On Wednesday, inflows into US-listed Bitcoin ETFs exceeded $315 million, marking a sharp reversal from the $96 million in outflows recorded the previous day.

The surge in demand reflects a bullish shift in investor sentiment despite the modest decline in BTC’s price on Wednesday.

$319 Million Pours Into BTC ETFs in a Day

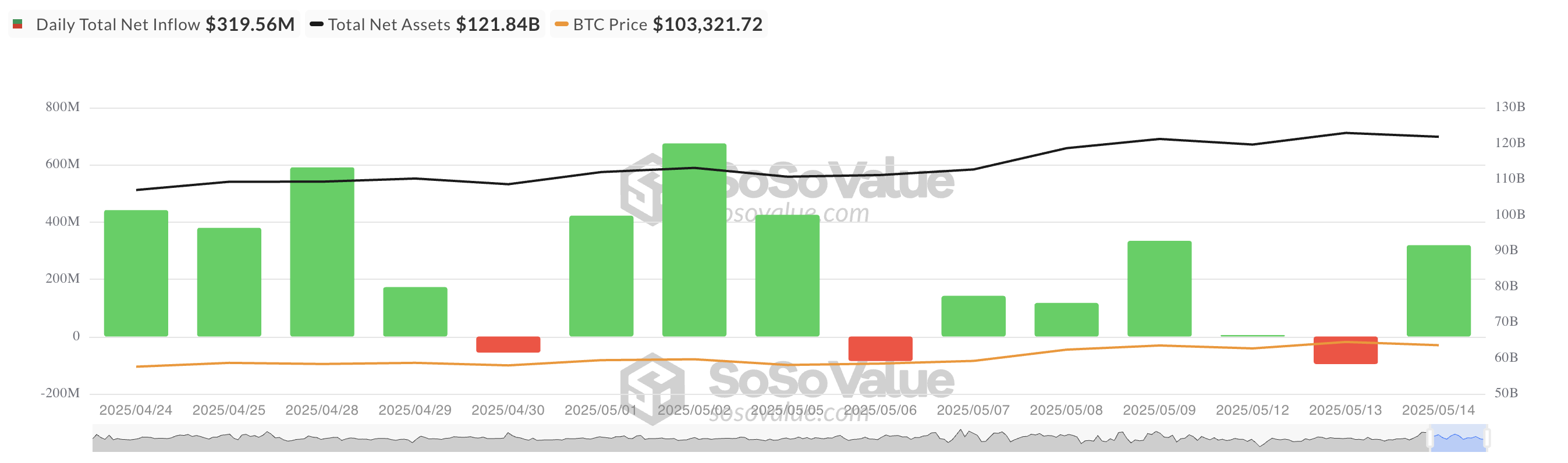

On Wednesday, none of the twelve spot BTC-backed ETFs reported outflows. According to SosoValue, inflows into these funds totaled $319.56 million, marking one of the strongest single-day performances in recent weeks.

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

The shift in sentiment points to renewed interest from retail and institutional investors, likely driven by a chance to buy the dip and growing confidence in BTC’s long-term potential, despite short-term price swings.

Yesterday, BlackRock’s ETF IBIT saw the highest net inflow, amounting to $232.89 million. As of this writing, its total historical net inflow is $45.01 billion.

Fidelity’s FBTC saw the second-highest daily net inflow, at $36.13 million, bringing its total historical net inflows to $11.65 billion.

BTC Pulls Back Slightly, But Derivatives Show Bulls Are Not Backing Down

BTC currently trades at $102,413, noting a modest 1% price pullback over the past day. However, market data points to lingering bullish sentiment while spot prices dip.

