Ethereum Taker-Buy-Sell Ratio Soars Despite ETH’s Sideways Movement

Ethereum (ETH) has been trading within a narrow range since the beginning of February, oscillating between key support and resistance levels.

However, despite this sideways price movement, futures traders remain resilient as they continue to open buy contracts, signaling confidence in ETH’s potential upside.

Ethereum’s Futures Market Shows Resilience

Readings from the ETH/USD one-day chart reveal that the leading altcoin has traded within a horizontal channel since the beginning of the month, facing resistance at $2,799 while finding support at $2,585. Despite this, its futures traders have maintained their bullish stance and have increased their buy orders.

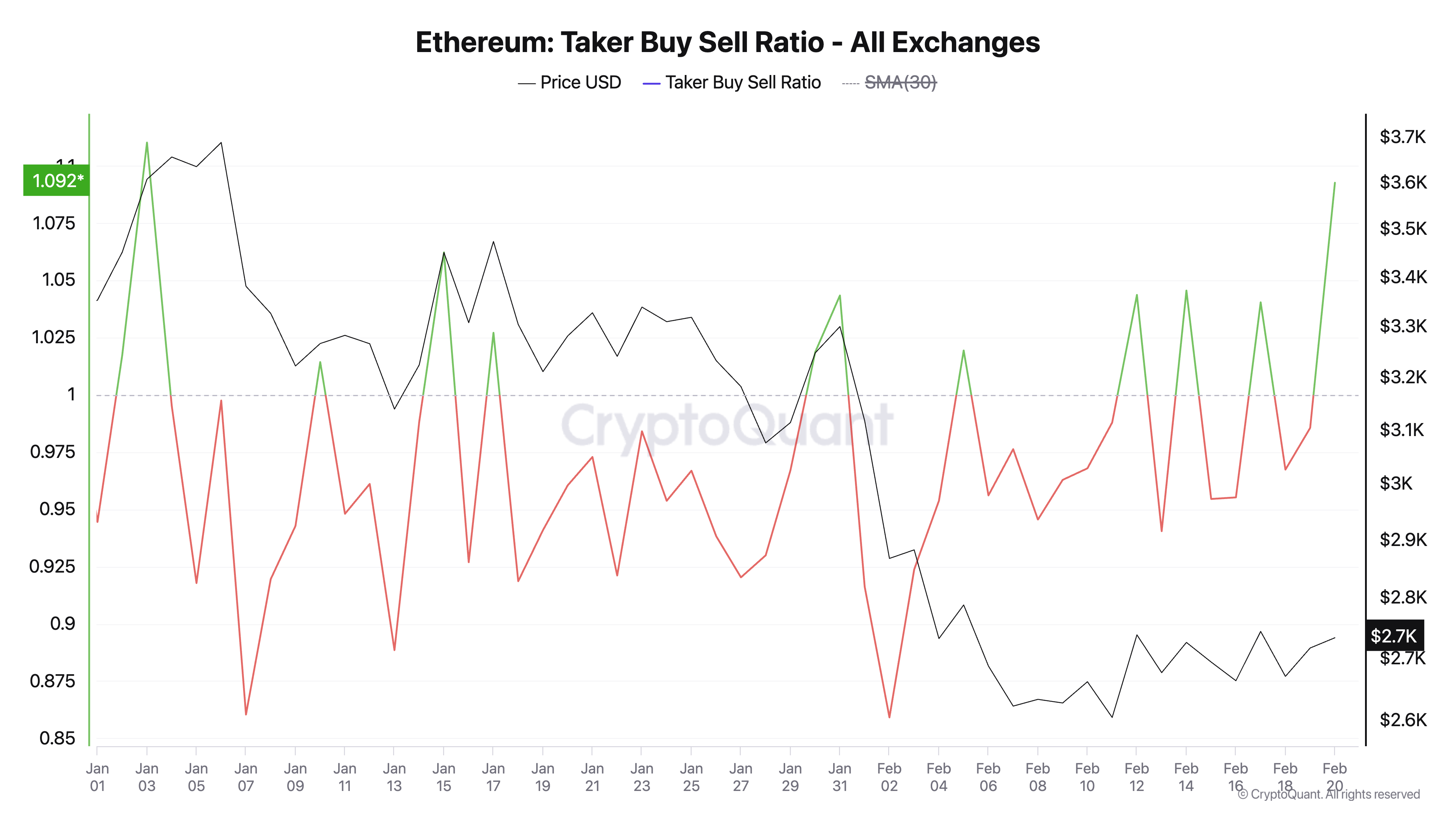

A key indicator of this bullish sentiment is Ethereum’s Taker-Buy-Sell Ratio, which has surged to its highest point since early January. According to CryptoQuant, it is at 1.09 at press time.

Ethereum’s Taker-Buy-Sell Ratio. Source: CryptoQuant

Ethereum’s Taker-Buy-Sell Ratio. Source: CryptoQuant

An asset’s taker buy-sell ratio measures the ratio between the buy and sell volumes in its futures market. Values above one indicate more buy than sell volume, while values below one suggest that more futures traders are selling their holdings.

