Crypto Scams on the Rise: Gemini and Coinbase Customers Warned

Crypto scams are surging as more people flock to digital currencies, with fraudsters exploiting the industry’s rapid growth to deceive investors.

Recently, numerous crypto users reported receiving fraudulent emails claiming that the Gemini exchange had filed for bankruptcy. Meanwhile, Coinbase Exchange has admitted that an employee illegally accessed user account information.

Gemini Exchange Addresses Bankruptcy Allegations

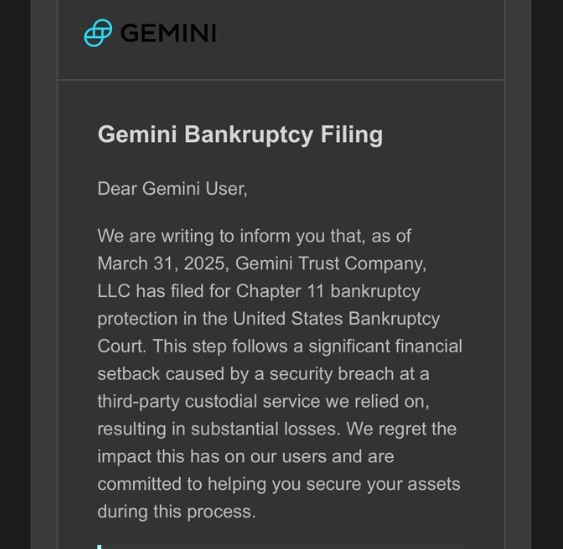

Multiple accounts highlighted the scam on social media, indicating that an email circulating falsely claims that Gemini has filed for bankruptcy. The email instructed users to withdraw to an Exodus wallet and provided a seed phrase.

These phishing emails, shared on April 1, urged recipients to withdraw their funds into a specified crypto wallet to protect their assets. This was an attempt to deceive users into transferring their cryptocurrencies to wallets controlled by scammers.

“Do not follow these directions. Please retweet to protect those that may have been doxxed and sent this email,” wrote Jason Williams, a contributor to Fox Business.

Phishing email targeting Gemini users. Source: Jason Williams on X

Phishing email targeting Gemini users. Source: Jason Williams on X

The deceptive emails alleged a substantial loss of $1.2 billion by Gemini Exchange. Understandably, some novice investors would heed this email and even move their assets to the address. After all, some victims of FTX Exchange contagion continue to pursue their funds even years after the incident.

“I got one also. It is better than your typical ‘Coin Base’ one, but still not quite there. Might fool a boomer though,” one X user remarked.

However, security experts advise users to always verify information through official channels, avoid clicking on unsolicited links, and refrain from sharing personal data. Gemini issued an official warning in response to the scam, acknowledging the threat against its users.

“We recently learned that some Gemini customers are being targeted with scam emails requesting users to transfer their crypto to outside wallets. Please be aware that Gemini will never request that you send crypto to outside wallets,” the exchange articulated.

Coinbase Admits Employee Illegally Accessed User Account Data

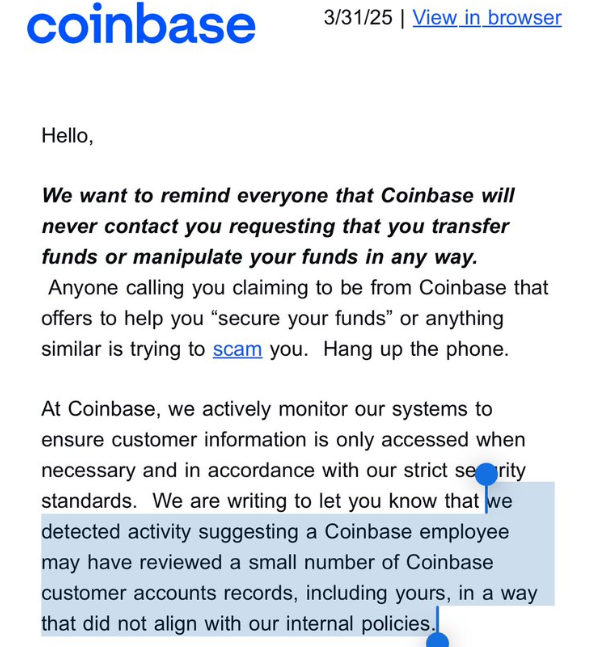

Coinbase exchange acknowledged a privacy violation by one of its staff in a somewhat related development. Specifically, a customer service employee accessed user account information without authorization.

This breach has raised concerns about potential scams targeting Coinbase users. Mike Dudas, a crypto investor and co-founder at The Block, shared an email from Coinbase acknowledging the incident.

“That explains the fake Coinbase phishing emails and phone calls today,” he stated.

Coinbase note to customers. Source: Mike Dudas on X

Coinbase note to customers. Source: Mike Dudas on X

This breach coincides with reports of phishing attempts, as users have received fake emails and calls purporting to be from Coinbase. These incidents reflect a broader wave of crypto-related fraud.

Blockchain investigator ZachXBT reported that Coinbase users lost over $65 million to social engineering scams between December 2024 and January 2025.

“Coinbase did not detect it; I sent them the intel,” the blockchain investigated noted.

Additionally, crypto analyst Cobie suggested Kraken might be experiencing a similar issue. Per his post, a new attack may be budding, where attackers infiltrate customer service roles to exfiltrate data.

“Kraken also recently hit with this too. Maybe a new scheme from attackers (get a CS agent employee in, exfil data),” the analyst remarked.

Amidst these events, ZachXBT recently explained how to avoid crypto scams. He emphasizes the importance of conducting thorough research before engaging with new DeFi protocols, especially those forked from existing projects on newly launched EVM chains.

Additionally, he advises caution when dealing with projects with few credible followers, as these may indicate potential scams.

Therefore, it is imperative that users remain vigilant against sophisticated phishing scams and unauthorized data breaches.