Kava (KAVA) Stands Out in a Sluggish Market as Buyers Take the Lead

Layer-1 (L1) coin KAVA has emerged as the day’s top performer with a modest 0.10% gain over the past 24 hours. The coin remains range-bound despite this lead, signaling a relative balance between buying and selling pressure.

Still, the sentiment around KAVA is quietly bullish. With technical and on-chain indicators pointing to a surging positive bias, the altcoin might be poised for a breakout above its narrow range.

Buyers Dominate as KAVA Teases Break Above Resistance

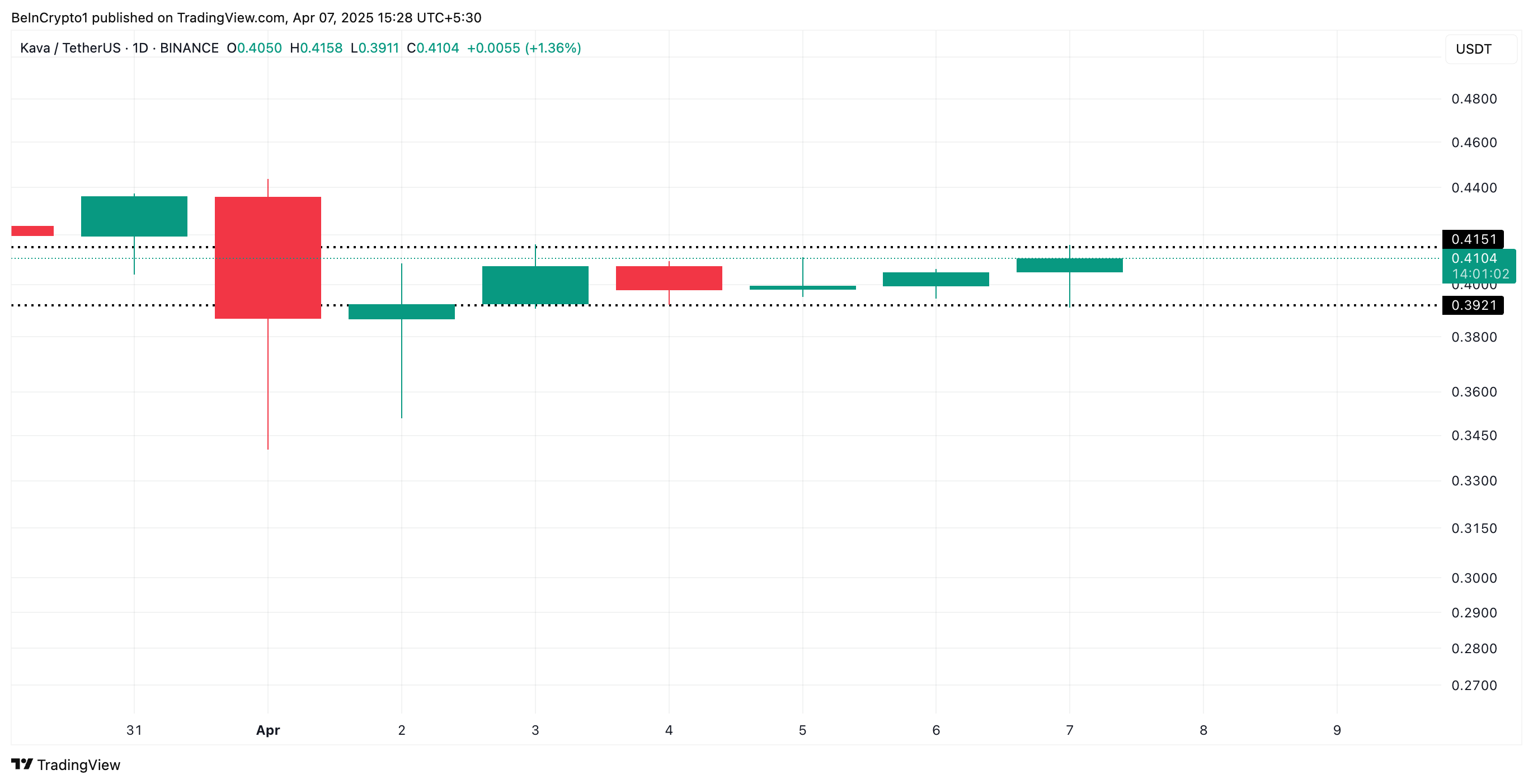

Since the beginning of April, KAVA’s price has oscillated within a range. The 98th largest crypto by market capitalization has faced resistance at $0.415 and has found support at $0.392.

