Second Day of BTC ETF Inflows Hints at Confidence Amid Volatility | ETF News

Spot Bitcoin ETFs logged a second consecutive day of net inflows on Tuesday, bringing in a total of $76.42 million.

This trend marks a notable shift in institutional investor sentiment, considering that last week was marked by persistent outflows as investors pulled capital from the market.

Bitcoin Funds See Two Straight Days of Inflows

Yesterday’s cash influx follows Monday’s $1.47 million inflows, reinforcing the idea that some institutional players are beginning to reposition for potential upside.

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

The gradual return of inflows into BTC ETFs suggests renewed confidence in the coin’s long-term prospects, even as its short-term price volatility continues to unsettle the broader market.

On Tuesday, BlackRock’s ETF IBIT recorded the largest daily net inflow, totaling $38.22 million, bringing its total cumulative net inflows to $39.64 billion.

Ark Invest and 21Shares’ ARKB recorded the second-highest net inflow of the day, attracting $13.42 million. The ETF’s total historical net inflows now stand at $2.60 billion.

Bitcoin Price Dips, But Long Bets Persist

The cryptocurrency market has witnessed a noticeable dip in trading activity over the past 24 hours, as reflected in a $40 billion drop in total market capitalization during the period.

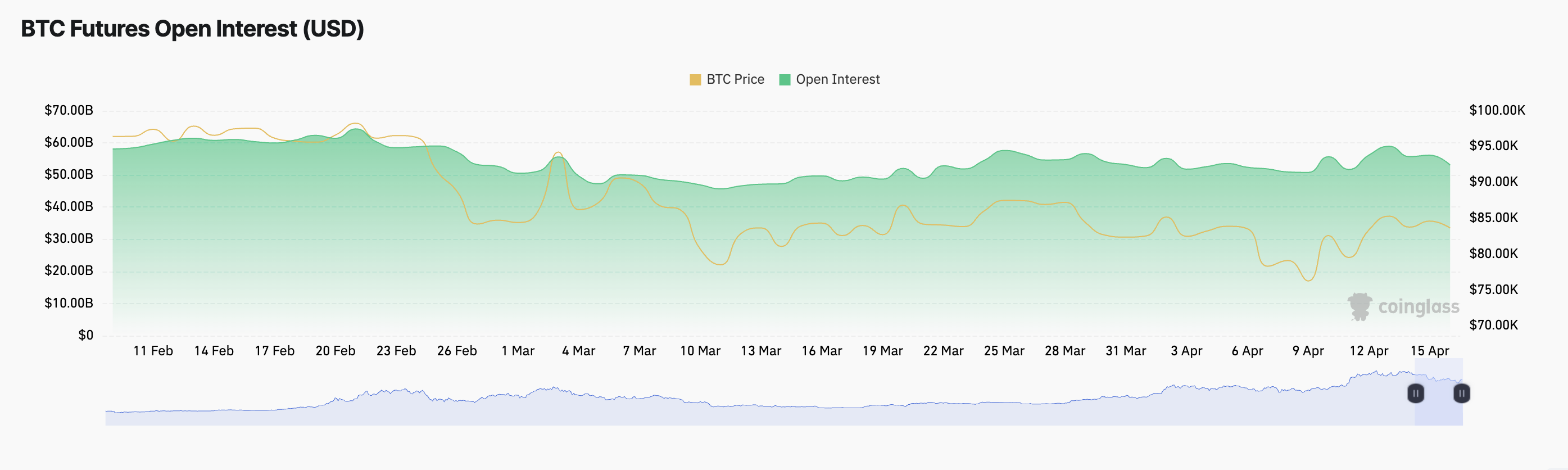

In line with this broader market pullback, BTC’s price has declined by 3%, currently trading at $83,341. This price dip has been accompanied by a 5% drop in the coin’s futures open interest, signaling a retreat from leveraged positions.

BTC Futures Open Interest. Source: Coinglass

BTC Futures Open Interest. Source: Coinglass

The decline in BTC’s open interest and price suggests that traders are closing their positions rather than opening new ones. This trend shows a market in retreat, where traders are exiting leveraged trades to avoid further losses or liquidations.

However, not all signals are bearish.

