated the legal proceedings to recover funds lost during the exploit.

The case was further complicated by the earlier arrest of Multichain CEO Zhaojun He, which took place shortly before the breach.

With the court’s approval, liquidation efforts will now proceed under Singaporean jurisdiction, kick-starting the restitution procedures for affected parties.