KAVA Price Analysis. Source: TradingView

KAVA Price Analysis. Source: TradingView

With the gradual resurgence in bullish bias toward the altcoin, KAVA could see a break above the $0.415 resistance level in the near term.

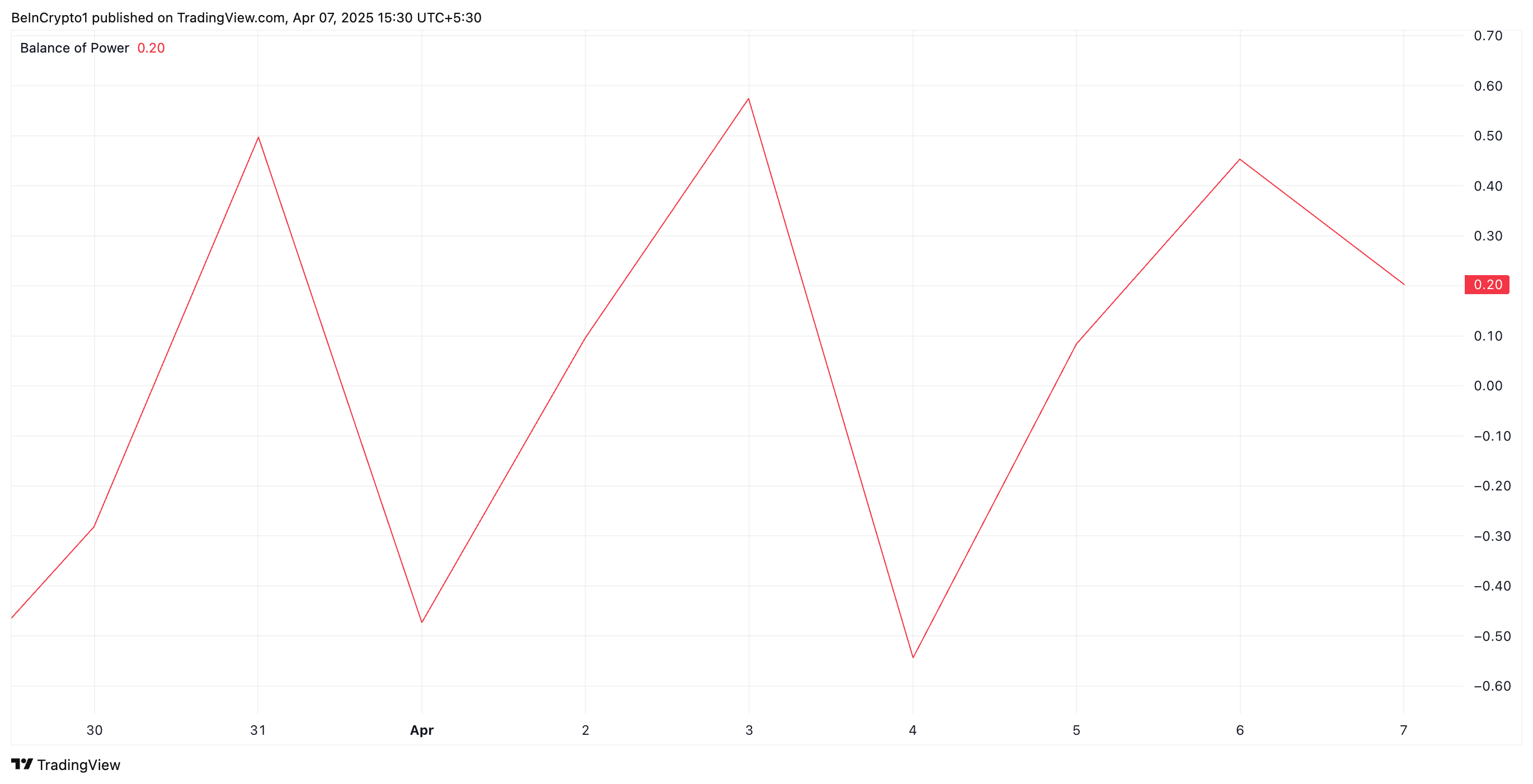

Its positive Balance of Power (BoP) on the daily chart confirms this outlook. At press time, this momentum indicator is at 0.20.

KAVA BoP. Source: TradingView

KAVA BoP. Source: TradingView

The BoP indicator measures the strength of buyers versus sellers in the market, helping to identify momentum shifts. When its value is negative, sellers are dominating the market over buyers.