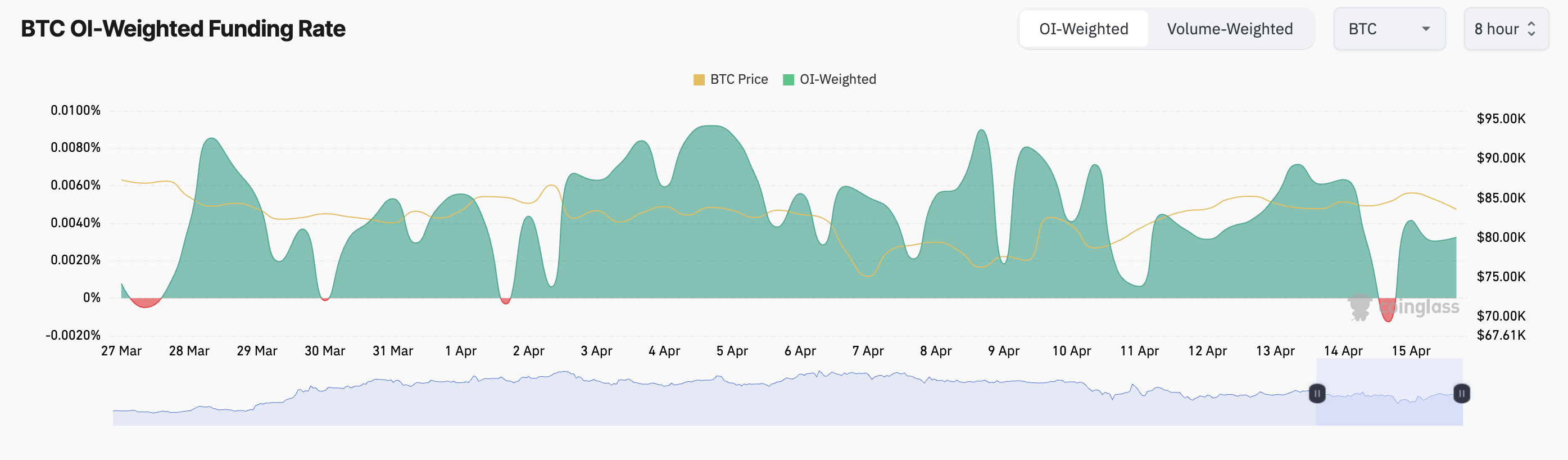

The coin’s funding rate has flipped back into positive territory and is currently at 0.0032% at press time. This signals that many futures traders are still opening long positions and expecting a recovery.

BTC Funding Rate. Source: Coinglass

BTC Funding Rate. Source: Coinglass

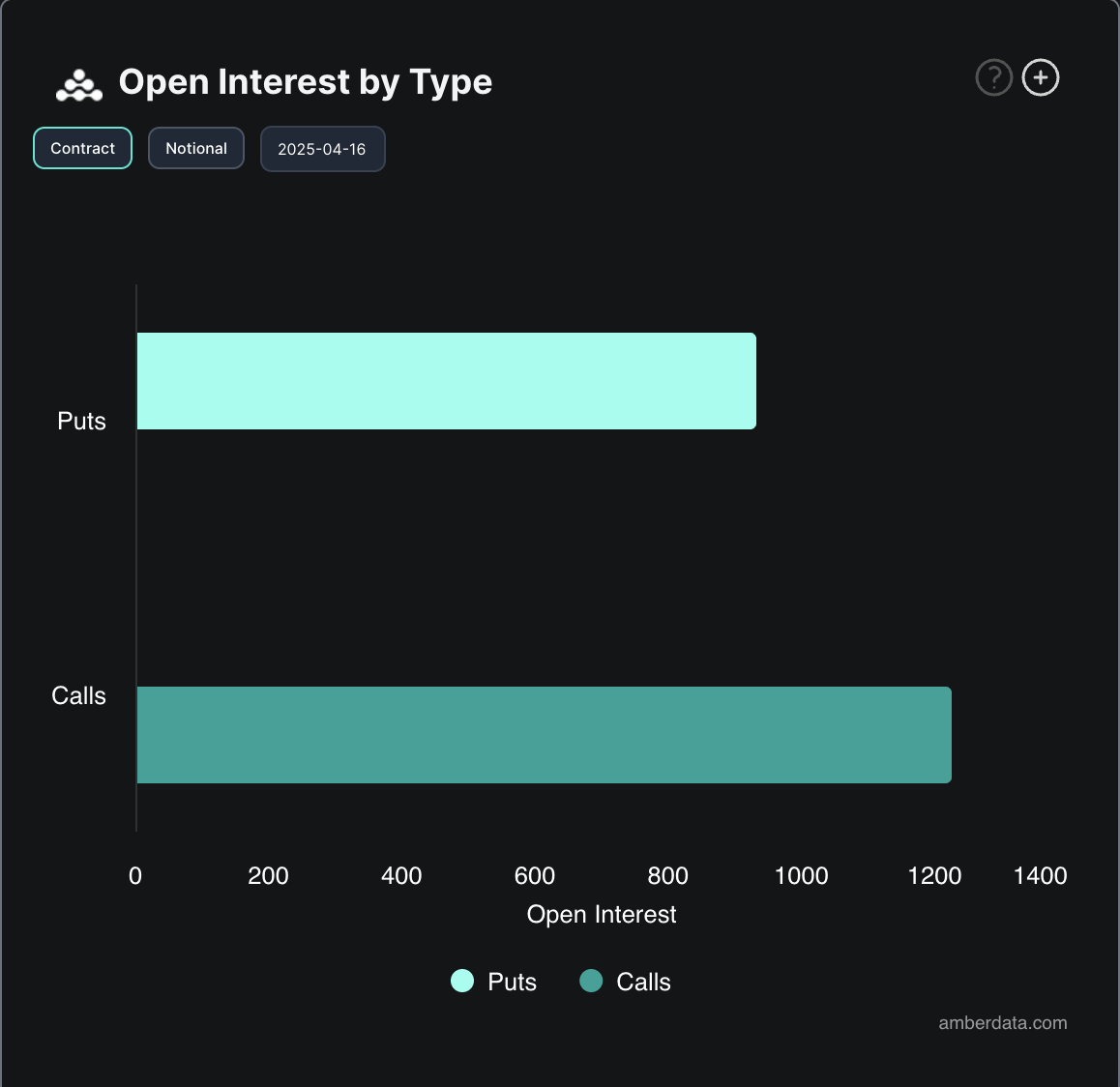

Notably, there are more calls than puts in the BTC options market today.

BTC Options Open Interest. Source: Deribit

BTC Options Open Interest. Source: Deribit

This indicates a bullish sentiment among options traders, as call options are typically used to bet on upward price movement.