AUD/USD retreats from YTD highs as risk sentiment steadies, US Dollar firms

- AUD/USD weakens after reaching a fresh YTD high of 0.6564 on Thursday.

- US-China trade lifts risk sentiment, but profit taking and a firmer USD limit gains.

- AUD/USD is heading toward 0.6500, with bullish momentum fading above 0.6550.

The Australian Dollar (AUD) is pulling back from weekly highs against the US Dollar (USD) on Friday.

At the time of writing, the AUD/USD pair is trading near 0.6520, having reached an intraday high of 0.6561.

AUD/USD retreats as USD regains ground and sentiment stabilizes

The US Dollar is recovering slightly after falling to three-year lows against its peers. On Friday, the Bureau of Economic Analysis released the latest core Personal Consumption Expenditure (PCE) figures. The core numbers, which reflect the pace at which prices are rising for goods excluding volatile items such as food and energy, increased in May. The annual rate increased by 2.7%, higher than the previously estimated 2.6%, with the monthly figure rising by 0.2 percentage points.

The Federal Reserve’s (Fed) preferred measure of inflation is closely monitored for potential clues on the trajectory of monetary policy. However, with President Trump placing pressure on the Fed to reduce rates prior to the September meeting, investors were also looking at the Michigan Sentiment Index numbers, which reflected a slight increase in optimism in June.

Despite the release of macroeconomic data, the easing of geopolitical tensions this week has been a major driver of the surge in the AUD/USD price.

With the ceasefire between Israel and Iran boosting demand for risk assets, safe-haven flows had diminished, placing additional pressure on the Greenback. News of China and the United States finalizing a trade deal on Friday provided additional support for AUD/USD, which was eager to retest the key psychological resistance level of 0.6600.

As markets continued to digest the recent developments and prepared to close, an increase in profit-taking sent AUD/USD lower.

Technical rejection at a key Fibonacci level pushes AUD/USD lower

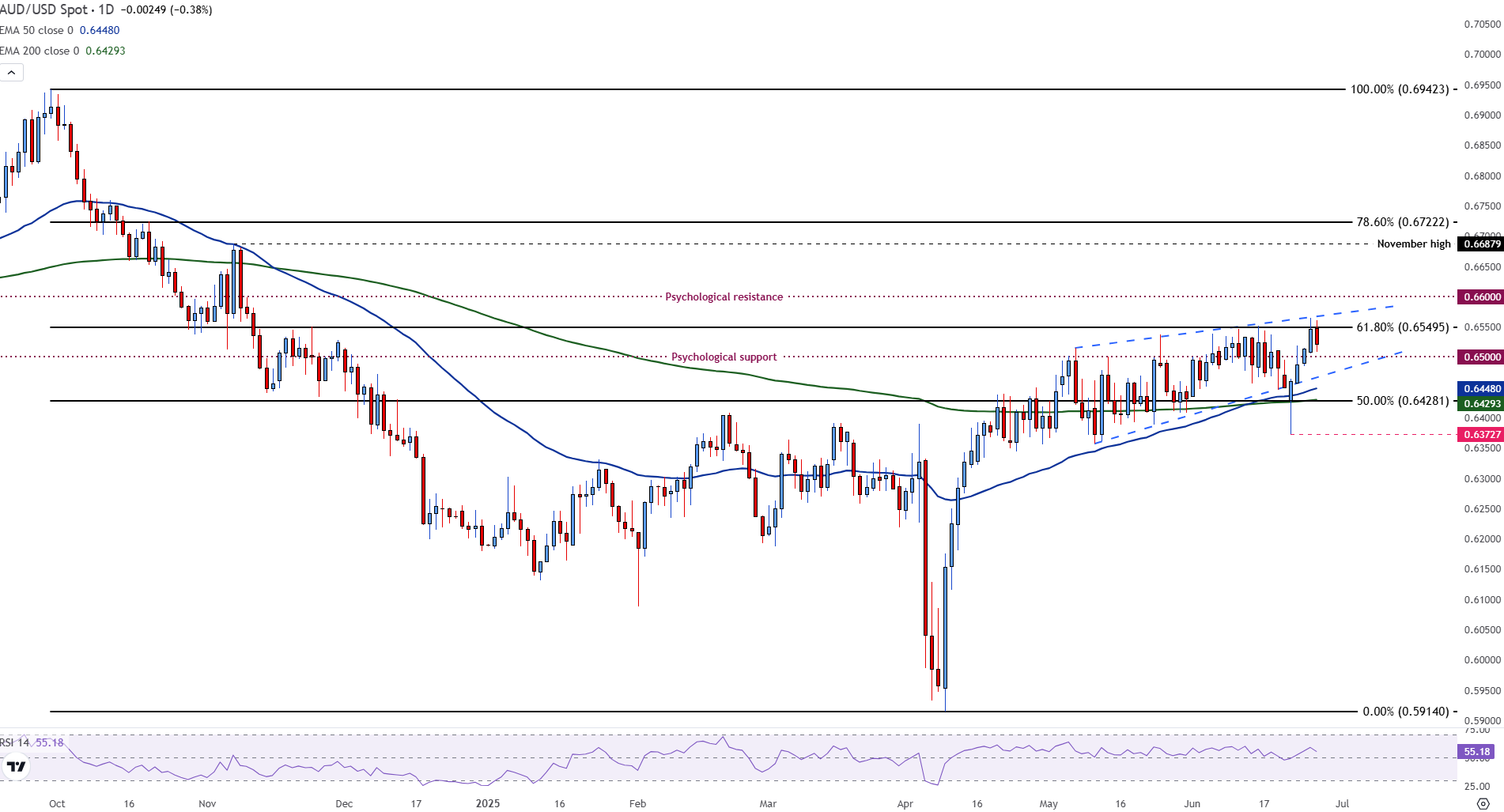

From a technical standpoint, AUD/USD has been trading within a rising wedge pattern, a structure often associated with a potential bearish reversal.

The pair attempted to break above the 61.8% Fibonacci retracement of the September-April downtrend around 0.6550 but failed to sustain momentum.

AUD/USD daily chart

The rejection at this level has triggered a fresh wave of selling, with immediate support now seen at the 50-day Exponential Moving Average (EMA) near 0.6448. Below that is the 200-day EMA at 0.6427, a break of which could expose Monday’s low of 0.6372.

Meanwhile, the Relative Strength Index (RSI) is at 55 and is pointing downward, indicating a fading of bullish momentum. The near-term outlook for AUD/USD remains cautious. While improved sentiment earlier this week lifted the pair, the inability to clear key resistance levels and resurgent demand for the US Dollar could signal the potential for additional downside risks.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.