TRUMP Jumps 15% Amid the US-UK Deal and Gala Dinner Hype – What’s Next?

TRUMP has experienced a notable 15% increase over the past week, following a period of volatility that marked the losses in February and March.

Despite this recovery, the altcoin continues to face market fluctuations. However, improving macroeconomic conditions are providing a more favorable environment for TRUMP, potentially setting it up for further gains.

TRUMP Investors Are Optimistic, But For A While

The ADX (Average Directional Index) shows that the bullish sentiment surrounding OFFICIAL TRUMP has not lost its strength, despite recent volatility.

Market participants are responding positively to recent developments, including the US closing a trade deal with the UK and entering talks with China to discuss tariffs. These diplomatic moves cast President Donald Trump in a favorable light, contributing to TRUMP’s price increase.

This growing optimism surrounding the US government’s trade efforts is benefiting TRUMP holders. As the market sentiment remains generally positive due to these geopolitical events, TRUMP’s price has seen a corresponding rise.

TRUMP ADX. Source: TradingView

TRUMP ADX. Source: TradingView

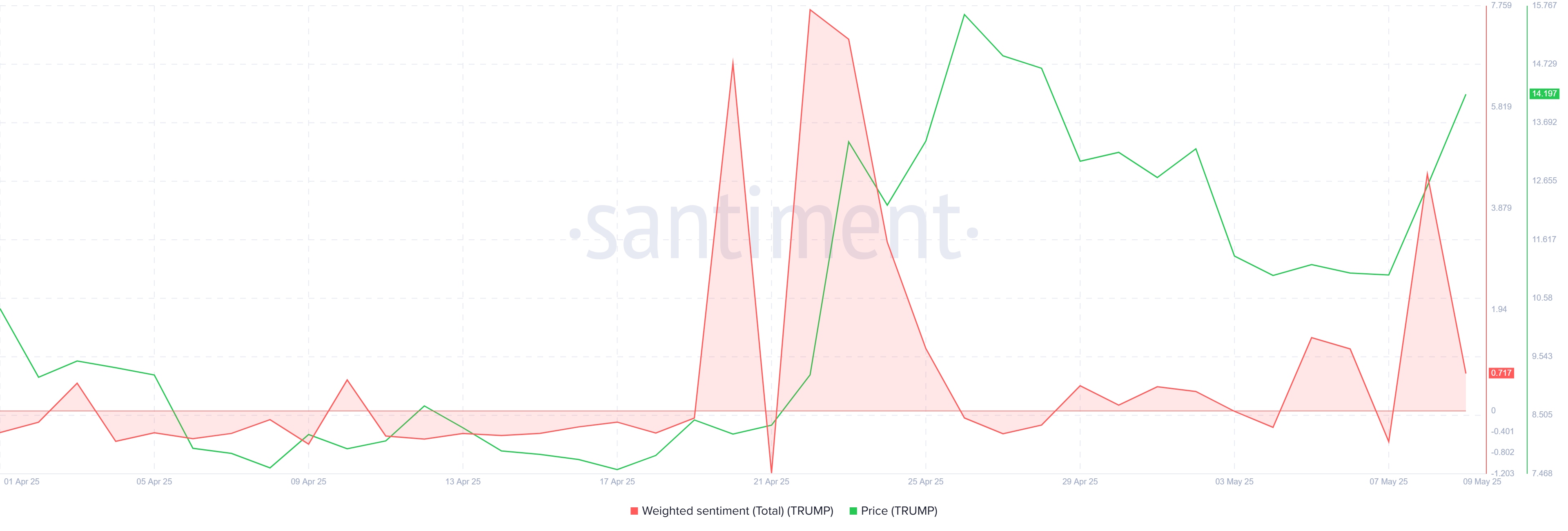

The overall macro momentum for TRUMP is influenced by shifting global sentiment. The weighted sentiment metric, which tracks market perceptions, spiked after the US-UK trade deal was announced. TRUMP holders showed excitement over the news, but the metric quickly declined.

As the initial excitement fades, it becomes clear that TRUMP’s price movement may not be entirely driven by long-term investor confidence. The reliance on short-term political developments could prove risky for the cryptocurrency, especially if future market sentiment shifts again.

TRUMP Weighted Sentiment. Source: Santiment

TRUMP Weighted Sentiment. Source: Santiment

TRUMP Price Banks On News

TRUMP is currently trading at $14.47, showing a 15% price increase over the past week. The altcoin is approaching the critical resistance level of $14.53, with the next target being $17.14.

Should TRUMP breach this resistance, it may continue its upward trajectory, potentially breaking further barriers and continuing its recovery from the recent downturn.

If trade talks between the US and China prove successful, it could positively influence President Trump’s image, pushing the price of TRUMP towards $20.00. This would signal a stronger market outlook and further boost investor confidence in the altcoin.

Successful trade agreements could create more positive momentum, further fueling TRUMP’s price growth.

TRUMP Price Analysis. Source: TradingView

TRUMP Price Analysis. Source: TradingView

However, the bullish outlook for TRUMP could be invalidated if the price falls back below the $13.36 support level. A drop to $12.18 or $10.29 would erase recent gains, signaling a shift in sentiment and possibly triggering a period of consolidation.

This would indicate that the current rally was more short-lived than sustainable.