Converesly, a positive BoP like this suggests that buying activity outweighs selling pressure. This reflects KAVA’s growing demand and potential for its price to appreciate further.

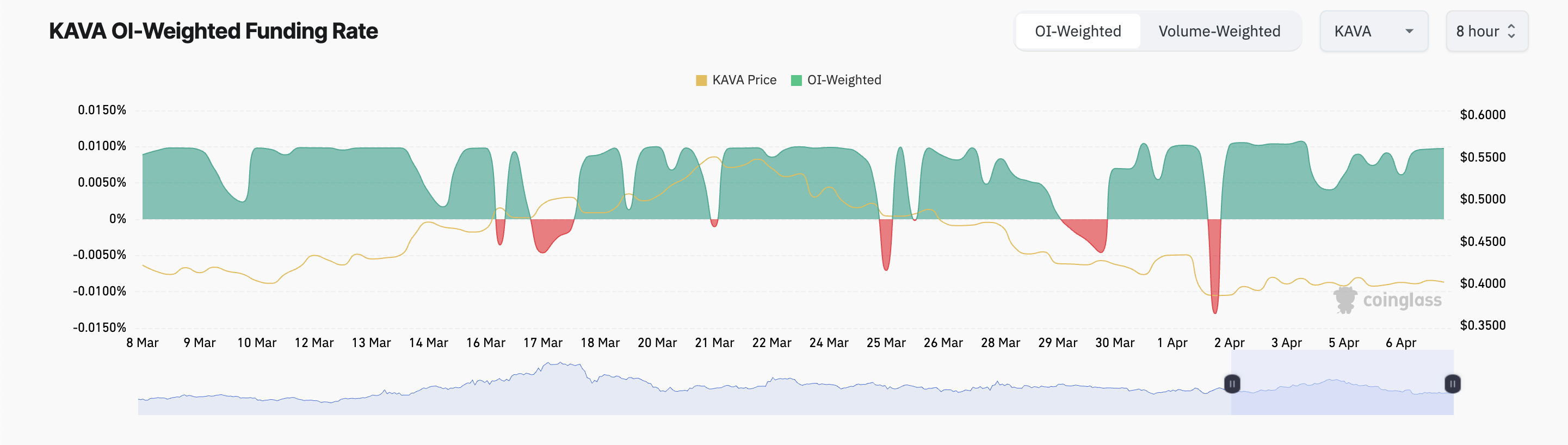

Moreover, the coin’s positive funding rate highlights the bullish sentiment among KAVA’s futures traders. As of this writing, the metric stands at 0.0097%.

KAVA Funding Rate. Source: Coinglass

KAVA Funding Rate. Source: Coinglass

The funding rate is a periodic payment between traders in perpetual futures contracts to keep prices aligned with the spot market. KAVA’s positive funding rate means long positions are paying short. This trend indicates that more KAVA traders are betting on its price to increase.

KAVA Approaches Breakout—Can It Flip $0.41 Into Support?