ETH’s taker-buy-sell ratio at 1.09 reflects the growing optimism among its futures traders amid its flat price performance in the past few weeks.

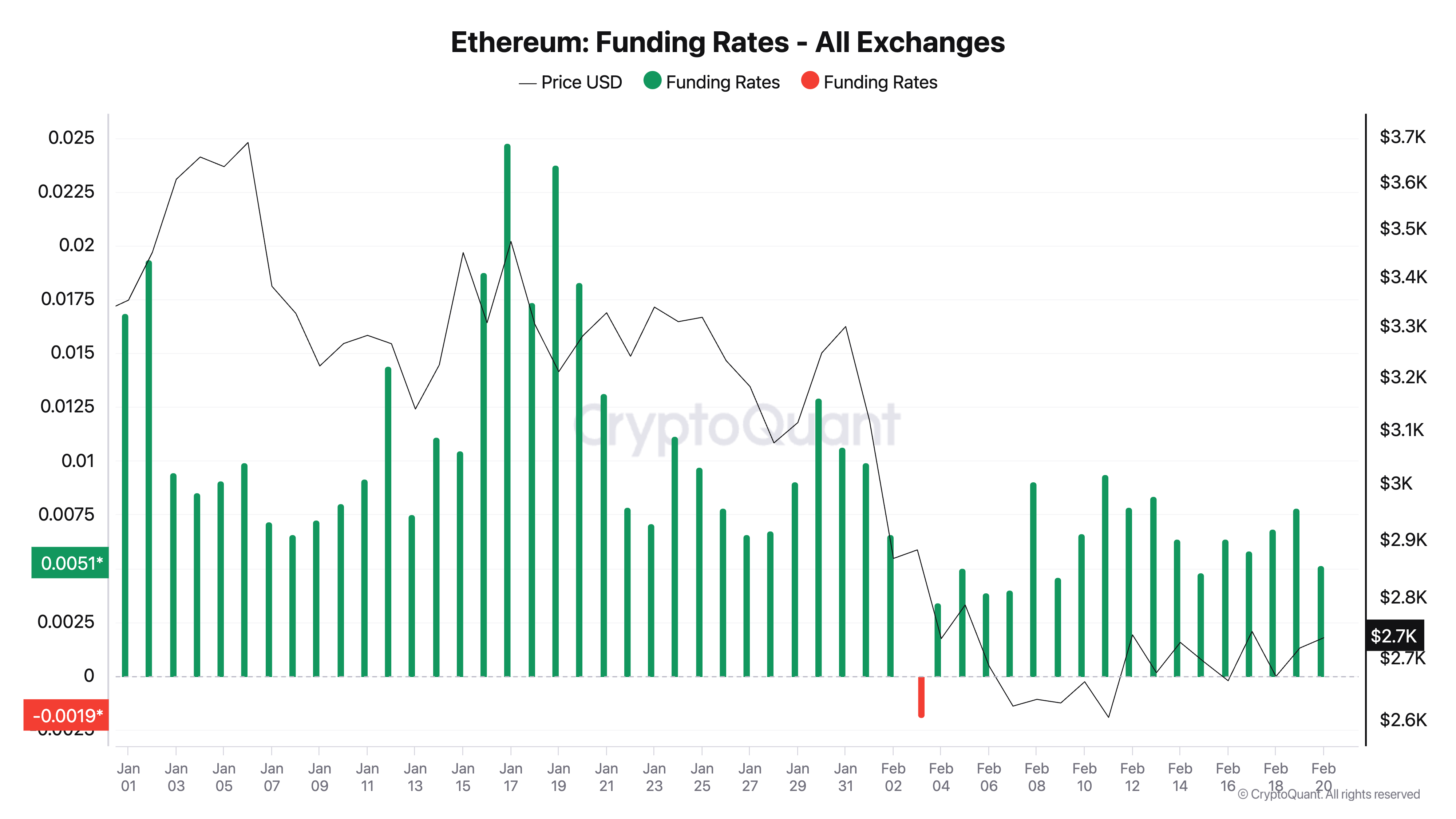

Furthermore, ETH’s funding rate has remained positive amid its price consolidation. As of this writing, the metric is at 0.0051%.

Ethereum’s Funding Rate. Source: CryptoQuant

Ethereum’s Funding Rate. Source: CryptoQuant

The funding rate is the periodic payment exchanged between long and short futures contract holders based on the difference between an asset’s spot price and futures price. When an asset’s funding rate is positive, it means that long position holders are paying short, indicating a market bias toward bullish sentiment.

During periods of price consolidation like this, a positive funding rate suggests that buyers are willing to pay a premium to hold long positions, signaling confidence in the asset’s potential to break out upward once the consolidation phase ends.

ETH Bulls Look to Break $2,758—A Path to $3,000?

A potential break above the resistance at $2,799 could propel its price to $2,967. If ETH’s demand strengthens at this level, it could rally above the critical $3,000 price point to trade at $3,202.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingView

However, if the bears regain dominance and force a break below support at $2,585, ETH’s price could plummet to $2,467. If the bulls are unable to defend this level, the decline could continue to $2,150.