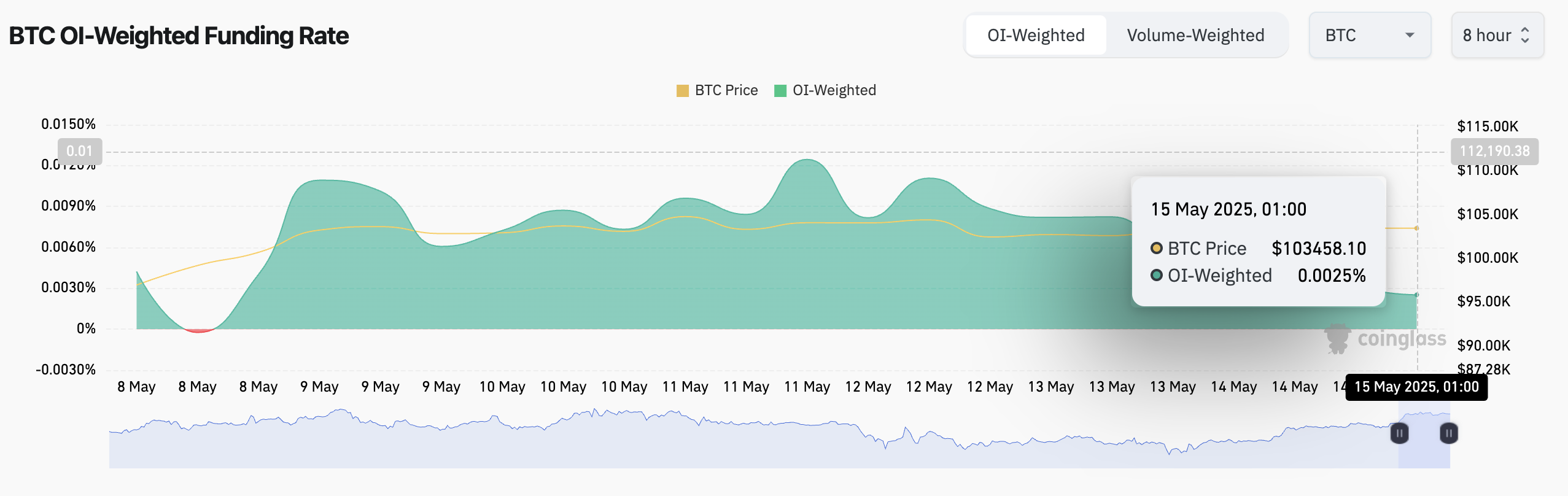

For example, the coin’s funding rate remains positive, indicating traders are still willing to pay a premium to maintain long positions in perpetual futures. At press time, this is at 0.0025%.

BTC Funding Rate. Source: Coinglass

BTC Funding Rate. Source: Coinglass

The funding rate is a periodic payment exchanged between traders in perpetual futures contracts to keep prices aligned with the spot market.

When its value is positive like this, it indicates bullish sentiment and a higher demand for longs. It means that traders holding long BTC positions pay those holding short positions, a trend that could increase the coin’s value.

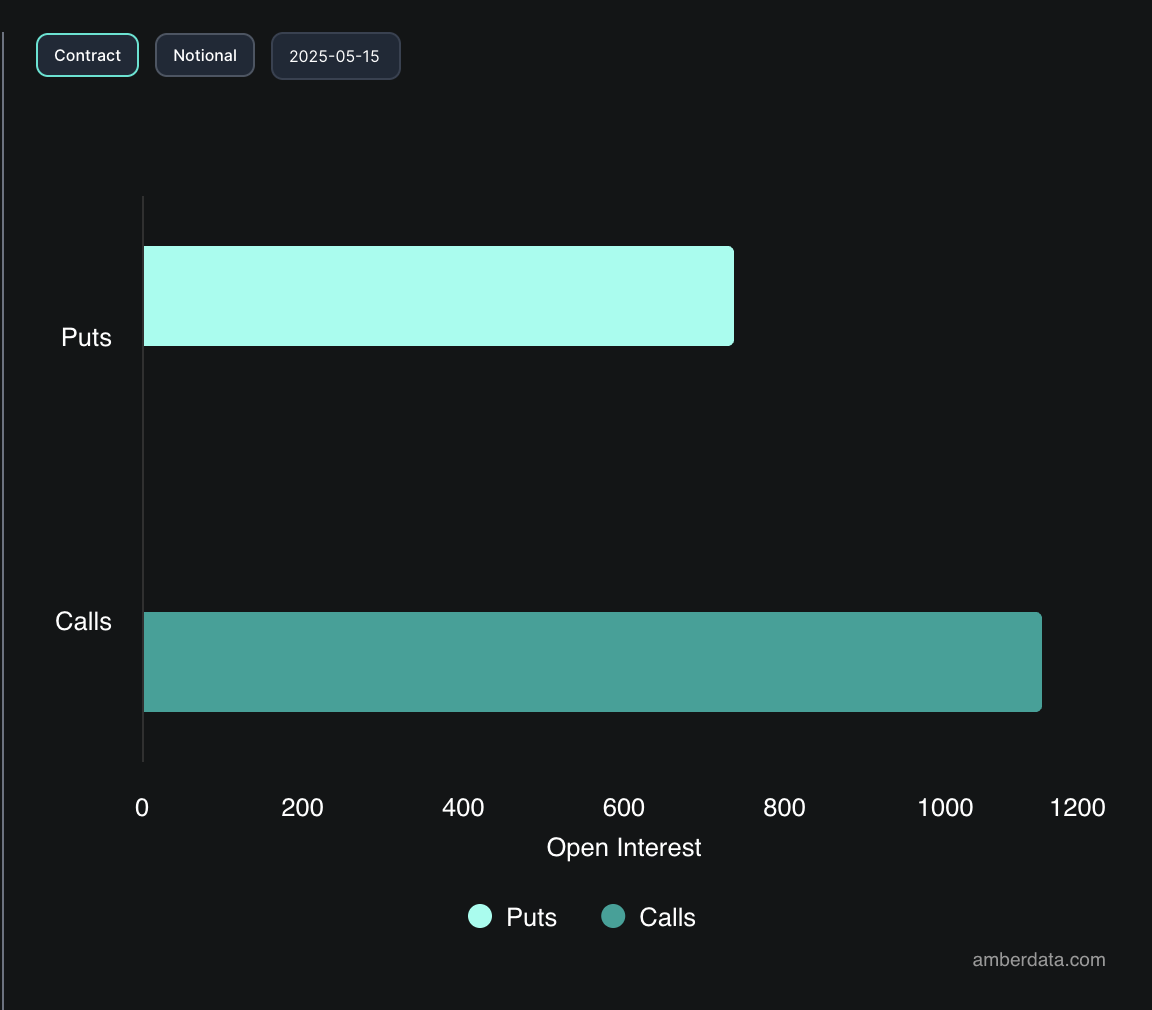

Additionally, options activity shows greater demand for calls over puts, suggesting traders are positioning for potential upside in the near term.

BTC Options Open Interest. Source: Deribit

BTC Options Open Interest. Source: Deribit

In conclusion, the inflows suggest that institutional investors may be buying the dip, betting on a longer-term recovery in BTC price.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.