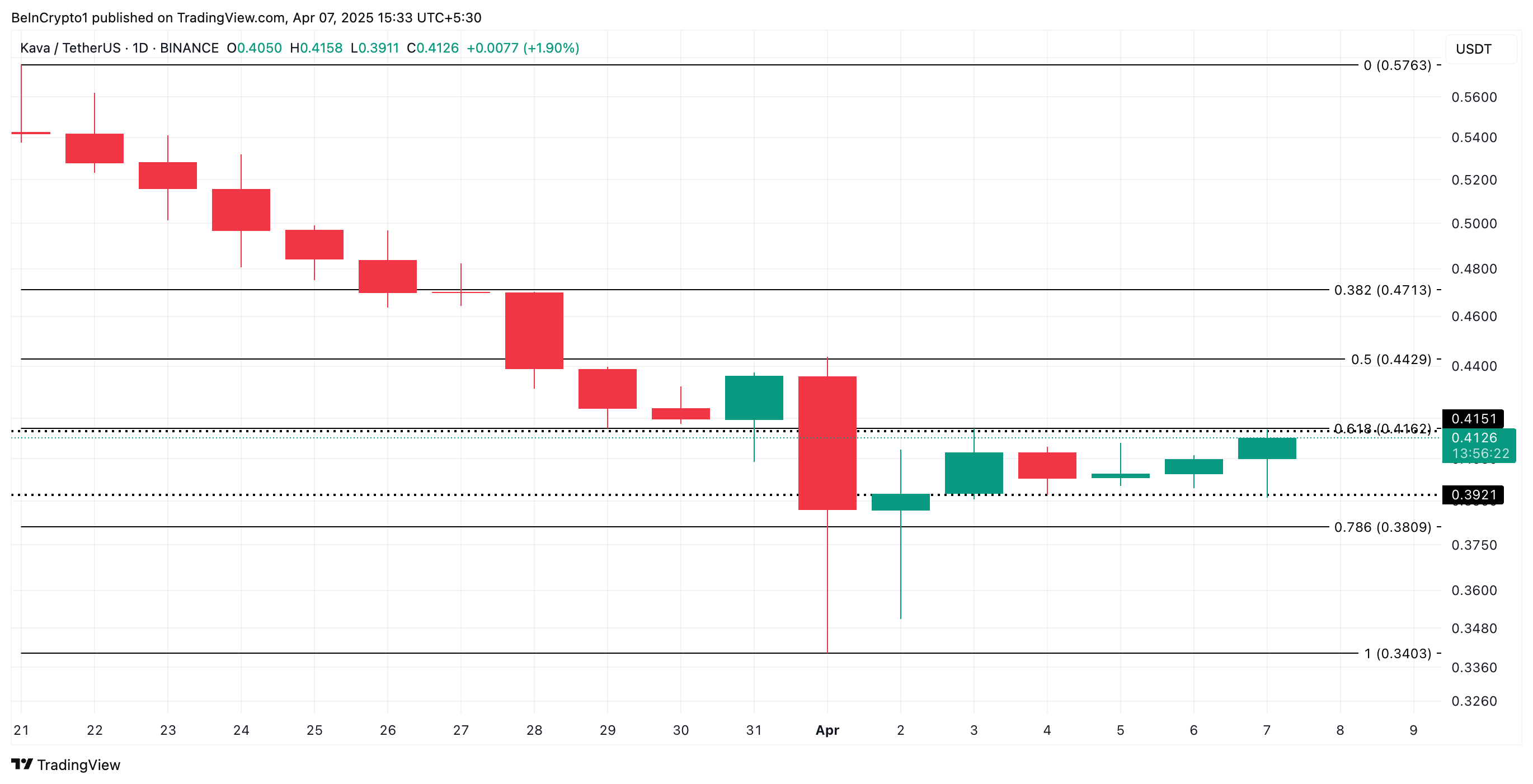

KAVA’s strengthening buying pressure could trigger a break above the resistance at $0.415. If this price level is successfully flipped into a support floor, KAVA’s uptrend will gain momentum and could reach $0.44.

KAVA Price Analysis. Source: TradingView

KAVA Price Analysis. Source: TradingView

Conversely, if profit-taking spikes, the coin could slip below support at $0.392. In this scenario, KAVA’s price could fall further to $0.38.