Here is what you need to know on Thursday, May 15:

The US Dollar (USD) struggles to find demand to start the European session on Thursday following Wednesday's choppy action. The European economic calendar will feature a revision to Eurozone Gross Domestic Product (GDP) growth data for the first quarter. Later in the day, April Producer Price Index (PPI), Retail Sales and weekly Initial Jobless Claims data from the US will be watched closely by market participants. Additionally, Federal Reserve (Fed) Chairman Jerome Powell will deliver a speech on the Fed's framework review at the Thomas Laubach Research Conference in Washington, DC.

US Dollar PRICE This week

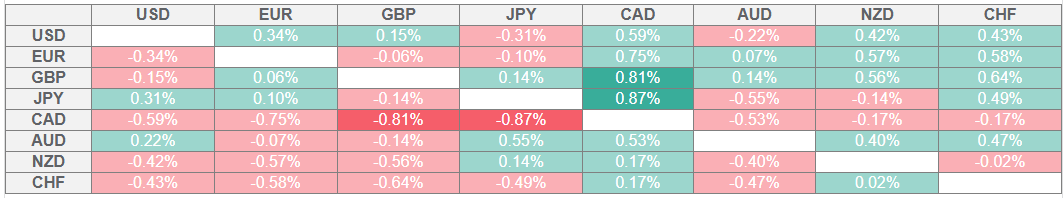

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Canadian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

After declining sharply in the first half of the day on Wednesday, the USD Index reversed its direction in the American session and closed the day virtually unchanged. Early Thursday, the USD Index stays on the back foot and falls toward 100.50, losing more than 0.3% on the day. Meanwhile, US stock index futures are down between 0.3% and 0.5% in the European morning, reflecting a cautious market stance.

Earlier in the day, the data from Australia showed that the Unemployment Rate held steady at 4.1% in April, as expected. In this period, Employment Change was +89K, compared to the market expectation of +20K. After closing the day in negative territory on Wednesday, AUD/USD holds its ground and edges higher toward 0.6450 on Thursday.

The UK's Office for National Statistics reported on Thursday that the GDP expanded at an annual rate of 1.3% in the first quarter. This reading followed the 1.5% growth recorded in the previous quarter and came in better than the market expectation of 1.2%. Other data from the UK showed that Industrial Production and Manufacturing Production contracted by 0.7% and 0.8%, respectively, on a monthly basis in March. GBP/USD gains traction in the European session and trades in positive territory near 1.3300.

Gold broke below $3,200 and lost more than 2% on Wednesday. XAU/USD extends its weekly decline and trades at its weakest level since April 10 below $3,150 in the European morning, losing nearly 1% on the day. Easing geopolitical tensions seem to be weighing on the precious metal. US President Donald Trump said on Thursday that they are getting very close to reaching a nuclear deal with Iran and added that India has offered a trade deal with "basically zero tariffs" to the US.

EUR/USD gains traction and trades above 1.1200 after posting small losses on Wednesday. Eurostat will release first-quarter Employment Change and March Industrial Production data in addition to the GDP revision. Several European Central Bank (ECB) policymakers will be delivering speeches later in the day.

Following a two-day decline, USD/JPY remains under bearish pressure and loses more than 0.5% on the day below 146.00 in the European session on Thursday. Japan’s Cabinet Office will publish Q1 GDP data in the early Asian session on Friday.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.