Here is what you need to know on Friday, June 27:

The US Dollar (USD) struggles to find demand early Friday, with the USD Index staying in negative territory below 97.50 after posting losses for four consecutive days. In the second half of the day, the US Bureau of Economic Analysis (BEA) will release the Personal Consumption Expenditures (PCE) Price Index data, the Federal Reserve's (Fed) preferred gauge of inflation, for May.

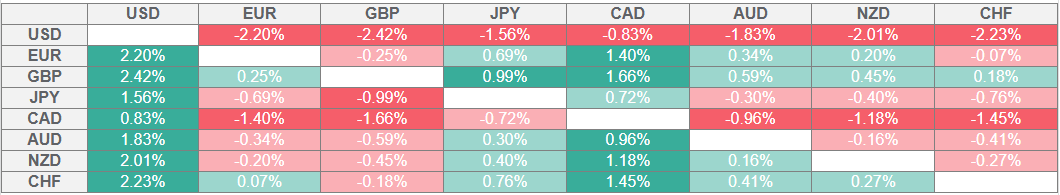

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The risk-positive market atmosphere and mixed macroeconomic data releases from the US caused the USD to continue to weaken against its rivals on Thursday. The BEA reported that the US' Gross Domestic Product (GDP) contracted at an annual rate of 0.5% in the first quarter, compared to the market expectation and the previous estimate of -0.2%. On a positive note, Durable Goods Orders rose at a stronger pace than forecast in May, while the weekly Initial Jobless Claims declined to 236,000 from 245,000 in the previous week. Reflecting the upbeat mood, Wall Street's main indexes gained about 1% on Thursday. In the European session on Friday, US stock index futures trade marginally higher.

The data from Japan showed in the Asian session that the Tokyo Consumer Price Index rose 3.1% on a yearly basis in June, down from the 3.4% increase recorded in May. After falling more than 0.5% on Thursday, USD/JPY fluctuates in a tight channel at around 144.50 on Friday.

USD/CAD stays in a consolidation phase slightly below 1.3650 after falling more than 0.6% on Thursday. Statistics Canada will publish monthly GDP data for April later in the day.

EUR/USD holds its ground and trades above 1.1700 in the European morning on Friday. The European Commission will release business and economic sentiment data for June.

GBP/USD moves sideways in a narrow band below 1.3750 after registering its highest daily close in over three years on Thursday.

Gold failed to benefit from the selling pressure surrounding the USD on Thursday and ended the day with small losses. XAU/USD extends its weekly slide on Friday and trades below $3,300, losing more than 1% on a daily basis.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.